Simply Put What Are The Main Types Of Employee Pension Plans

Simply Put What Are The Main Types Of Employee Pension Plans Do You Have An Employee Pension Do you have an employee pension plan? if you do, take 2 minutes to see how it works to help make the most of your retirement savings.learn more: www . Types of pension plans . there are two main types of pension plans: the defined benefit plan and the defined contribution plan.

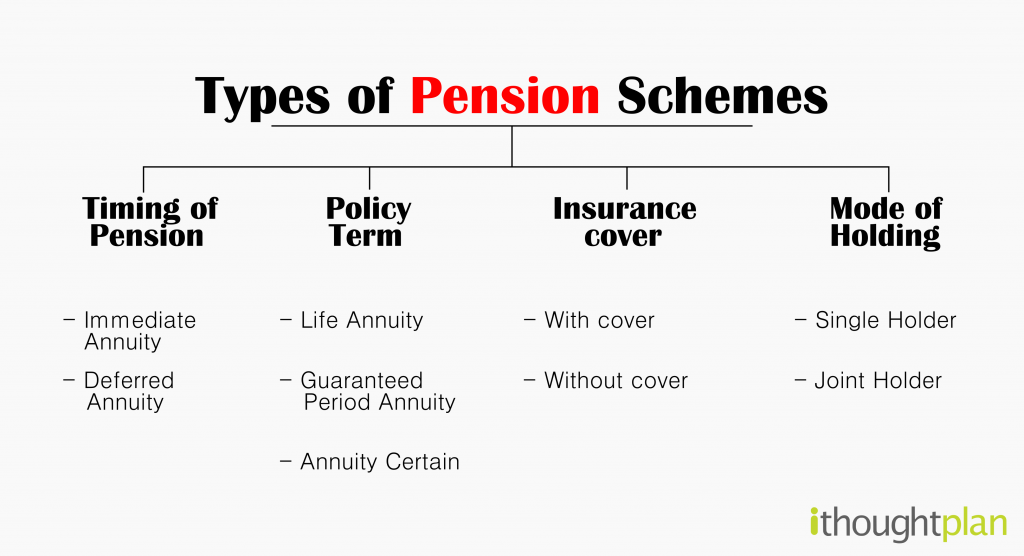

Types Of Pension Plans Ithought Plan S Blog On Pension Schemes Employers offer a variety of retirement plans to their employees, each with distinct features, benefits, and regulatory requirements. these plans generally fall into two broad categories: defined benefit plans and defined contribution plans. The main types of pension plans include defined benefit plans, defined contribution plans, and hybrid plans, each offering unique features and benefits. understanding these types can help individuals make informed decisions about their retirement savings. In order to select the right plan for your employees, and for your organization as a whole, it’s important to know about various types of employer sponsored and non employer sponsored plans, and how each of these plans differ. The two most widely known types of pension plans are defined benefit and defined contribution plans. however, government pensions also have distinct features that are worth discussing.

Types Of Pension Plans Ithought Plan S Blog On Pension Schemes In order to select the right plan for your employees, and for your organization as a whole, it’s important to know about various types of employer sponsored and non employer sponsored plans, and how each of these plans differ. The two most widely known types of pension plans are defined benefit and defined contribution plans. however, government pensions also have distinct features that are worth discussing. There are two primary types of employer sponsored retirement plans: defined benefit and defined contribution plans. 1. defined benefit plans—also called pension plans—offer you a guaranteed monthly benefit during retirement in exchange for contributing to the plan while you're working. Pension plans are retirement plans where employers contribute money on your behalf. an employee can access this money once they retire. this differs from a 401 (k) as you usually contribute your own money from your paycheck for retirement in this plan. But the more you know about the different types of retirement plans, the easier it is to make smart choices for your future. in this blog, we break down the main types of retirement plans and define each one. This guide will walk you through the types of plans, their benefits, and important considerations to ensure you optimize your retirement benefits. what is a pension plan? a pension plan is a type of retirement plan that provides retirement benefits to employees after they retire.

Comments are closed.