Predictive Analytics Platform Dragonfly Ai

Predictive Analytics Platform Dragonfly Ai Salary expense is recorded in the books of accounts with a journal entry for salary paid. debit the salary account and credit the. Journal entry for paid salary by cheque when the company issue cheque to pay for the salary, it will increase the salary expense on income statement. it also reduces the amount of cash at the bank. the journal entry is debiting salary expenses and credit cash at bank.

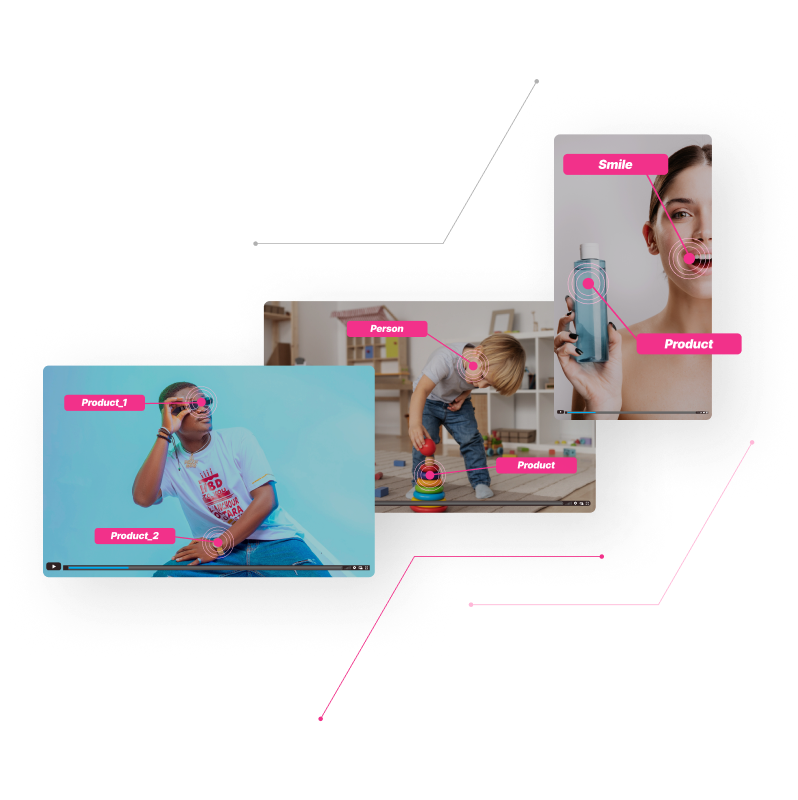

Creative Insights For Higher Impact Creative Dragonfly Ai Journal entries form the foundation of the accounting process, as they record each financial transaction systematically to ensure accuracy in the preparation of ledgers and financial statements. to support students and professionals in mastering this essential topic, this page combines concise explanations with practical exercises. Journal entry for paid wages wage expense is the cost of labor incurred by a company during a period of time. a company’s wage expense is the total amount of money that it pays to its employees in a given period. 21 steve co. paid by cheque 35,000 22 stationery bill paid by cheque 2,000 22 telephone bill by cash 500 31 paid rent by cash 2,000 paid salaries by cash 3,000 withdrew cash personal use 5,000 required: record journal entries for the transactions and post them to ledgers. solution: journals: jan 1 dr cash on hand 80,000 dr bank 20,000 cr. These are debited or credited according to the rules of debit and credit, applicable to the specific accounts. every business transaction affects two accounts. applying the principle of double entry, one account is debited and the other account is credited. every transaction can be recorded in the journal. also read: 30 transactions with their journal entries, ledger, trial balance and final.

Creative Insights For Higher Impact Creative Dragonfly Ai 21 steve co. paid by cheque 35,000 22 stationery bill paid by cheque 2,000 22 telephone bill by cash 500 31 paid rent by cash 2,000 paid salaries by cash 3,000 withdrew cash personal use 5,000 required: record journal entries for the transactions and post them to ledgers. solution: journals: jan 1 dr cash on hand 80,000 dr bank 20,000 cr. These are debited or credited according to the rules of debit and credit, applicable to the specific accounts. every business transaction affects two accounts. applying the principle of double entry, one account is debited and the other account is credited. every transaction can be recorded in the journal. also read: 30 transactions with their journal entries, ledger, trial balance and final. Salaries paid journal entry is passed to record the salary payments to employees by the business. salaries are treated as an expense in the books of business, so when the salary is paid, the salary account gets debited and the cash bank a c gets credited. Ledger posting in salaries ledger account in bank account. example : in the books of m s.trimurthy traders, salary paid to employee for ₹10000 on dt.01 07 2021 for the month of june' 2021 vide cheque no.700106 of axis bank current account. Later, when it makes salaries payment on january 2, for this accrued amount of $30,000, it can make the journal entry for salaries paid with the debit of salaries payable account and the credit of cash account as below:. Guide to ledger account examples. here we discuss most common examples of ledger account along with journal entry and explanations.

Creative Insights Predictive Analytics Platform Dragonfly Ai Salaries paid journal entry is passed to record the salary payments to employees by the business. salaries are treated as an expense in the books of business, so when the salary is paid, the salary account gets debited and the cash bank a c gets credited. Ledger posting in salaries ledger account in bank account. example : in the books of m s.trimurthy traders, salary paid to employee for ₹10000 on dt.01 07 2021 for the month of june' 2021 vide cheque no.700106 of axis bank current account. Later, when it makes salaries payment on january 2, for this accrued amount of $30,000, it can make the journal entry for salaries paid with the debit of salaries payable account and the credit of cash account as below:. Guide to ledger account examples. here we discuss most common examples of ledger account along with journal entry and explanations.

Creative Insights Predictive Analytics Platform Dragonfly Ai Later, when it makes salaries payment on january 2, for this accrued amount of $30,000, it can make the journal entry for salaries paid with the debit of salaries payable account and the credit of cash account as below:. Guide to ledger account examples. here we discuss most common examples of ledger account along with journal entry and explanations.

Comments are closed.