Solved Part V Accounts Receivable Uncollectible Accounts Chegg

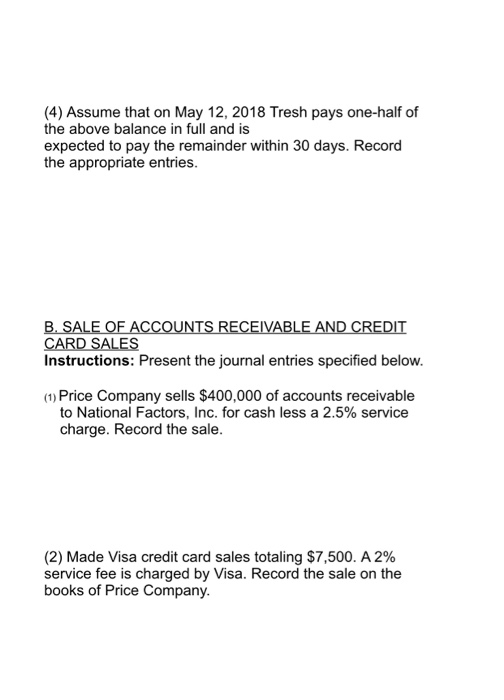

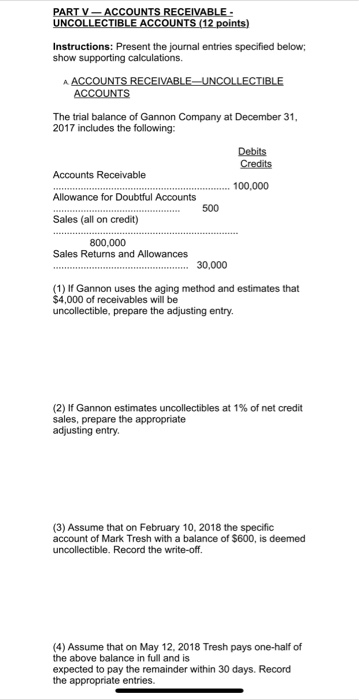

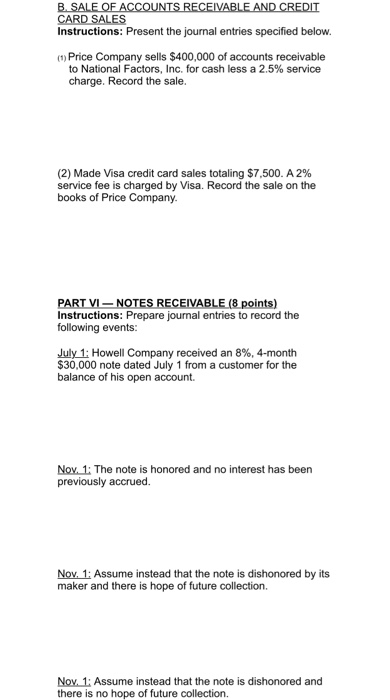

Solved Part V Accounts Receivable Uncollectible Accounts Chegg Part v accounts receivable uncollectible accounts (12 points) instructions: present the journal entries specified below; show supporting calculations. The journal entry to recognize uncollectible accounts expense under the direct write off method requires a (debit credit) to the uncollectible accounts expense account and a (debit credit) to the accounts receivable account.

Solved Part V Accounts Receivable Uncollectible Accounts Chegg Even if no accounts are known to be uncollectible at the time, arnold should estimate future bad debts and record those estimates as an expense (bad debt expense) and reduction in total assets (allowance for uncollectible accounts) in the current year. There are two main ways to estimate an allowance for bad debts: the percentage sales method and the accounts receivable aging method. bad debts can be written off on both business and individual tax returns. Uncollectible accounts are frequently called “bad debts.” a simple method to account for uncollectible accounts is the direct write off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. Cullumber company uses the allowance method to estimate uncollectible accounts receivable. the unadjusted balance in allowance for doubtful accounts is a debit of $5,000. the company produced the following information from aging its accounts receivable at year end.

Solved Part V Accounts Receivable Uncollectible Accounts Chegg Uncollectible accounts are frequently called “bad debts.” a simple method to account for uncollectible accounts is the direct write off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. Cullumber company uses the allowance method to estimate uncollectible accounts receivable. the unadjusted balance in allowance for doubtful accounts is a debit of $5,000. the company produced the following information from aging its accounts receivable at year end. The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. the method looks at the balance of accounts receivable at the end of the period and assumes that a certain amount will not be collected. Lowery co. uses the direct write off method of accounting for uncollectible accounts receivable. lowery has a customer whose accounts receivable balance has been determined to likely be uncollectible. This approach estimates bad debt expenses based on the balance in accounts receivable, but it also considers the uncollectible time period for each account. the longer the time passes with a receivable unpaid, the lower the probability that it will get collected. When a company is unable to collect on an account, it becomes an uncollectible accounts receivable. learn more about what that means in this article.

Solved Part V Accounts Receivable Uncollectible Accounts Chegg The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. the method looks at the balance of accounts receivable at the end of the period and assumes that a certain amount will not be collected. Lowery co. uses the direct write off method of accounting for uncollectible accounts receivable. lowery has a customer whose accounts receivable balance has been determined to likely be uncollectible. This approach estimates bad debt expenses based on the balance in accounts receivable, but it also considers the uncollectible time period for each account. the longer the time passes with a receivable unpaid, the lower the probability that it will get collected. When a company is unable to collect on an account, it becomes an uncollectible accounts receivable. learn more about what that means in this article.

Solved Part V Accounts Receivable Uncollectible Accounts Chegg This approach estimates bad debt expenses based on the balance in accounts receivable, but it also considers the uncollectible time period for each account. the longer the time passes with a receivable unpaid, the lower the probability that it will get collected. When a company is unable to collect on an account, it becomes an uncollectible accounts receivable. learn more about what that means in this article.

Solved A Company Has The Following Accounts Receivable And Chegg

Comments are closed.