Peer To Peer Lending Aka P2p Loans Or Crowdlending Explained In One Minute

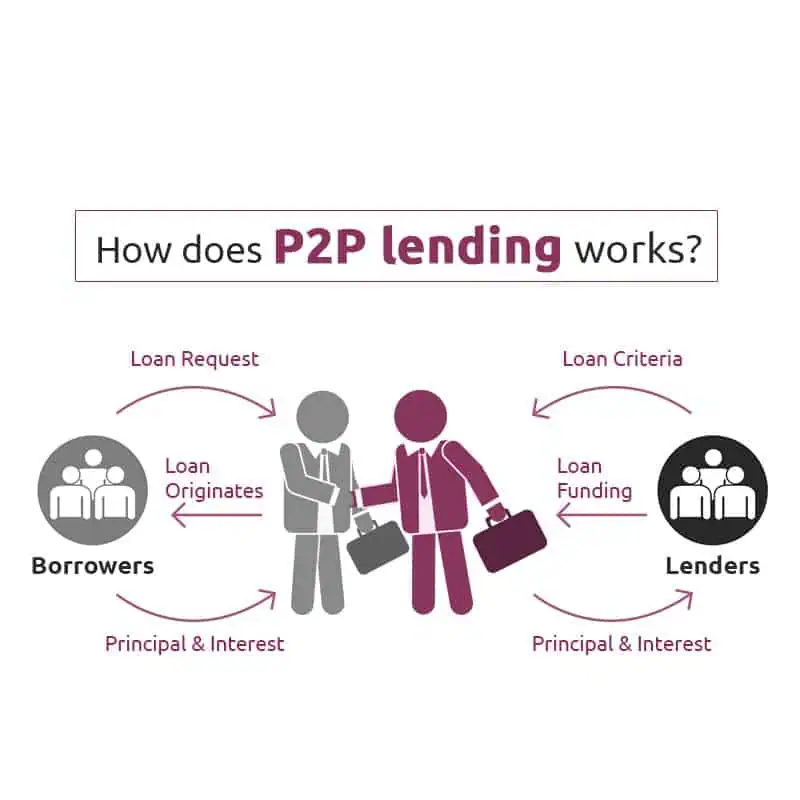

Peer To Peer Lending In South Africa Arcadia Finance Peer to peer lending (sometimes referred to as p2p lending or crowdlending) is basically an alternative to "traditional" banking or in other words, a way for you to borrow from or. Peer to peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms. make sure you know about the potential risks of p2p lending before you decide to become a p2p borrower or lender.

All You Need To Know About Peer To Peer P2p Lending Discover the benefits and drawbacks of peer to peer lending for borrowers and investors, from flexibility and returns to risks and regulations. Peer to peer (p2p) lending is a financial practice in which individuals and businesses lend money directly to one another through online platforms, bypassing traditional financial. Peer to peer (p2p) lending is an innovative form of borrowing and investing money without the involvement of traditional financial institutions. by using online platforms, borrowers and lenders can make mutually beneficial transactions directly without the need for a bank as a middleman. Peer to peer lending provides a distinctive method for borrowing that bypasses conventional financial institutions such as banks. by using peer to peer lending platforms, borrowers can obtain funds directly from individual investors.

