Solved Uncollectible Accounts Will Amount To 4 Of Accounts Chegg

Solved Uncollectible Accounts Will Amount To 4 Of Accounts Chegg Our expert help has broken down your problem into an easy to learn solution you can count on. question: uncollectible accounts will amount to 4% of accounts receivable. read the requirements. select the explanation on the last line of the journal entry table.) there are 2 steps to solve this one. Companies with large amounts of uncollectible accounts normally use the direct write off method to account for uncollectible accounts expense. t f. we have an expert written solution to this problem! the primary advantage of using the direct write off method of recognizing the uncollectible accounts expense is simplicity. t f.

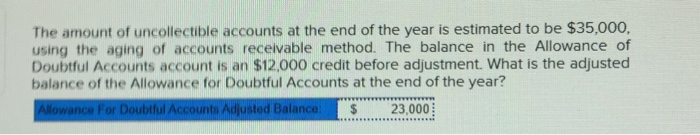

Solved The Amount Of Uncollectible Accounts At The End Of Chegg Video answer: hi to everyone. so first one is year ending adjusting entry for allowance for doubtful account. so credit sale dollar one one zero triple zero beginning allowance dollar one eighty zero estimated allowance two percent dollar two two. Once this account is identified as uncollectible, the company will record a reduction to the customer’s accounts receivable and an increase to bad debt expense for the exact amount uncollectible. Definition of uncollectible accounts. in this article, we’ll cover how to estimate uncollectible accounts under gaap. uncollectible accounts, often referred to as bad debts, are amounts owed to a company that are deemed unlikely to be collected. In this guide, we’ll break down how to handle these uncollectible accounts without losing your sanity—or your sense of humor. so grab a cup of coffee (or something stronger), and let’s get to it!.

Solved The Allowance For Uncollectible Accounts Should Be 4 Chegg Definition of uncollectible accounts. in this article, we’ll cover how to estimate uncollectible accounts under gaap. uncollectible accounts, often referred to as bad debts, are amounts owed to a company that are deemed unlikely to be collected. In this guide, we’ll break down how to handle these uncollectible accounts without losing your sanity—or your sense of humor. so grab a cup of coffee (or something stronger), and let’s get to it!. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. 1. the accounts affected are uncollectible accounts expense, accounts receivable (controlling), and accounts receivable—robert galvin (subsidiary). 2. uncollectible accounts expense is an expense account. accounts receivable (controlling) and accounts receivable—robert galvin (subsidiary) are asset accounts. 3. Once the company has identified accounts that are likely to be uncollectible, it needs to estimate the amount of uncollectible accounts. this can be done using different methods, such as the percentage of sales method or the aging of accounts receivable method. Bad debt expense is management's determination of which accounts will be sent to the attorney for collection., the cash account shows a balance of $90,000 before reconciliation. the bank statement does not include a deposit of $4,600 made on the last day of the month.

Solved The Amount Of Uncollectible Accounts At The End Of Chegg Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. 1. the accounts affected are uncollectible accounts expense, accounts receivable (controlling), and accounts receivable—robert galvin (subsidiary). 2. uncollectible accounts expense is an expense account. accounts receivable (controlling) and accounts receivable—robert galvin (subsidiary) are asset accounts. 3. Once the company has identified accounts that are likely to be uncollectible, it needs to estimate the amount of uncollectible accounts. this can be done using different methods, such as the percentage of sales method or the aging of accounts receivable method. Bad debt expense is management's determination of which accounts will be sent to the attorney for collection., the cash account shows a balance of $90,000 before reconciliation. the bank statement does not include a deposit of $4,600 made on the last day of the month.

Comments are closed.