Problem Tracking Error Portfolio Chegg

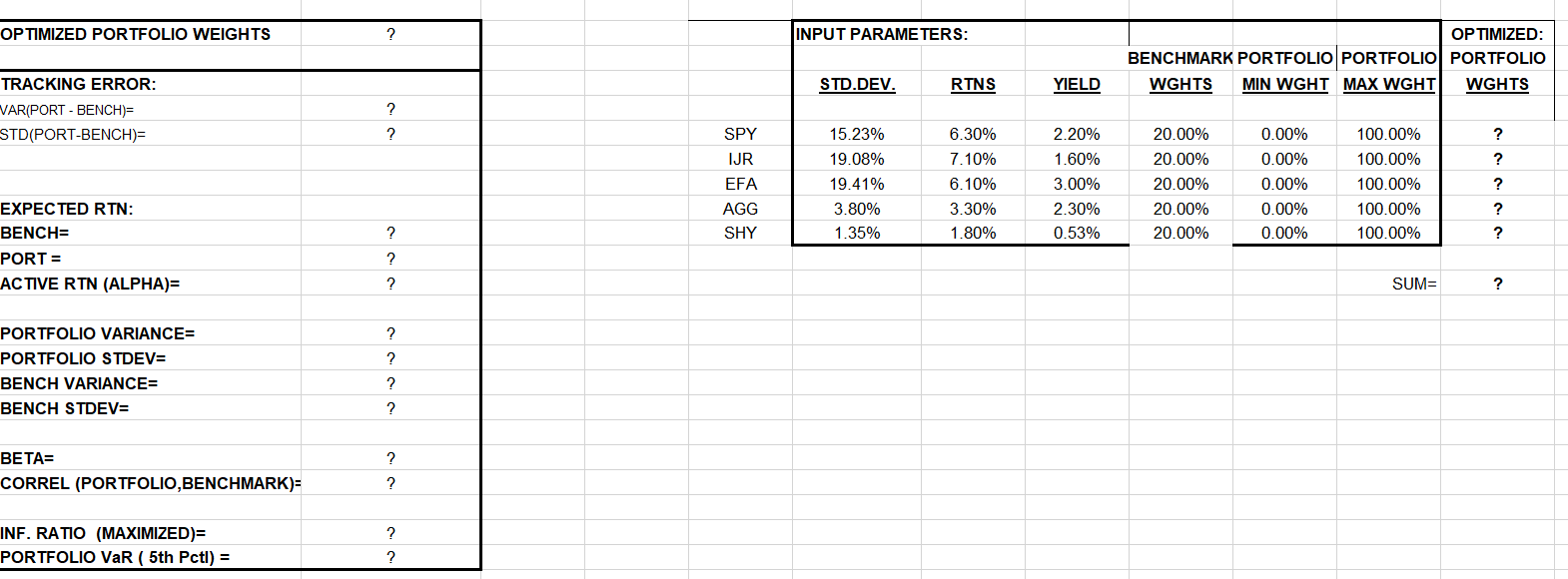

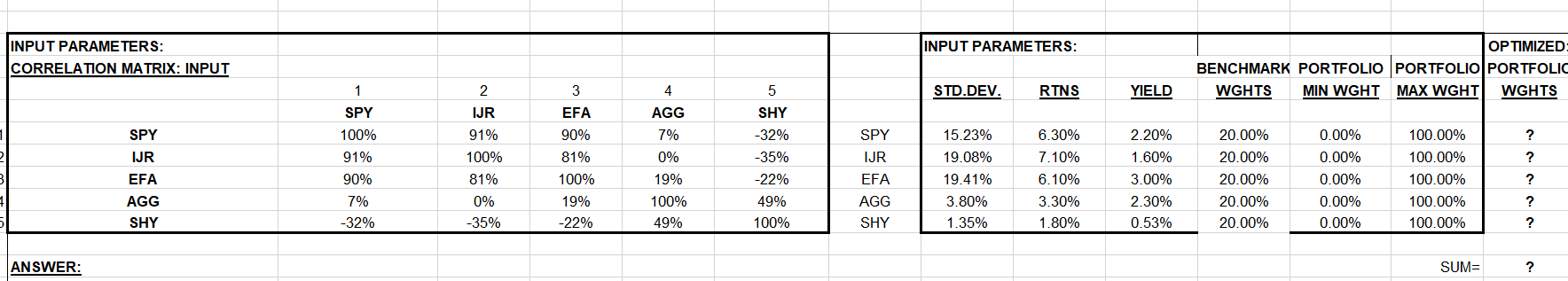

Problem Tracking Error Portfolio Chegg * use solver to maximize active return and set tracking error = 2%: note we seek long only asset positions (i.e., portfolio weights >= 0% ) * you are to compute the statistics indicated with a question mark "?". In practice, tracking error is a gauge of how consistently a portfolio outperforms, or underperforms, its benchmark. the lower the tracking error, the more closely the portfolio mimics its benchmark’s performance. the higher the tracking error, the more the portfolio deviates from the benchmark.

Problem Tracking Error Portfolio Chegg I think the n 1 formula is only for calculating each manager’s tracking error, which is already calculated for you. if you are calculating a portfolio (consisting of multiple managers each with their own tracking error, you use the formula in the answer). It's not clear to me that there is a solution to this problem. you have 10 stocks that you can pick, which all have random returns. you have an index which is also randomly created. Tracking error indicates how closely the portfolio behaves like its benchmark and measures a manager’s ability to replicate the benchmark return. tracking error is calculated as the standard deviation of the difference between the portfolio return and its benchmark index return. Tracking error is a crucial concept in portfolio management that measures the deviation of a portfolio's performance from its benchmark. it provides valuable insights into the effectiveness of investment strategies and helps investors assess the risk associated with their portfolios.

Solved Assume That The Tracking Error Of Portfolio X Is 8 70 Chegg Tracking error indicates how closely the portfolio behaves like its benchmark and measures a manager’s ability to replicate the benchmark return. tracking error is calculated as the standard deviation of the difference between the portfolio return and its benchmark index return. Tracking error is a crucial concept in portfolio management