Solved 3 Using Future Value And Present Value Calculation Chegg

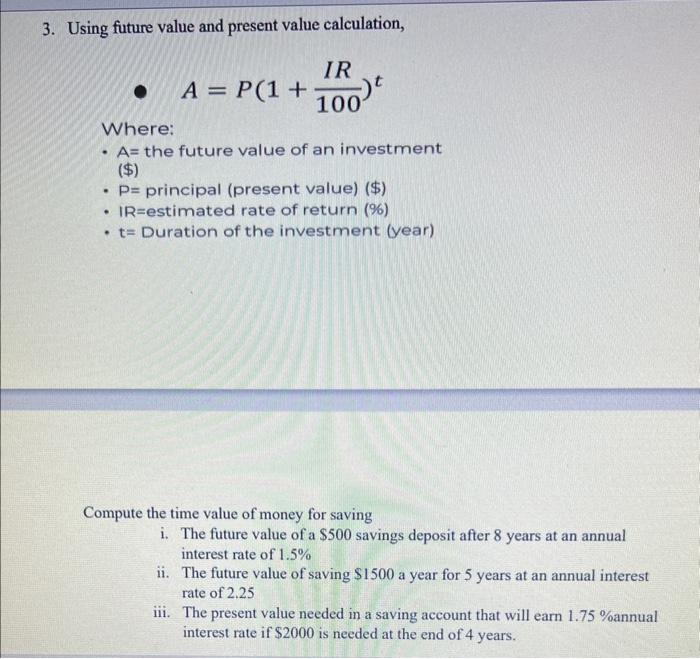

Solved 3 Using Future Value And Present Value Calculation Chegg The present value needed in a saving account that will earn 1.75% annual interest rate if $2000 is needed at the end of 4 years. not the question you’re looking for? post any question and get expert help quickly. In this equation, (1 r)n is the compounding factor that calculates the principal amount along with interest and interest on interest. it is called the “future value interest factor.” now, if we solve the above example with the given formula, we get. =1000 (1 0.10) 3 = rs. 1,331.

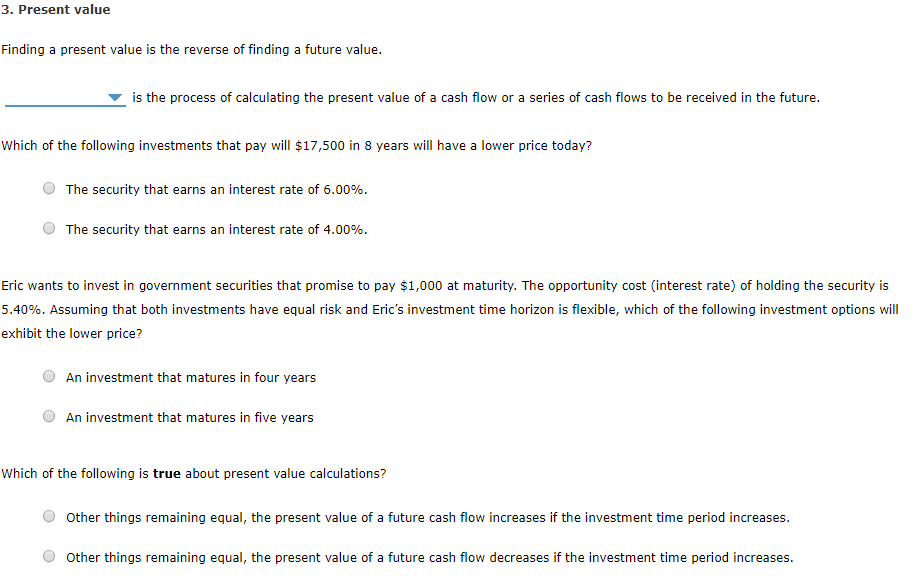

Solved 3 Present Value Finding A Present Value Is The Chegg Pv = $717.31 automate the process using excel or a calculator, by inputting the data into the cash flow register and pressing the npv key. The result of the pv calculation is the present value of any future value sum plus future cash flows or annuity payments. Free calculator to find the future value and display a growth chart of a present amount or periodic deposits. Net present value (npv) is a method used to determine the current value of all future cash flows generated by a project, including the initial capital investment. it is widely used in capital budgeting to establish which projects are likely to turn the greatest profit.

