Solved Appendix 1 Present Value Of R1 Appendix 2 Present Chegg

Appendix 1 Table 1 Present Value Of R1 Appendix 2 Chegg There’s just one step to solve this. appendix 1: present value of r1 appendix 2 : present value of a regular annuity of r1 per period for n periods use the information given below to answer the following questions. Figure 18.2 present value of annuity due (annuity in advance—beginning of period payments) chapter 18 appendix: present value tables 1100.

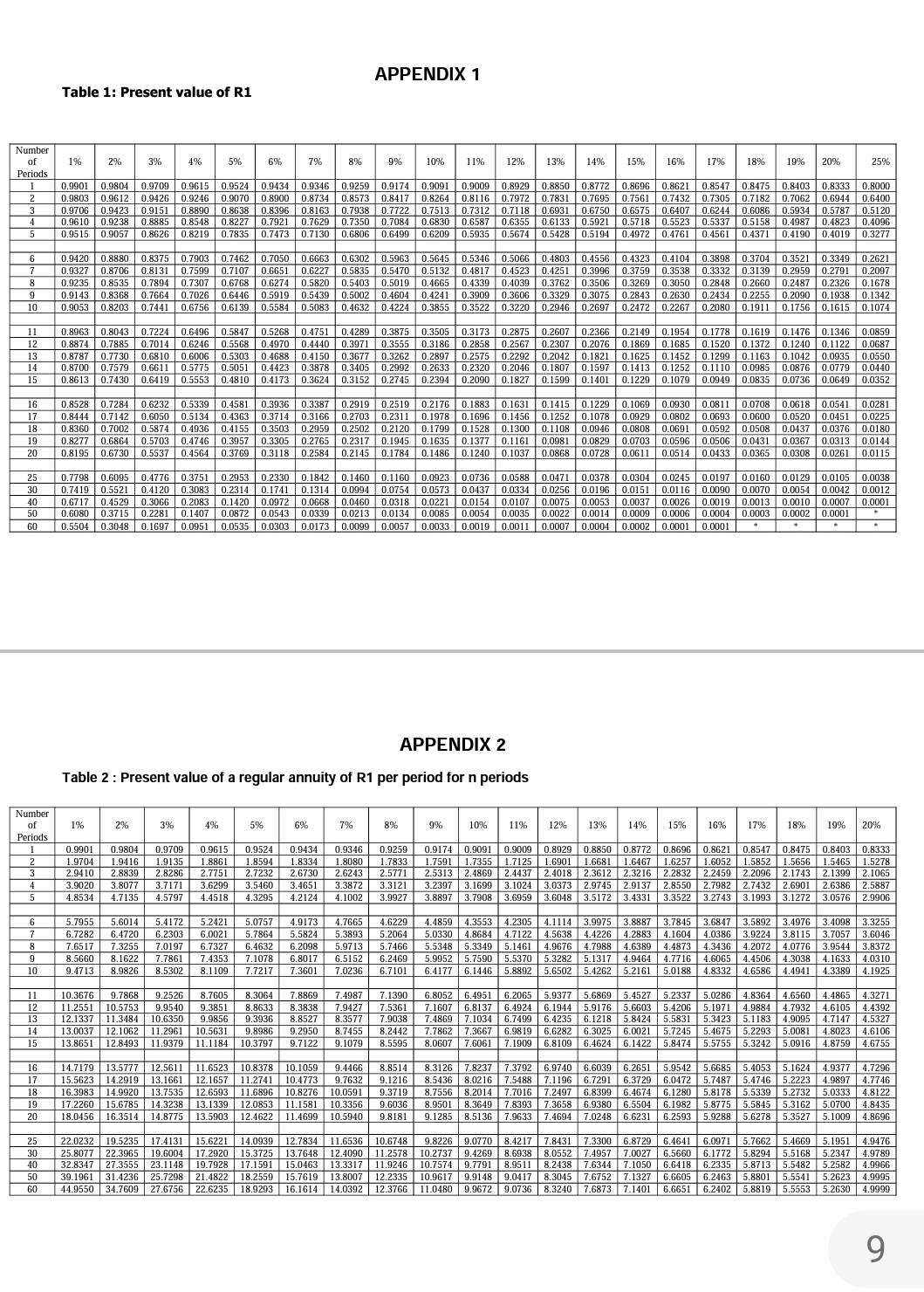

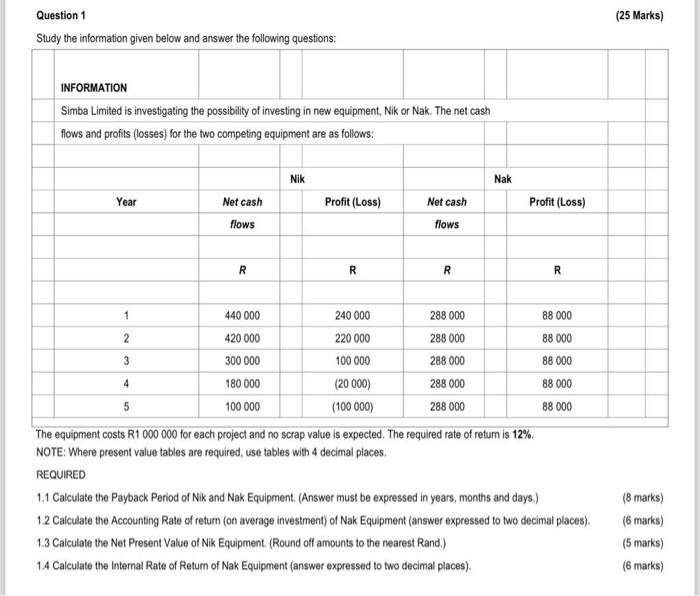

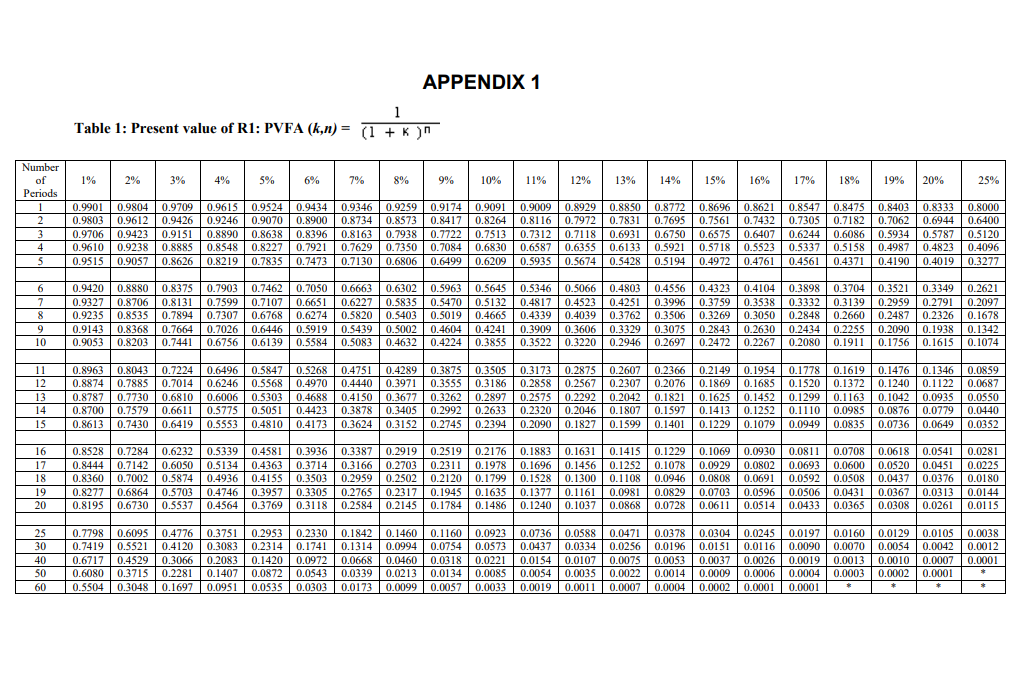

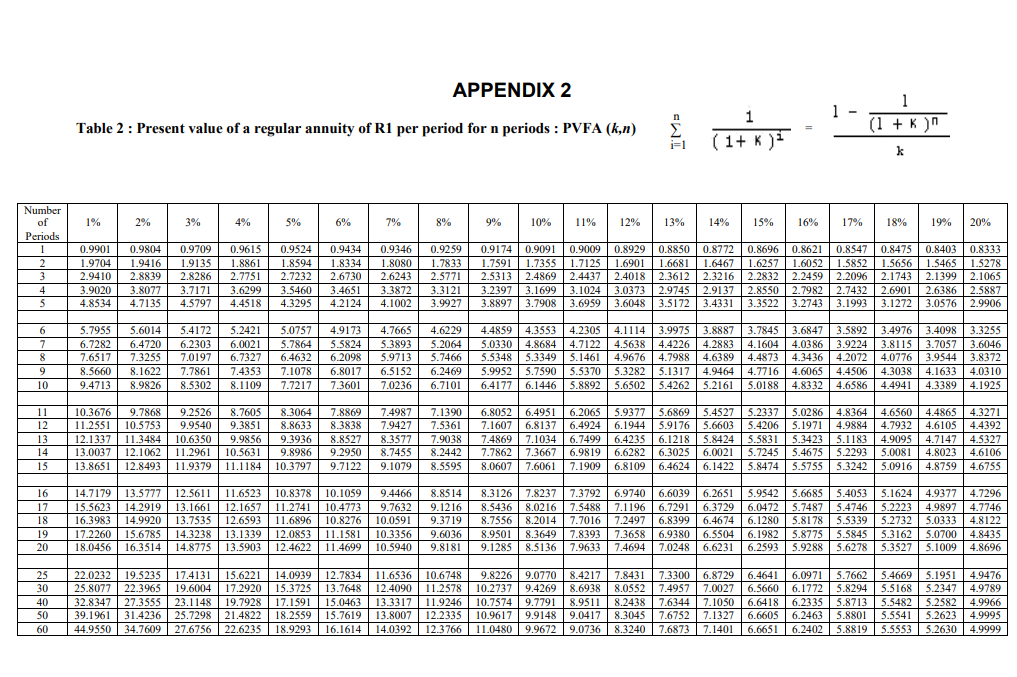

Solved Table 1 Present Value Of R1 Pv 1 K 21 Appendix Chegg Describe the two steps required to calculate net present value and internal rate of return when using excel. what is the payback method, and why do managers use this method? what are the two weaknesses associated with the payback method?. Use the present value tables in appendix a (present value of $1) and appendix b (present value of annuity of $1) to compute the npv of each of the following cash inflows: $22,900 received at the end of 15 years. Figure 8.10 present value of a $1 annuity received at the end of each period for n periods. factor = 1 − (1 r)−n r (8.9.2) (8.9.2) factor = 1 − (1 r) − n r. Appendix 1 (k,n)= (1 k)n1appendix 2 table 2 : present value of a regular annuity of r1 per period for n periods : pvfa (k,n)∑i=1n (1 k)i1=k1− (1 k)n1question 5 (20 marks) note: where applicable, use the present value tables provided in appendices 1 and 2 that appear after question 5.

