Mgt201 Module 3 Topic 44 52 Time Value Of Money Financial Management Short Lecture

Msl 708 Financial Management Topic 1a Time Value Of Money Topics Tentative Pre Readings If you enjoyed this video and found it helpful, please like, subscribe, and hit the notificat. Corporate financing. concepts such as interest, time value of money, cash flows, risk & return, cost of capital, leverage, financing would be thoroughly discussed. in the later lectures, we will talk about some specialized areas of finance like international finance & working capital finance.

Acct332 Week 1 Lecture Notes Time Value Of Money Chapter 2 Time Value Of Money Practice This course, therefore, introduces you to three major decision making areas in financial management the investment, financing and asset management decisions. recognize the contents and uses of financial statements. explore how key financial ratios are used to assess the financial health of a firm. What is the time value of money (tvm)? money in the past money in the present money in the future money in hand today is worth more than money promised at some future time because it can be invested with interest and grow over time. • i=prt module 3: time value of money compound interest • compound interest is called the interest on interest, as well as the principal amount • compound interest is also charged with a certain rate • the difference between simple and compound interest is that here the rate is applied on the balance amount i.e. principal plus previous. Studying financial management mgt201 at virtual university of pakistan? on studocu you will find 91 lecture notes, practice materials, practical, mandatory.

Mgt 143 Chap 4 Time Value Of Money Ppt • i=prt module 3: time value of money compound interest • compound interest is called the interest on interest, as well as the principal amount • compound interest is also charged with a certain rate • the difference between simple and compound interest is that here the rate is applied on the balance amount i.e. principal plus previous. Studying financial management mgt201 at virtual university of pakistan? on studocu you will find 91 lecture notes, practice materials, practical, mandatory. Present value (pv), a cornerstone of time value of money, empowers individuals, investors and businesses to translate future cash flows into today’s value. the grip on this concept improves your analytical skills and helps in rational decision making. In financial management, we cannot do any calculations without time value of money. and that is why it is also called the mathematics of finance. so, every finance student needs to learn how time value of money actually works. The difference in value between money received today and money received in the future; also, the observation that two cash flows at two different points in time have different values. For paid services, contact: 0300 7113455thank you for watching! if you enjoyed this video and found it helpful, please like, subscribe, and hit the notificat.

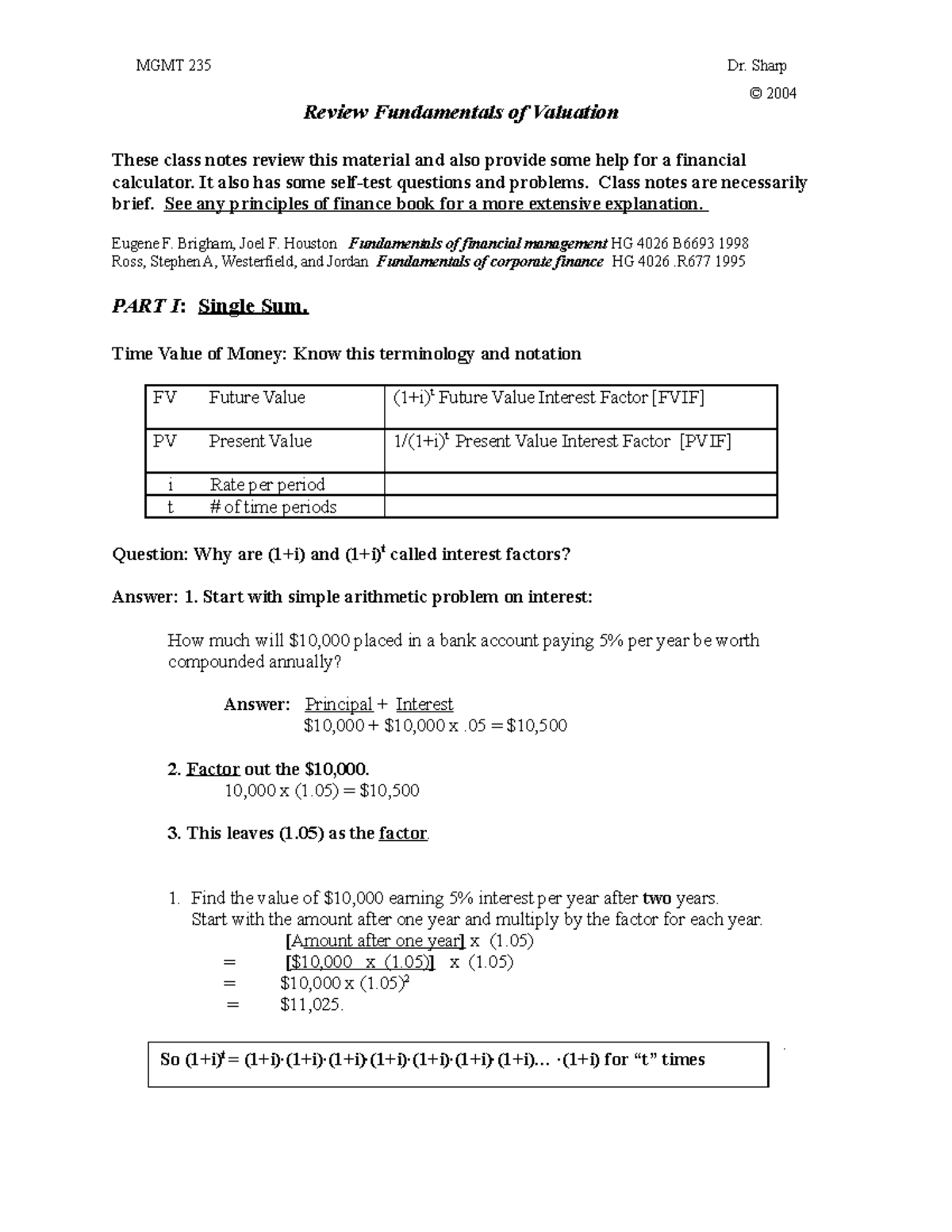

Time Value Of Money Assignment Mgmt 235 Dr Sharp Review Fundamentals Of Valuation Present value (pv), a cornerstone of time value of money, empowers individuals, investors and businesses to translate future cash flows into today’s value. the grip on this concept improves your analytical skills and helps in rational decision making. In financial management, we cannot do any calculations without time value of money. and that is why it is also called the mathematics of finance. so, every finance student needs to learn how time value of money actually works. The difference in value between money received today and money received in the future; also, the observation that two cash flows at two different points in time have different values. For paid services, contact: 0300 7113455thank you for watching! if you enjoyed this video and found it helpful, please like, subscribe, and hit the notificat.

Lecture Slides Week 1 Introduction And Short Term Financial Management Pdf Advanced The difference in value between money received today and money received in the future; also, the observation that two cash flows at two different points in time have different values. For paid services, contact: 0300 7113455thank you for watching! if you enjoyed this video and found it helpful, please like, subscribe, and hit the notificat.

Comments are closed.