Solved Calculate The Leading P E Ratio Given The Following Chegg

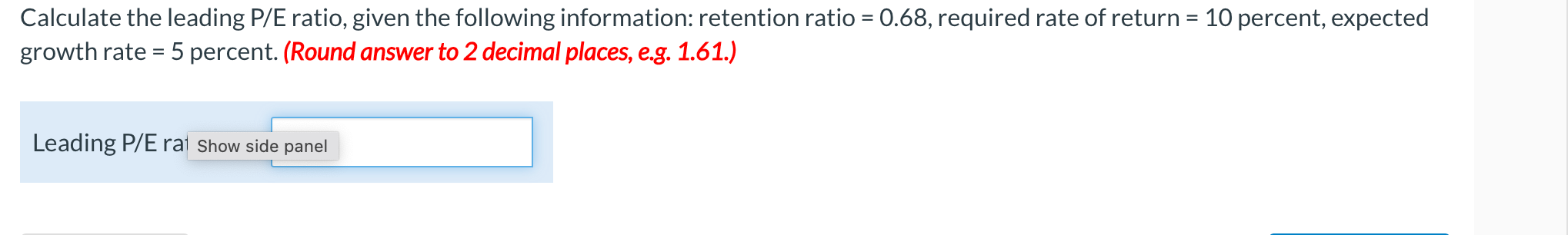

Solved Calculate The Leading P E Ratio Given The Following Chegg Calculate the leading p e ratio, given the following information: retention ratio = 0.68, required rate of return = 10 percent, expected growth rate = 5 percent. (round answer to 2 decimal places, e.g. 1.61.). Study with quizlet and memorize flashcards containing terms like equity valuation part 5, trailing p e, leading p e and more.

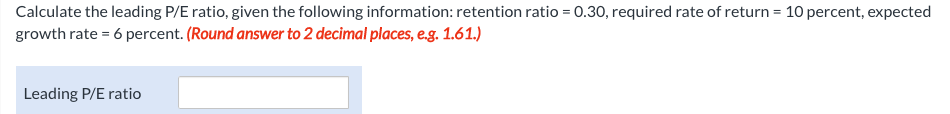

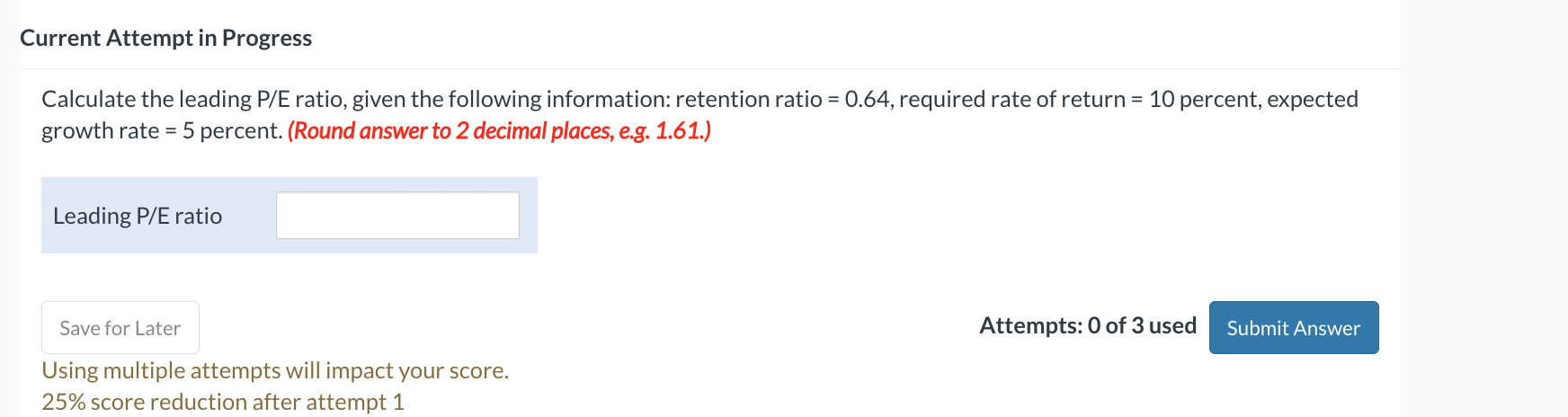

Solved Calculate The Leading P E Ratio Given The Following Chegg For example, the price to earnings (p e) ratio provides the implied valuation of a company based on its current earnings, or accounting profitability. the formula for calculating the p e ratio—or price earnings ratio—is equal to the current stock price divided by earnings per share (eps). To calculate the leading p e ratio, we need to determine the dividend payout ratio. the dividend payout ratio is calculated by subtracting the retention ratio from 1. so, 1 0.68 = 0.32. this means that 32 percent of earnings will be paid out as dividends, while 68 percent will be retained to finance growth. Calculate the leading p e ratio, given the following information: retention ratio = 0.50, required rate of return answered step by step solved by verified expert. Los 23 (g) calculate and interpret the justified leading and trailing p es using the gordon growth model. trustpilot rating score: 4.7 of 5, based on 61 reviews. learn with examples based on stock price, earnings per share, dividends, required rate of return, and dividend growth rate.