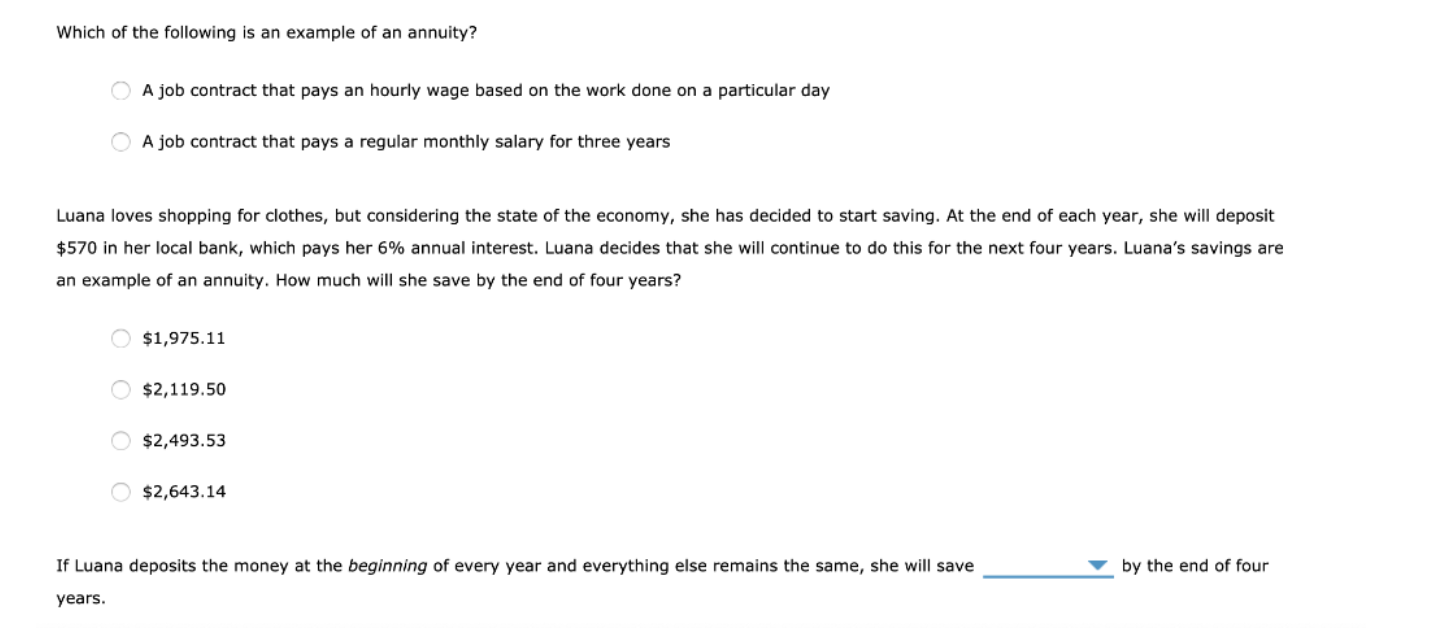

Solved 3 Present Value Finding A Present Value Is The Chegg Free calculator to find the future value and display a growth chart of a present amount or periodic deposits. Net present value (npv) is a method used to determine the current value of all future cash flows generated by a project, including the initial capital investment. it is widely used in capital budgeting to establish which projects are likely to turn the greatest profit. The present value represents what must be invested now to guarantee a desired payment in the future. future value is the amount a investment will grow to over time. managers typically adopt the present value approach. When estimating the intrinsic value of an asset, namely via the discounted cash flow (dcf) method, how much a company is worth is equal to the sum of the present value of all the future free cash flows (fcfs) the company is expected to generate in the future. Calculate the present value of uneven, or even, cash flows. finds the present value (pv) of future cash flows that start at the end or beginning of the first period. similar to excel function npv(). Guide to present value vs future value. here we discuss the top 7 difference between present and future value along with infographics.