that measures the deviation of a portfolio's performance from its benchmark. it provides valuable insights into the effectiveness of investment strategies and helps investors assess the risk associated with their portfolios. Learn how to calculate and interpret tracking error, the difference between portfolio returns and a benchmark index, with practical examples. Solution step 1 step 1: introduction and objective the problem needs to calculate the tracking error of portfolio a's. Tracking error is the extent to which a portfolio’s performance differs from the performance of the benchmark to which it’s being compared. for example, if you own an index fund (or etf) and you find that it’s not tracking its index very closely, then the fund is exhibiting tracking error. This example shows how to compute a portfolio that minimizes the tracking error subject to a benchmark portfolio.

Solved Assume That The Tracking Error Of Portfolio X Is Chegg Learn how to calculate and interpret tracking error, the difference between portfolio returns and a benchmark index, with practical examples. Solution step 1 step 1: introduction and objective the problem needs to calculate the tracking error of portfolio a's. Tracking error is the extent to which a portfolio’s performance differs from the performance of the benchmark to which it’s being compared. for example, if you own an index fund (or etf) and you find that it’s not tracking its index very closely, then the fund is exhibiting tracking error. This example shows how to compute a portfolio that minimizes the tracking error subject to a benchmark portfolio.

Solved Assume That The Tracking Error Of Portfolio X Is 7 40 Chegg Tracking error is the extent to which a portfolio’s performance differs from the performance of the benchmark to which it’s being compared. for example, if you own an index fund (or etf) and you find that it’s not tracking its index very closely, then the fund is exhibiting tracking error. This example shows how to compute a portfolio that minimizes the tracking error subject to a benchmark portfolio.

Comments are closed.