Solved Table 1 Present Value Of R1 Pv 1 K 21 Appendix Chegg Figure 8.10 present value of a $1 annuity received at the end of each period for n periods. factor = 1 − (1 r)−n r (8.9.2) (8.9.2) factor = 1 − (1 r) − n r. Appendix 1 (k,n)= (1 k)n1appendix 2 table 2 : present value of a regular annuity of r1 per period for n periods : pvfa (k,n)∑i=1n (1 k)i1=k1− (1 k)n1question 5 (20 marks) note: where applicable, use the present value tables provided in appendices 1 and 2 that appear after question 5. Use the present value tables in appendix a and appendix b to compute the npv of each of the following cash inflows: required: $105,250 received at the end of six years. the discount rate is 3 percent. $3,600 received annually at the end of each of the next 15 years. Question 7 correct mark 5.00 out of 5.00 computing present values of single amounts and annuities refer to tables 1 and 2 in appendix a near the end of the book to compute the present value for each of the following amounts. Figure 18.3 present value of ordinary annuity (annuity in arrears—end of period payments). Chapter 2 present value 2 3 1.2 present value (pv) we can ask the question in reverse (interest rate r =4%). what is the pv of $1 received a year from now? • consider putting away 1 1.04 today. a year later receive: 1 1.04 × (1 0.04) = 1. • the pv of $1 received a year from now is: 1 1 r = 1 1 0.04. • the present value of $1 received t.

