Receivables Practice Quiz Practice Exercises Pe 7 Lo 2 Revenue Recognition Which One Of The

Exercises On Receivables Pdf Debits And Credits Bad Debt Accounts receivable (ar) is an accounting term for money owed to a business for goods or services that it has delivered but not been paid for yet. accounts receivable is listed on the company's. What are receivables? the term receivables is short for accounts receivable (a r), which are amounts bought by customers for a company's goods and services.

Quiz Worksheet Revenue Recognition Study In accounting, receivable refers to the amounts owed to a company by its customers or clients for goods sold or services rendered on credit. the receivable entry in bookkeeping essentially represents the money a business is expected to receive in the future. To calculate accounts receivable, add up all of the company’s sales on net credit terms. net terms may be represented as net 15, net 30, net 60, and so on. the number refers to the amount of time extended to the customer to pay the invoice. for example, “net 15” would mean that the customer must pay in full within 15 days. Accounts receivable are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame. accounts receivable is shown in a balance sheet as an asset. When a client doesn’t pay and we can’t collect their receivables, we call that a bad debt. businesses that have been around for a while will often estimate their total bad debts ahead of time to make sure the accounts receivable shown on their financial statements aren’t unrealistically high.

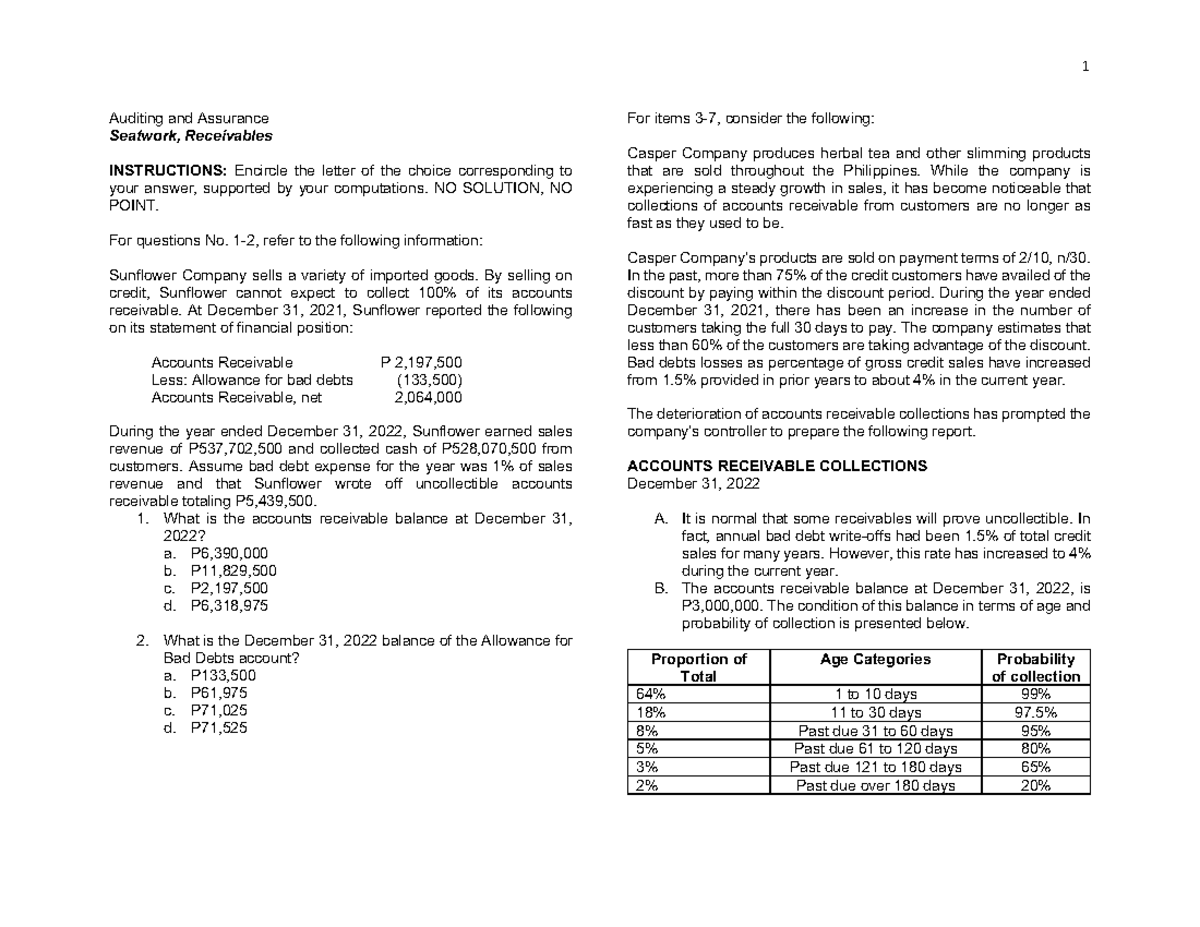

Quiz Receivables Practice Materials Auditing And Assurance Seatwork Receivables Accounts receivable are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame. accounts receivable is shown in a balance sheet as an asset. When a client doesn’t pay and we can’t collect their receivables, we call that a bad debt. businesses that have been around for a while will often estimate their total bad debts ahead of time to make sure the accounts receivable shown on their financial statements aren’t unrealistically high. Accounts receivable (a r) or receivables are the amounts customers owe to the company for the goods delivered or services provided. likewise, the company makes the journal entry for accounts receivable to recognize the assets that it has a claim as well as to recognize the revenue that it has earned for the period. The balance of money due to a business for goods or services provided or used but not yet paid for by customers is known as accounts receivable. these are goods and services delivered by a business on credit to their customer with an understanding that payment will come at a later date. Accounts receivable represents money a company has invoiced for goods or services that have been delivered but not yet paid for. accounts receivable is the flip side of accounts payable, which is money that a company owes to another business for products or services received. Accounts receivable arise from credit sales. for many retail firms, accounts receivable represents a substantial portion of their current assets. the function of a company's credit department is to establish and enforce credit policies.

