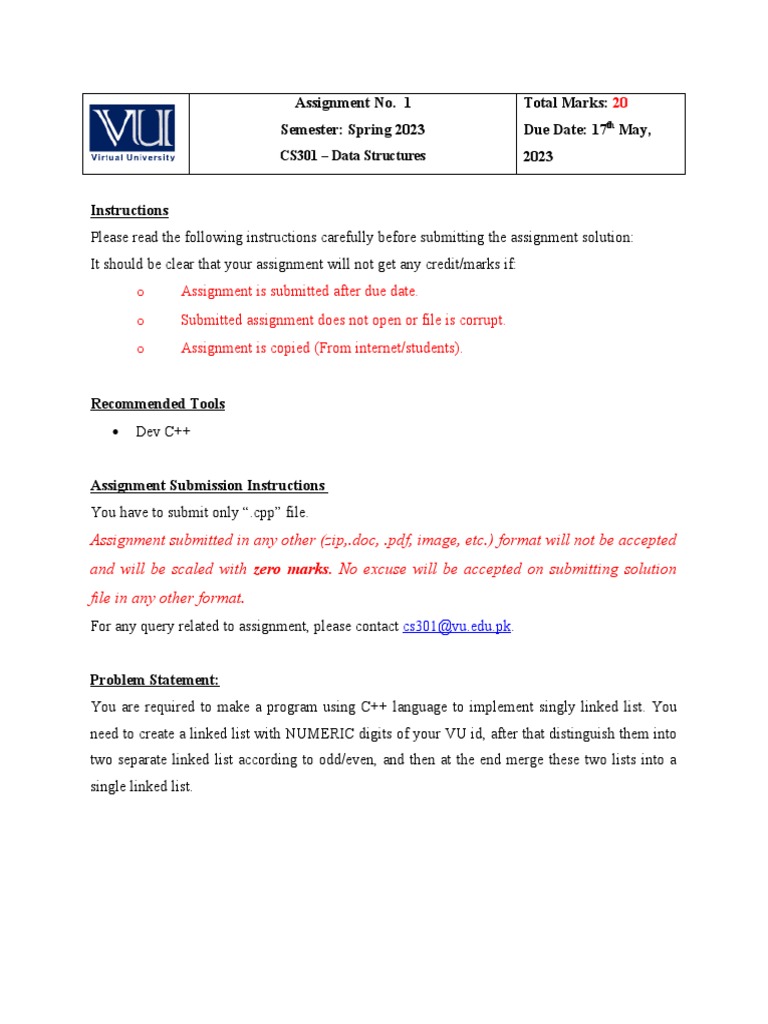

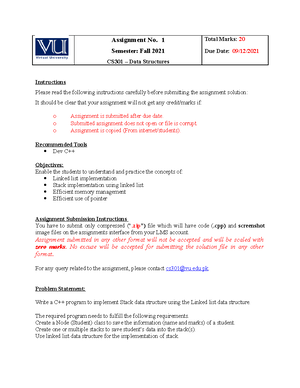

Spring 2023 Cs301 1 Assignment No 1 Semester Spring 2023 Cs301 Data Structures Total Marks

Spring 2023 Assignment 1 Cs301p Pdf Systems Engineering Data Management A personal savings plan can help you reach your personal savings goals. here are four common steps to create a plan and keep track of your goals. if you need additional help with financial planning, a financial advisor can also work with you in creating a financial plan for your savings, investment and tax needs. Creating a personal savings plan is essential for securing your financial future and achieving your short term and long term goals. it also makes it easier to improve your spending habits, plan for emergencies and fund big ticket items while having peace of mind. when you’re ready to move forward, keep these 10 tips in mind to help simplify the process of creating a personal savings plan.

