Tax Benefits For Employers Navigating 401k And Pension Contributions Jake Jorgovan

Tax Benefits For Employers Navigating 401k And Pension Contributions Jake Jorgovan Learn how to maximize tax benefits for employers with strategies on 401k and pension plan contributions, including deductions, tax credits, and compliance tips. But did you know that this common benefit also comes with tax incentives? employers who make contributions to the plan on behalf of employees can deduct the contributions on the company’s federal income tax return, furthering tax benefits of the plan.

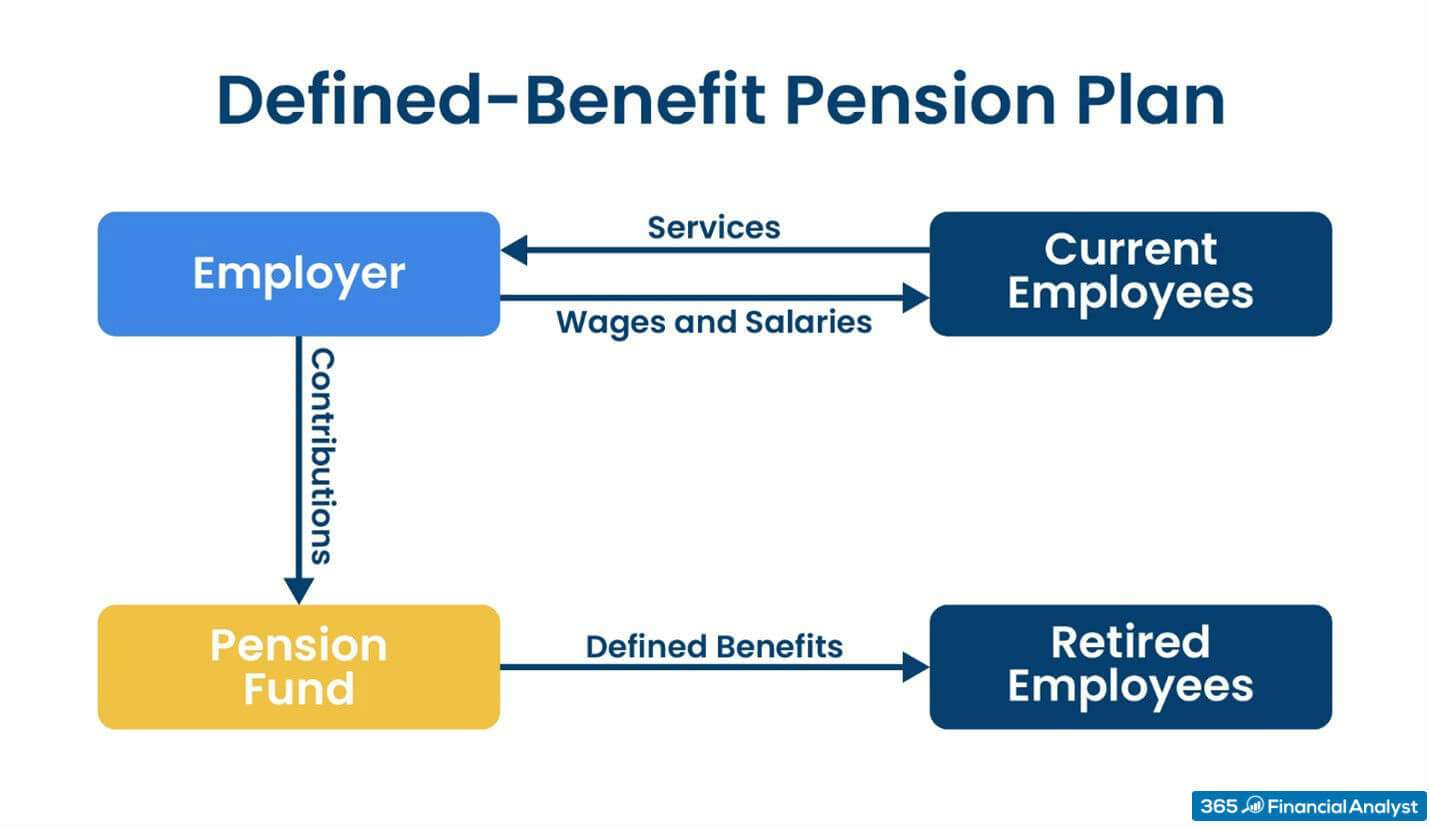

Tax Benefits For Employers Navigating 401k And Pension Contributions Jake Jorgovan You also handle administrative duties or hire someone to do it – like managing paperwork, ensuring contributions are deposited promptly, and following federal rules. in return, you get tax advantages (employer contributions are tax deductible as a business expense) and a happier workforce. Explore how pension contributions and tax relief benefits can optimize your retirement savings across various income levels and allowances. Matching employer contributions are one of the top benefits of employee 401 (k) plans for employees. employers have the option to match a percentage of employee contributions up to a set portion of total salary, or contribute up to a certain dollar amount, regardless of employee salary. Employer contributions made to a 401(k) plan are not subject to payroll taxes, which can result in significant savings for the company. this reduction in payroll taxes can also help employers offset the administrative costs of offering a 401(k) plan to employees.

Tax Benefits For Employers Navigating 401k And Pension Contributions Jake Jorgovan Matching employer contributions are one of the top benefits of employee 401 (k) plans for employees. employers have the option to match a percentage of employee contributions up to a set portion of total salary, or contribute up to a certain dollar amount, regardless of employee salary. Employer contributions made to a 401(k) plan are not subject to payroll taxes, which can result in significant savings for the company. this reduction in payroll taxes can also help employers offset the administrative costs of offering a 401(k) plan to employees. To encourage more companies to offer 401 (k) plans, the government provides tax credits and deductions that can really add up. and the deal recently got even sweeter for companies with fewer than 100 employees, thanks to legislation that increased the available tax credits. Contributions are made pre tax and reduce their taxable income. the money grows tax deferred, which means more money compounds over time and maximizes potential returns. Employer retirement benefits, like pensions, also affect taxes; planning the timing and method of withdrawals can help minimize tax burdens. when managing tax liabilities linked to employee benefits, both employers and employees can use several effective strategies. As section 404 of the internal revenue code notes, employers can deduct costs associated with a retirement plan setup, including administrative expenses and contributions.¹ so, the answer is yes, employer contributions to retirement plans are tax deductible.

Comments are closed.