Appendix 1 Table 1 Present Value Of R1 Pvfa Chegg Use the present value tables in appendix a and appendix b to compute the npv of each of the following cash inflows: required: $105,250 received at the end of six years. the discount rate is 3 percent. $3,600 received annually at the end of each of the next 15 years. Question 7 correct mark 5.00 out of 5.00 computing present values of single amounts and annuities refer to tables 1 and 2 in appendix a near the end of the book to compute the present value for each of the following amounts. Figure 18.3 present value of ordinary annuity (annuity in arrears—end of period payments). Chapter 2 present value 2 3 1.2 present value (pv) we can ask the question in reverse (interest rate r =4%). what is the pv of $1 received a year from now? • consider putting away 1 1.04 today. a year later receive: 1 1.04 × (1 0.04) = 1. • the pv of $1 received a year from now is: 1 1 r = 1 1 0.04. • the present value of $1 received t.

Appendix 1 Table 1 Present Value Of R1 Pvfa Chegg Figure 18.3 present value of ordinary annuity (annuity in arrears—end of period payments). Chapter 2 present value 2 3 1.2 present value (pv) we can ask the question in reverse (interest rate r =4%). what is the pv of $1 received a year from now? • consider putting away 1 1.04 today. a year later receive: 1 1.04 × (1 0.04) = 1. • the pv of $1 received a year from now is: 1 1 r = 1 1 0.04. • the present value of $1 received t.

Comments are closed.