Pension Plans Explained Defined Contribution Vs Defined Benefit Plans

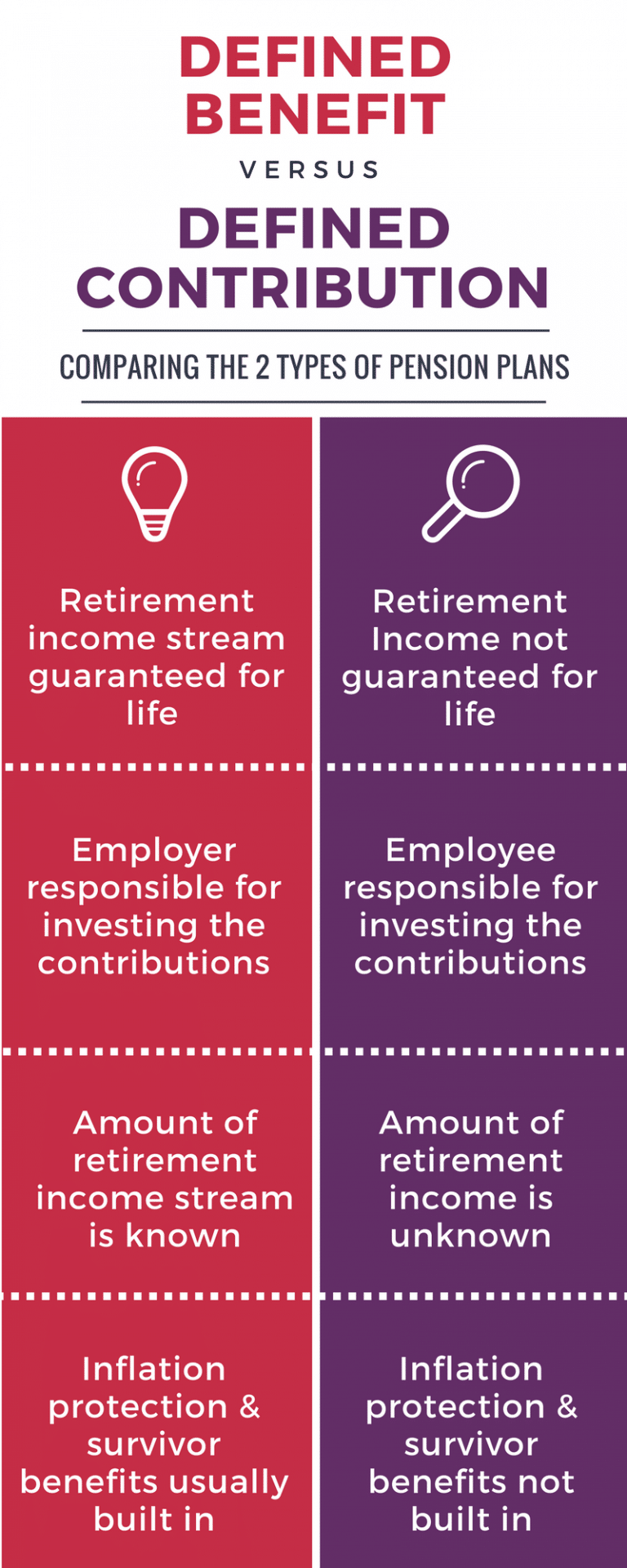

Infographic Defined Benefit Vs Defined Contribution Pension Plan Pharma Tax As the names imply, a defined benefit plan—also commonly known as a traditional pension plan—provides a specified payment amount in retirement. a defined contribution plan allows. A defined benefit plan (e.g., a pension) is one where you know what to expect from your payout when you retire. a defined contribution plan (e.g., a 401 (k) or ira) is one where you choose how much to pay into the plan without knowing what the retirement benefit will be.

Pension Plans Part 2 Defined Benefit Vs Defined Contribution Pharma Tax Defined benefit plans and defined contribution plans are two primary categories of employer sponsored retirement plans, and they both can help you save along your journey toward retirement. the main differentiators fall around who primarily funds the plan, control over contributions and portability. Confused about the difference between defined benefit and defined contribution pensions? we break down the key differences, pros and cons of each. The two primary types of pension plans are defined benefit and defined contribution plans. this article focuses on shedding light on these pension plan structures, their differences, and the factors influencing their popularity in today’s employment landscape. Here is a comparison of defined benefit and defined contribution plans to understand the pros and cons of each.

Defined Benefit Plan Vs Defined Contribution Plan The two primary types of pension plans are defined benefit and defined contribution plans. this article focuses on shedding light on these pension plan structures, their differences, and the factors influencing their popularity in today’s employment landscape. Here is a comparison of defined benefit and defined contribution plans to understand the pros and cons of each. Compare defined benefit and defined contribution pension plans to understand their differences, pros, and cons, and find out which is best for your retirement strategy. Distinguishing between traditional pension (defined benefit) schemes and the flexibility offered by defined contribution plans like 401 (k) plans sheds light on why understanding the nuances matters. Many employees are presented with two primary options: a defined benefit plan and a defined contribution plan. while both aim to provide financial security for retirement, they differ significantly in structure, benefits, and how they’re managed. So, what is it that sets defined benefit pensions and defined contribution pensions apart? the key difference is: with a defined benefit pension, the amount you get is usually based on your salary and how long you've been part of the pension scheme.

Comments are closed.