Section 87a Of Income Tax Act Ay 2024 25 Vitia Yolanda

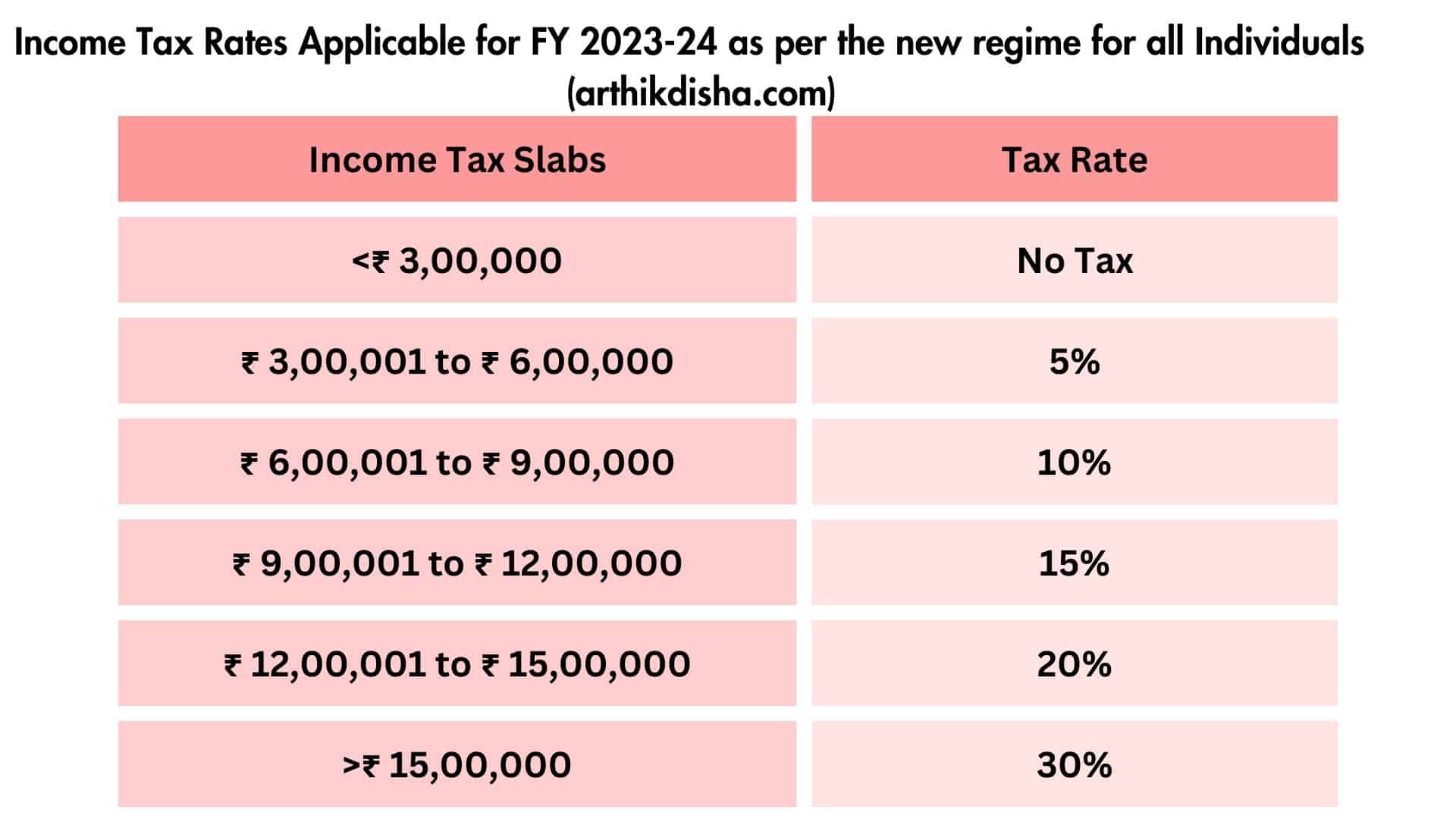

Section 87a Of Income Tax Act Ay 2024 25 Vitia Yolanda B. rebate under the proviso to section 87a of the income tax act, 1961, (‘the act’), is also allowable from tax payable at special rates except tax levied in accordance with section 112a of the act, where an assessee has opted for the new tax regime enacted in section 115bac of the act. Section 87a of the income tax act is a significant provision that provides a rebate on the income tax payable by individuals, offering taxpayers a chance to reduce their tax liabilities. this rebate applies to individuals whose total income falls below a specific threshold. with the introduction of the new tax regime and ongoing amendments in tax laws, understanding the latest updates.

