Pensions Defined Contribution Plan Vs Defined Benefit Program What Is The Difference

Pensions Defined Contribution Plan Vs Defined Benefit Program What Is The Difference Employers make regular contributions to a pool of money set aside to fund payments to eligible employees after they retire. traditional pension plans in the u.s., known as defined benefit plans,. But for most private sector us workers, pensions disappeared long ago. in a traditional pension, employers contribute, invest and manage retirement funds for their workers, who then receive.

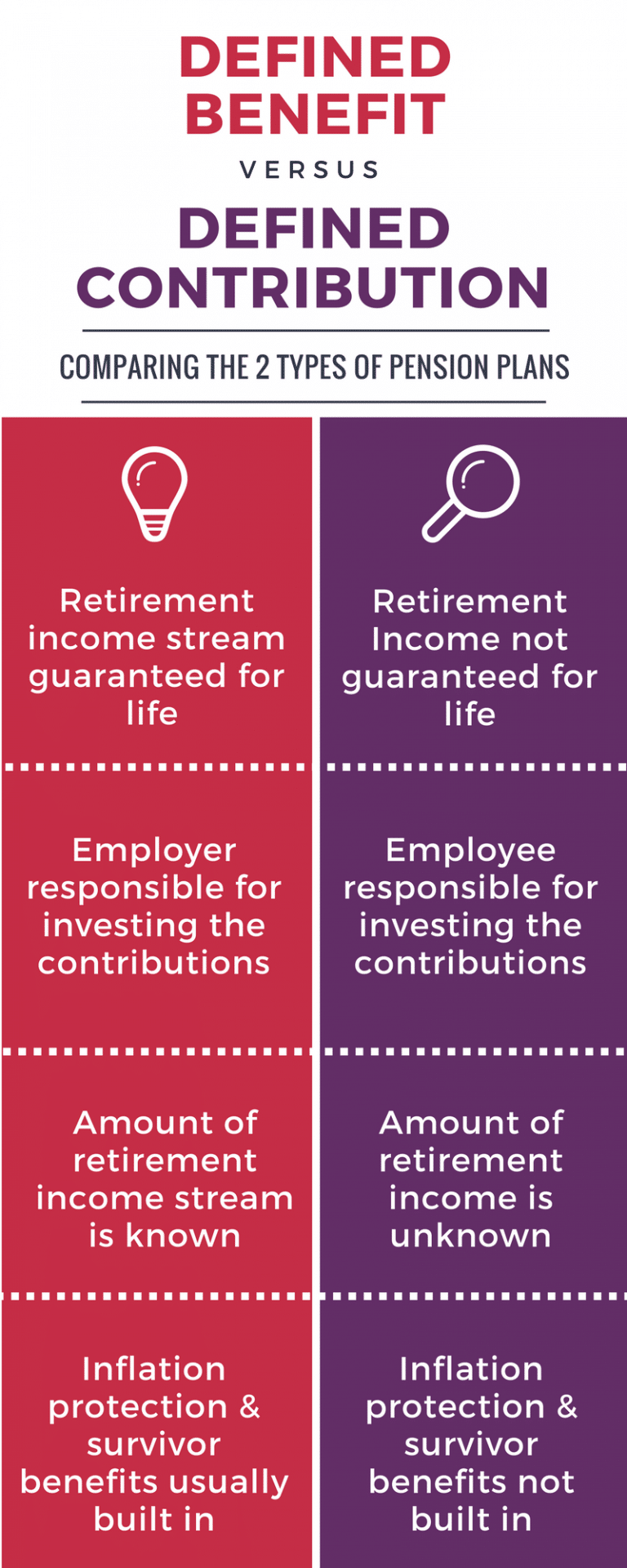

Infographic Defined Benefit Vs Defined Contribution Pension Plan Pharma Tax California pensions uses software applications and deep knowledge of the regulations to administer retirement plans for both private and public employers. our team of retirement professionals is dedicated to helping employers get the most out of every dollar. According to the federal reserve, just 22% of non retired adults had access to a pension as of 2021, the last year for which data is available. but what is a pension, and why is it so. Welcome to the nj division of pensions & benefits. here you can learn all about your health benefit and pension related information for active employees, retirees, and employers. our mission is to provide quality benefits and services to meet the needs of our clients. Pensions are often paid monthly for the rest of the retiree’s life or in a lump sum upon retirement. in most cases, pension income is calculated as a proportion of an employee’s earnings throughout his working years.

Defined Benefit Plan Vs Defined Contribution Plan How They Stack Up Welcome to the nj division of pensions & benefits. here you can learn all about your health benefit and pension related information for active employees, retirees, and employers. our mission is to provide quality benefits and services to meet the needs of our clients. Pensions are often paid monthly for the rest of the retiree’s life or in a lump sum upon retirement. in most cases, pension income is calculated as a proportion of an employee’s earnings throughout his working years. Search california public, government employee, workers salaries, pensions and compensation. Though the terms pension plans and pension funds are sometimes used interchangeably, they are actually quite different. as we’ve mentioned, a pension plan is an employer sponsored retirement plan that’s funded by either employer or employee contributions (or a combination of the two). A pension is a type of retirement plan where employers promise to pay a defined benefit to employees for life after they retire. it’s different from a defined contribution plan, like a 401 (k), where employees contribute their own money in an employer sponsored investment program. Mse and martin lewis explain what you need to know about pensions and saving for your retirement, including the pension 'superpowers' that will help you build your retirement pot.

Defined Benefit Plan Vs Defined Contribution Plan Zalamea Actuarial Blog Search california public, government employee, workers salaries, pensions and compensation. Though the terms pension plans and pension funds are sometimes used interchangeably, they are actually quite different. as we’ve mentioned, a pension plan is an employer sponsored retirement plan that’s funded by either employer or employee contributions (or a combination of the two). A pension is a type of retirement plan where employers promise to pay a defined benefit to employees for life after they retire. it’s different from a defined contribution plan, like a 401 (k), where employees contribute their own money in an employer sponsored investment program. Mse and martin lewis explain what you need to know about pensions and saving for your retirement, including the pension 'superpowers' that will help you build your retirement pot.

Comments are closed.