Solved 4 49 Activity Based Costing And Activity Based Chegg

Solved Chapter 61 Activity Based Costing Customer Chegg Prepare a schedule calculating the unit cost and gross margin of part 24z2 using the activity based costing approach. use the cost drivers given as cost allocation bases. Study with quizlet and memorize flashcards containing terms like activity based costing (abc), activity, activity cost pool and more.

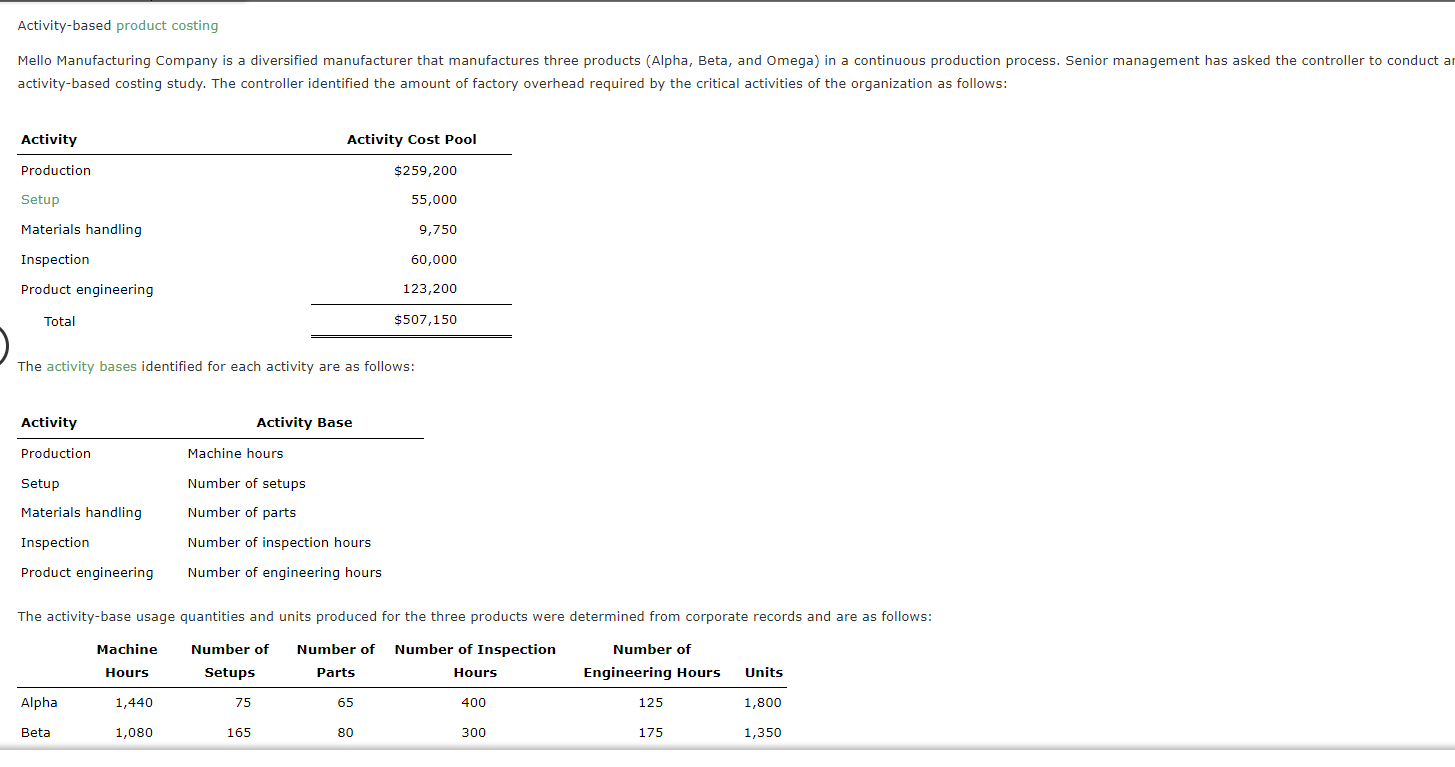

Solved Activity Based Product Costing Activity Based Costing Chegg Has prepared the following analysis showing the estim ated total cost and expected activity for each of its three activity cost pools:. The document discusses activity based costing systems used by two companies, duckhorn housecleaning and trico. for duckhorn housecleaning, activity rates are computed for cleaning, job support, and client support activities. Answer: activity based costing (abc) is the costing that begins with the tracking of activities and then the output of the product. in other words, it is the costing method mechanism that focuses on activities conducted for the manufacture of goods. Chapter 4 activity based management and activity based costing 4 (oh allocation using cost drivers) wambaugh corp. has decided to imple ment an activity based costing system for its in house legal department.

Solved Activity Based Product Costing Activity Based Costing Chegg Answer: activity based costing (abc) is the costing that begins with the tracking of activities and then the output of the product. in other words, it is the costing method mechanism that focuses on activities conducted for the manufacture of goods. Chapter 4 activity based management and activity based costing 4 (oh allocation using cost drivers) wambaugh corp. has decided to imple ment an activity based costing system for its in house legal department. What is the purpose of activity based costing? activity based costing (abc) is a cost accounting method designed to improve the accuracy of cost allocation by assigning costs to activities based on their actual consumption of resources. Study with quizlet and memorize flashcards containing terms like overhead (indirect costs), what's important to remember about manufacturing overhead?, business can choose to allocate however they want (whatever makes sense for their business) based on two different systems: and more. Question: what is activity based costing ? what is activity based costing ? there are 2 steps to solve this one. Study with quizlet and memorize flashcards containing terms like what is the most accurate estimate of product cost?, what is the relevant activity base for assigning all overhead costs to jobs for job order costing?, what is the flow for a traditional costing system? and more.

Comments are closed.