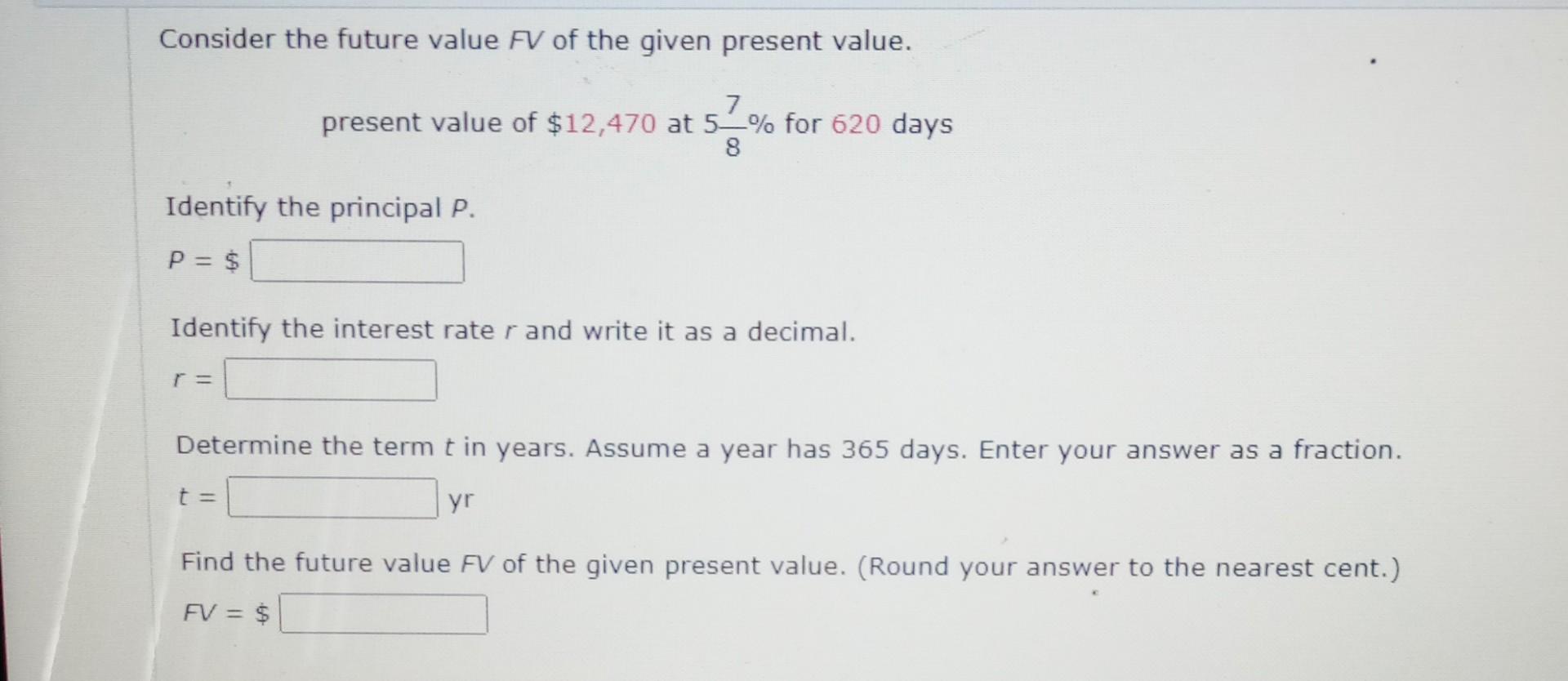

Solved Present Value Future Value Chegg The present value represents what must be invested now to guarantee a desired payment in the future. future value is the amount a investment will grow to over time. managers typically adopt the present value approach. When estimating the intrinsic value of an asset, namely via the discounted cash flow (dcf) method, how much a company is worth is equal to the sum of the present value of all the future free cash flows (fcfs) the company is expected to generate in the future. Calculate the present value of uneven, or even, cash flows. finds the present value (pv) of future cash flows that start at the end or beginning of the first period. similar to excel function npv(). Guide to present value vs future value. here we discuss the top 7 difference between present and future value along with infographics.

Solved Consider The Future Value Fv Of The Given Present Chegg Calculate the present value of uneven, or even, cash flows. finds the present value (pv) of future cash flows that start at the end or beginning of the first period. similar to excel function npv(). Guide to present value vs future value. here we discuss the top 7 difference between present and future value along with infographics.

Solved 3 Present Value Finding A Present Value Is The Chegg

Comments are closed.