Section 87a Of Income Tax Act Ay 2024 25 Vitia Yolanda The current itr filing applies to fy 2024 25 (ay 2025 26), where the old rebate limits are still in effect. the ₹60,000 rebate under section 87a will apply only from fy 2025 26 . Under section 87a, the maximum rebate limit is rs. 12,500 under the old tax regime and rs. 25,000 under the new tax regime. Since section 87a is incorporated in chapter vill the provision is not applicable. the cit (a) held that a composite reading of section 87a r.w.s.111a r.w.s. 112a does not bar the appellate from claiming rebate under section 87a. the appellant has continued the option exercised under section 115bca. Section 87a provides a tax rebate to taxpayers with a total income of up to rs 5 lakh under the old tax regime (resulting in a rebate of up to rs 12,500) or up to rs 7 lakh under the new tax regime (resulting in a rebate of up to rs 25,000) for fy 2023 24 (ay 2024 25).

Section 87a Of Income Tax Act Ay 2024 25 Aili Nikoletta Since section 87a is incorporated in chapter vill the provision is not applicable. the cit (a) held that a composite reading of section 87a r.w.s.111a r.w.s. 112a does not bar the appellate from claiming rebate under section 87a. the appellant has continued the option exercised under section 115bca. Section 87a provides a tax rebate to taxpayers with a total income of up to rs 5 lakh under the old tax regime (resulting in a rebate of up to rs 12,500) or up to rs 7 lakh under the new tax regime (resulting in a rebate of up to rs 25,000) for fy 2023 24 (ay 2024 25). While processing the return under section 143 (1), the centralized processing centre ( cpc ) limited the rebate under section 87a to ₹10,250, significantly lower than the claimed rebate of ₹20,010 . the disallowance resulted in an increased tax liability of ₹9,760 for the appellant. A new amendment to section 87a introduces marginal relief, applicable only under the new tax regime. this ensures that a slight increase in income above ₹7,00,000 will not immediately disqualify a taxpayer from receiving the rebate. Rebate under 87a of income tax | section 87a of income tax act | 87a rebate for ay 2024 25rebate undcer 87a of income taxsection 87a of income tax actrebate. Learn how to maximize your section 87a rebate for fy 2024 25 and avoid common mistakes that lead to income tax notices. expert tips and guidance included.

Section 87a Of Income Tax Act Ay 2024 25 Aili Nikoletta While processing the return under section 143 (1), the centralized processing centre ( cpc ) limited the rebate under section 87a to ₹10,250, significantly lower than the claimed rebate of ₹20,010 . the disallowance resulted in an increased tax liability of ₹9,760 for the appellant. A new amendment to section 87a introduces marginal relief, applicable only under the new tax regime. this ensures that a slight increase in income above ₹7,00,000 will not immediately disqualify a taxpayer from receiving the rebate. Rebate under 87a of income tax | section 87a of income tax act | 87a rebate for ay 2024 25rebate undcer 87a of income taxsection 87a of income tax actrebate. Learn how to maximize your section 87a rebate for fy 2024 25 and avoid common mistakes that lead to income tax notices. expert tips and guidance included.

Section 87a Of Income Tax Act Ay 2024 25 Elsie Idaline Rebate under 87a of income tax | section 87a of income tax act | 87a rebate for ay 2024 25rebate undcer 87a of income taxsection 87a of income tax actrebate. Learn how to maximize your section 87a rebate for fy 2024 25 and avoid common mistakes that lead to income tax notices. expert tips and guidance included.

Comments are closed.