Solved Calculate The Leading P E Ratio Given The Following Chegg Calculate the leading p e ratio, given the following information: retention ratio = 0.50, required rate of return answered step by step solved by verified expert. Los 23 (g) calculate and interpret the justified leading and trailing p es using the gordon growth model. trustpilot rating score: 4.7 of 5, based on 61 reviews. learn with examples based on stock price, earnings per share, dividends, required rate of return, and dividend growth rate. The price earnings ratio (p e ratio) is the relationship between a company’s stock price and earnings per share (eps). it is a popular ratio that gives investors a better sense of the value of the company. Calculate how much investors are paying for each dollar of earnings. note: the price to earnings (p e) ratio helps assess how much investors are willing to pay for each dollar of a company’s earnings. the price to earnings (p e) ratio is calculated using the following formula:. To calculate the fundamentals based ratios, we assume that markets are efficient (the price of a stock equals its value) and divide the both sides of expression p 0 = d 1 (r g) by either last year's or next year's earnings: leading ratio: p 0 e 1 = d 1 (e 1 x (r g)) = (1 b) (r g). Calculate the price earnings ratio, peg ratio, dividend rate, and dividend payout ratio for each of the following companies. will each ratio consistently rank the companies from "best" to "worst" performer?.

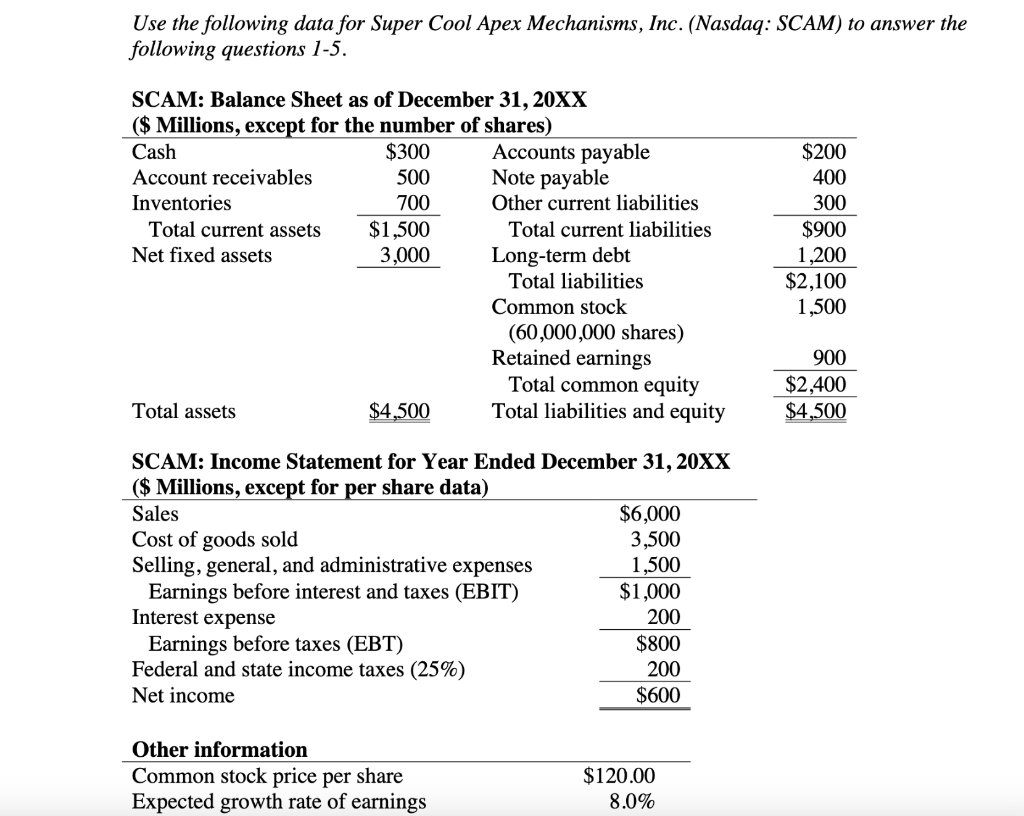

Solved Using The P E Ratio Approach To Valuation Calculate Chegg The price earnings ratio (p e ratio) is the relationship between a company’s stock price and earnings per share (eps). it is a popular ratio that gives investors a better sense of the value of the company. Calculate how much investors are paying for each dollar of earnings. note: the price to earnings (p e) ratio helps assess how much investors are willing to pay for each dollar of a company’s earnings. the price to earnings (p e) ratio is calculated using the following formula:. To calculate the fundamentals based ratios, we assume that markets are efficient (the price of a stock equals its value) and divide the both sides of expression p 0 = d 1 (r g) by either last year's or next year's earnings: leading ratio: p 0 e 1 = d 1 (e 1 x (r g)) = (1 b) (r g). Calculate the price earnings ratio, peg ratio, dividend rate, and dividend payout ratio for each of the following companies. will each ratio consistently rank the companies from "best" to "worst" performer?.

Solved 1 What Is The P E Ratio 2 What Is The Peg Chegg To calculate the fundamentals based ratios, we assume that markets are efficient (the price of a stock equals its value) and divide the both sides of expression p 0 = d 1 (r g) by either last year's or next year's earnings: leading ratio: p 0 e 1 = d 1 (e 1 x (r g)) = (1 b) (r g). Calculate the price earnings ratio, peg ratio, dividend rate, and dividend payout ratio for each of the following companies. will each ratio consistently rank the companies from "best" to "worst" performer?.

Comments are closed.