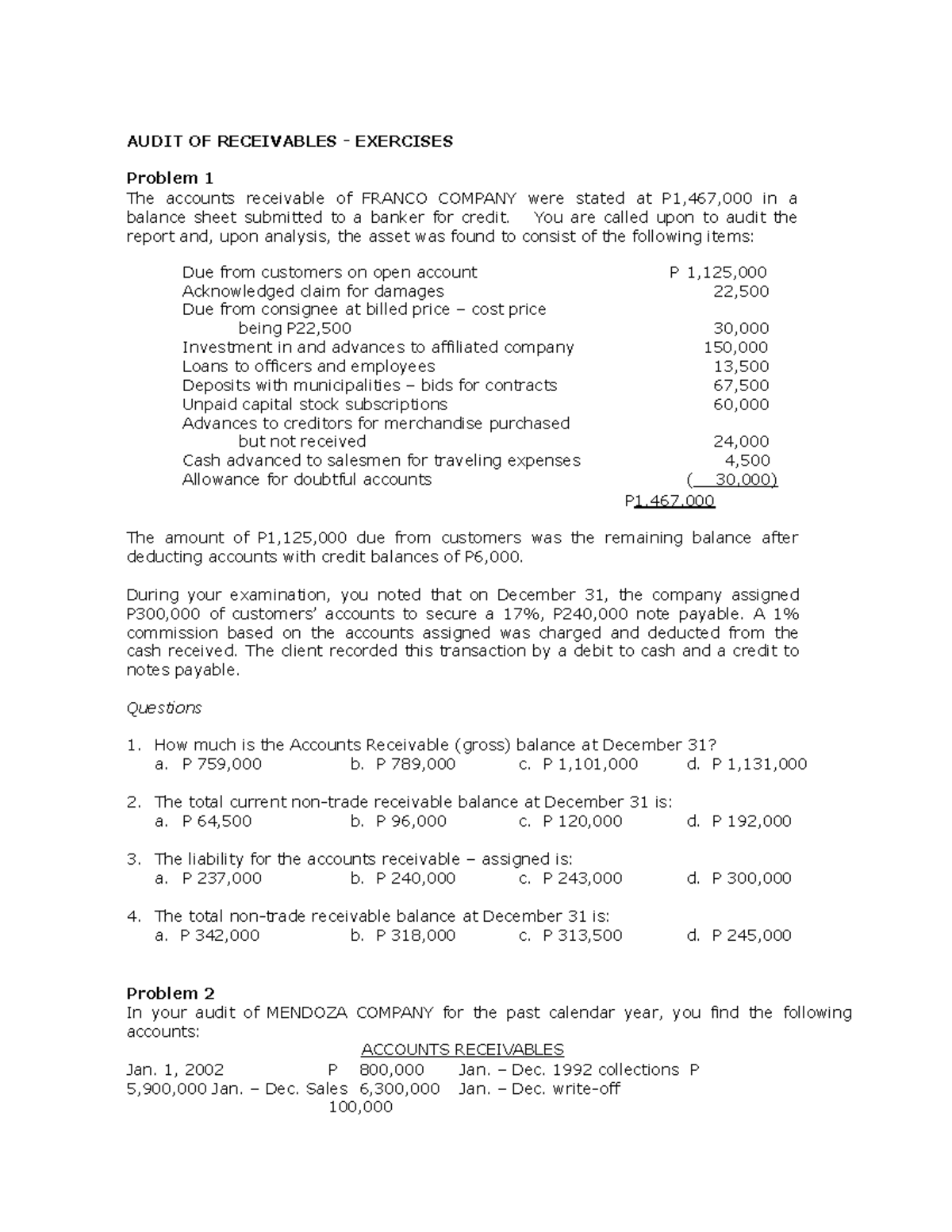

Audit Of Receivables Exercises Audit Of Receivables Exercises Problem 1 The Accounts Accounts receivable (a r) or receivables are the amounts customers owe to the company for the goods delivered or services provided. likewise, the company makes the journal entry for accounts receivable to recognize the assets that it has a claim as well as to recognize the revenue that it has earned for the period. The balance of money due to a business for goods or services provided or used but not yet paid for by customers is known as accounts receivable. these are goods and services delivered by a business on credit to their customer with an understanding that payment will come at a later date. Accounts receivable represents money a company has invoiced for goods or services that have been delivered but not yet paid for. accounts receivable is the flip side of accounts payable, which is money that a company owes to another business for products or services received. Accounts receivable arise from credit sales. for many retail firms, accounts receivable represents a substantial portion of their current assets. the function of a company's credit department is to establish and enforce credit policies.

Comments are closed.