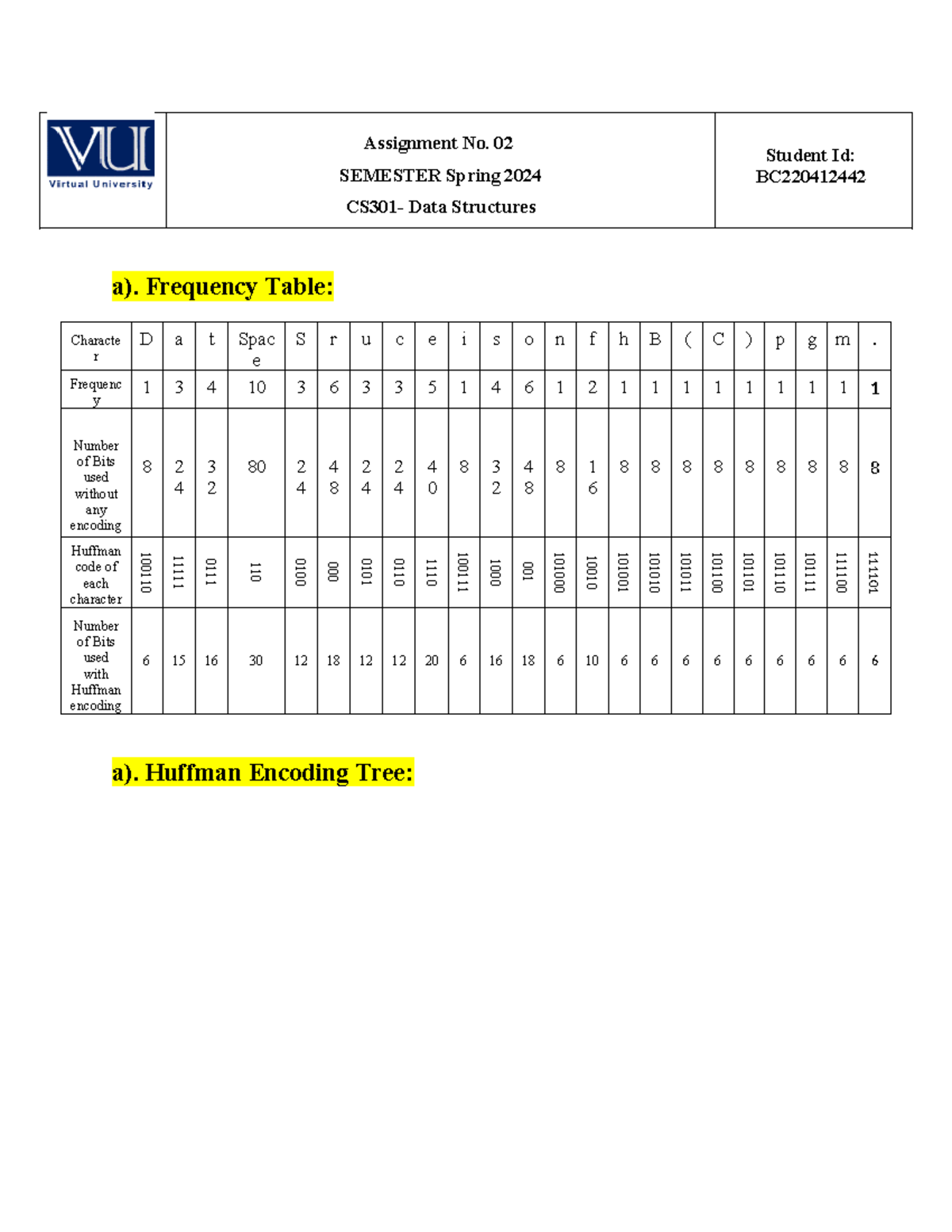

Cs301 Assignment 2 Solution File Spring 2024 Assignment No 02 Semester Spring 2024 Cs301 A realistic spending and savings plan accounts for how much you earn and how much you wish to spend, and it leaves room for flexibility: money for dining out, say, can be repurposed if you spend. A good savings plan puts you on a path toward financial well being. if you create one and follow it, you'll know you're looking out for your future self. By following these steps and implementing a personal savings plan, you’ll be well on your way to achieving financial stability and realizing your dreams. remember, financial success is a result of consistency, discipline, and making informed decisions. Financial experts often encourage people to pay themselves first to build savings. this means that you set aside money for a rainy day before paying your other expenses. following this simple piece of advice can help you build a financial cushion but following through takes effort and planning.