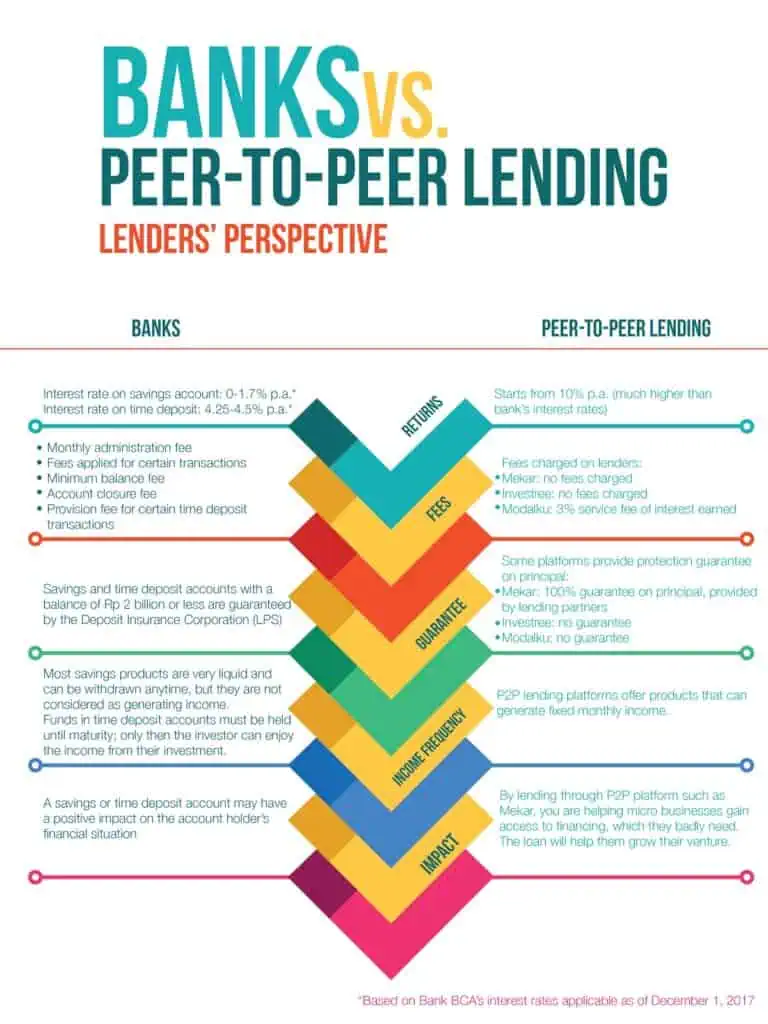

Your Guide On Peer To Peer Lending Malaysia Nexea Peer to peer (p2p) lending is an innovative form of borrowing and investing money without the involvement of traditional financial institutions. by using online platforms, borrowers and lenders can make mutually beneficial transactions directly without the need for a bank as a middleman. Peer to peer lending provides a distinctive method for borrowing that bypasses conventional financial institutions such as banks. by using peer to peer lending platforms, borrowers can obtain funds directly from individual investors. Peer to peer lending platforms connect borrowers who need money and investors who want to earn income. here's everything you need to know. What is peer to peer (p2p) lending? peer to peer lending (p2p), sometimes referred to as social lending, crowd lending, or debt crowdfunding, is a process by which people can borrow money directly from other individuals without involving a bank, credit union, or other financial institution. Peer to peer lending, also known as p2p lending, crowdlending, and social lending, enables borrowers to interact directly with lenders, circumventing the middleman typically involved in conventional banking systems. A comprehensive guide by wealthy nerd providing insights into peer to peer lending. understand how it works, its pros, cons, risks, and rewards, and how it compares to traditional lending methods.

Your Guide On Peer To Peer Lending Malaysia Nexea Peer to peer lending platforms connect borrowers who need money and investors who want to earn income. here's everything you need to know. What is peer to peer (p2p) lending? peer to peer lending (p2p), sometimes referred to as social lending, crowd lending, or debt crowdfunding, is a process by which people can borrow money directly from other individuals without involving a bank, credit union, or other financial institution. Peer to peer lending, also known as p2p lending, crowdlending, and social lending, enables borrowers to interact directly with lenders, circumventing the middleman typically involved in conventional banking systems. A comprehensive guide by wealthy nerd providing insights into peer to peer lending. understand how it works, its pros, cons, risks, and rewards, and how it compares to traditional lending methods.

Peer To Peer Lending Statistics 2025 Coinlaw Peer to peer lending, also known as p2p lending, crowdlending, and social lending, enables borrowers to interact directly with lenders, circumventing the middleman typically involved in conventional banking systems. A comprehensive guide by wealthy nerd providing insights into peer to peer lending. understand how it works, its pros, cons, risks, and rewards, and how it compares to traditional lending methods.

Peer To Peer Lending The Top 5 Platforms Reviewed

Comments are closed.