Pdf Portfolio Performance Under Tracking Error And Benchmark Volatility Constraints

Pdf Portfolio Performance Under Tracking Error And Benchmark Volatility Constraints Portfolio that exhibited jorion’s (2003) absolute risk constraint caused the unrestricted weights to form entirely impractical values throughout the bear market conditions with considerable short selling repercussions. Purpose using a portfolio comprising liquid global stocks and bonds, this study aims to limit absolute risk to that of a standardised benchmark and determine whether this has a significant.

A Tracking Error Volatility Tev B Portfolio Volatility C Covariance Download Scientific This work addresses this gap and demonstrates, for the first time, the relative portfolio performance of several standard portfolio choices on the frontier. To do this, this paper explores the risk and return relationship of active portfolios subject to a tev constraint. i show that the tev constraint is described by an ellipse in the usual mean variance space. this yields several new insights. Using a portfolio comprising liquid global stocks and bonds, this study aims to limit absolute risk to that of a standardised benchmark and determine whether this has a significant impact on expected return in both high volatility period (hv) and low volatility period (lv). This additional restriction substantially improved active portfolio performance. bertrand (2005) examined the consistency between the risk adjusted performance attribution process and portfolio optimisation under te constraints.

A Tracking Error Volatility Tev B Portfolio Volatility C Covariance Download Scientific Using a portfolio comprising liquid global stocks and bonds, this study aims to limit absolute risk to that of a standardised benchmark and determine whether this has a significant impact on expected return in both high volatility period (hv) and low volatility period (lv). This additional restriction substantially improved active portfolio performance. bertrand (2005) examined the consistency between the risk adjusted performance attribution process and portfolio optimisation under te constraints. Roll (1992) initiated research into tracking error (te) constrained portfolio behaviour and developed the framework for describing an efficient frontier in risk return space constrained by various levels of te. Purpose using a portfolio comprising liquid global stocks and bonds, this study aims to limit absolute risk to that of a standardised benchmark and determine whether this has a significant impact on expected return in both high volatility period (hv) and low volatility period (lv). Purpose this paper aims to perform an analytical analysis on portfolio allocation when a tracking error volatility (tev) constraint holds, drawing specific attention to the portfolio. Econstor is a publication server for scholarly economic literature, provided as a non commercial public service by the zbw.

Portfolio Analysis Pdf Pdf Risk Standard Deviation Roll (1992) initiated research into tracking error (te) constrained portfolio behaviour and developed the framework for describing an efficient frontier in risk return space constrained by various levels of te. Purpose using a portfolio comprising liquid global stocks and bonds, this study aims to limit absolute risk to that of a standardised benchmark and determine whether this has a significant impact on expected return in both high volatility period (hv) and low volatility period (lv). Purpose this paper aims to perform an analytical analysis on portfolio allocation when a tracking error volatility (tev) constraint holds, drawing specific attention to the portfolio. Econstor is a publication server for scholarly economic literature, provided as a non commercial public service by the zbw.

Solved 1 You Want The Volatility Of Your Complete Portfolio Chegg Purpose this paper aims to perform an analytical analysis on portfolio allocation when a tracking error volatility (tev) constraint holds, drawing specific attention to the portfolio. Econstor is a publication server for scholarly economic literature, provided as a non commercial public service by the zbw.

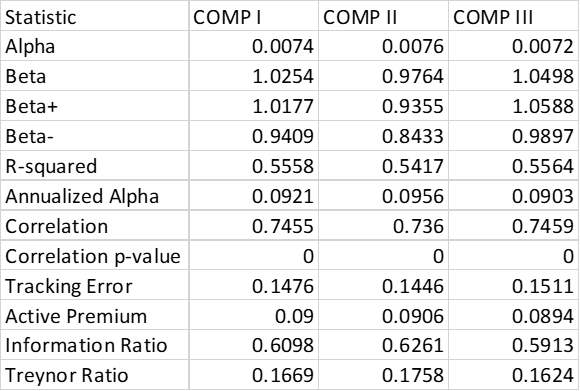

Discuss And Compare The Tracking Error Volatility Chegg

Comments are closed.