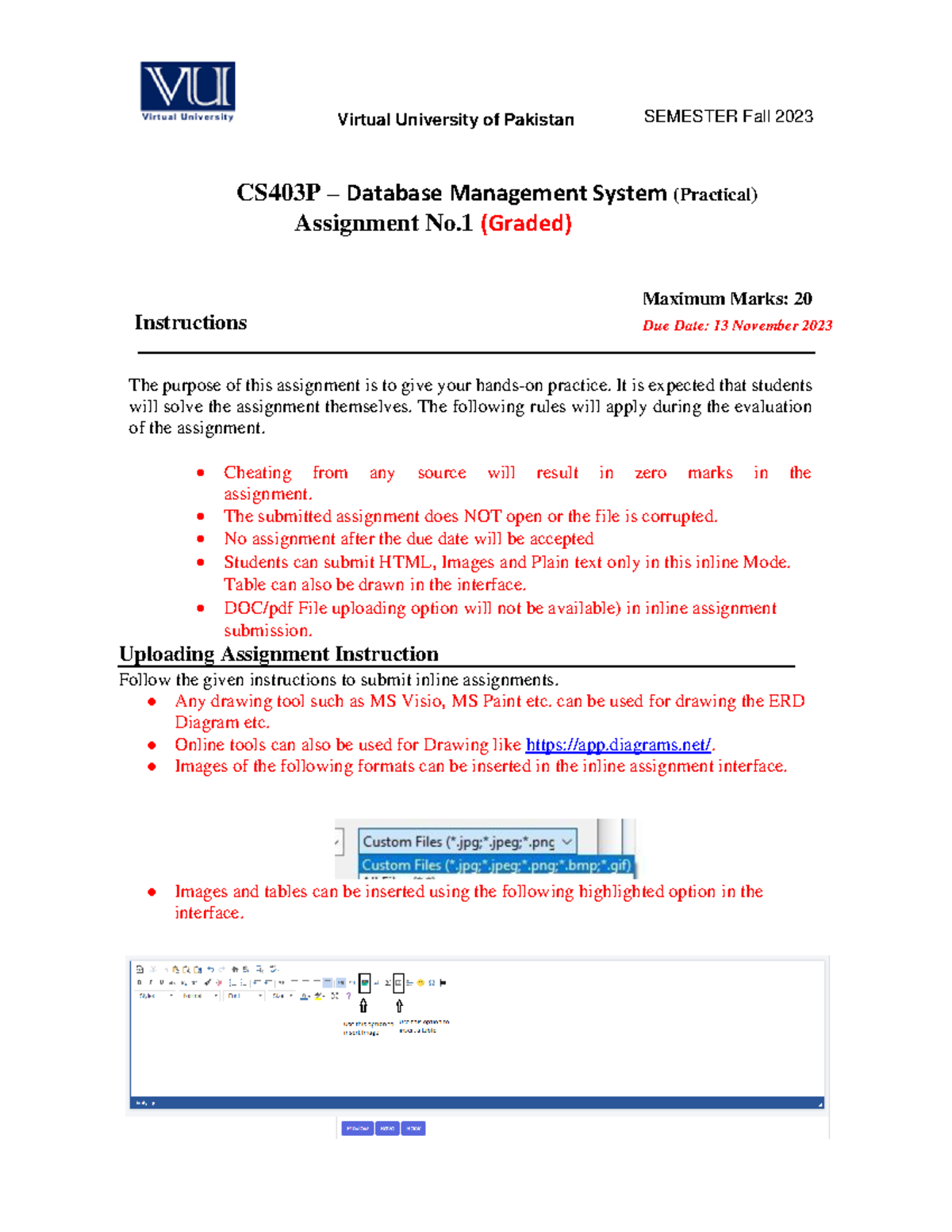

Fall 2023 Cs301 Virtual University Of Pakistan Semester Fall 2023 Cs403p Database Management By following these steps and implementing a personal savings plan, you’ll be well on your way to achieving financial stability and realizing your dreams. remember, financial success is a result of consistency, discipline, and making informed decisions. Financial experts often encourage people to pay themselves first to build savings. this means that you set aside money for a rainy day before paying your other expenses. following this simple piece of advice can help you build a financial cushion but following through takes effort and planning. Struggling to save money? learn how to create a customized savings plan that fits your lifestyle and financial goals. this step by step guide covers budgeting, setting realistic savings targets, building an emergency fund. start saving smarter today!. Whether you're saving for a vacation or retirement, sticking to your savings plan can be challenging. follow these tips to create a plan that sticks. A savings plan is a strategy or method for setting aside money on a regular basis in order to reach a financial goal, such as building an emergency fund, saving for a down payment on a home, or planning for retirement. the purpose of a savings plan is to create a consistent and disciplined approach to saving money, so that over time, you can accumulate the funds needed to achieve your. Whether you’re aiming to save money for an emergency fund, your retirement, or a luxury item, a savings plan will help you to be successful in putting aside the funds you need. to create a money saving plan, you need to work out a method of saving that works for you, based on your income, expenses, and saving goals.

Cs301 Assignment 2 Solution 2023 Download Struggling to save money? learn how to create a customized savings plan that fits your lifestyle and financial goals. this step by step guide covers budgeting, setting realistic savings targets, building an emergency fund. start saving smarter today!. Whether you're saving for a vacation or retirement, sticking to your savings plan can be challenging. follow these tips to create a plan that sticks. A savings plan is a strategy or method for setting aside money on a regular basis in order to reach a financial goal, such as building an emergency fund, saving for a down payment on a home, or planning for retirement. the purpose of a savings plan is to create a consistent and disciplined approach to saving money, so that over time, you can accumulate the funds needed to achieve your. Whether you’re aiming to save money for an emergency fund, your retirement, or a luxury item, a savings plan will help you to be successful in putting aside the funds you need. to create a money saving plan, you need to work out a method of saving that works for you, based on your income, expenses, and saving goals.

Spring 2023 Cs301 1 Pdf Data Data Management A savings plan is a strategy or method for setting aside money on a regular basis in order to reach a financial goal, such as building an emergency fund, saving for a down payment on a home, or planning for retirement. the purpose of a savings plan is to create a consistent and disciplined approach to saving money, so that over time, you can accumulate the funds needed to achieve your. Whether you’re aiming to save money for an emergency fund, your retirement, or a luxury item, a savings plan will help you to be successful in putting aside the funds you need. to create a money saving plan, you need to work out a method of saving that works for you, based on your income, expenses, and saving goals.

Cs301 Assignment 2 Solution Fall 2023 Cs301 Assignment 2 Solution Fall 2023 For More Files

Comments are closed.