Tds Payment Due Dates Tds Return Due Dates Tds Due Dates

Tds Payment Due Dates Tds Return Due Dates Tds Due Dates Caknowledge Check tds return filing and payment due dates for fy 2025 26 (ay 2026 27). know about time limit to deposit tds and file tds return. also know interest and penalty charges for late deposit or filing of tds return. Check tds return filing due dates & payment deadlines for fy 2024 25. avoid penalties, learn about late fees, interest, and online tds payment process.

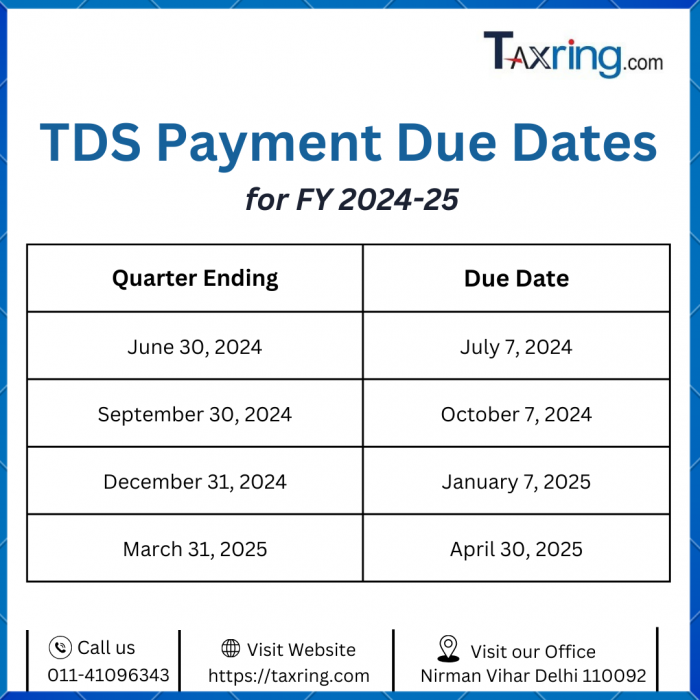

Tds Payment Online Due Dates For Tds Return Fy 2024 25 This article outlines the due dates for tds payment and return filing, highlights the consequences of missing deadlines, and explains the significance of form 26as in the process. Learn about the due dates for tds and tcs payments, returns, and consequences for late filing, deduction, and payment under the income tax act. The due date for tds payment is usually the 7th of the next month. however, for march, the due date for tds payment to the government is extended to 30 april 2025. the following are the tds return forms and the purpose for which they are used: this form is used for reporting tds on salary payments. In this blog, we will provide an overview of the tds return due dates and payment deadlines for the financial year 2024 25, along with details on penalties for late payments. whether you are a taxpayer or a tax professional, staying informed with taxspanner can help you manage your tds obligations efficiently.

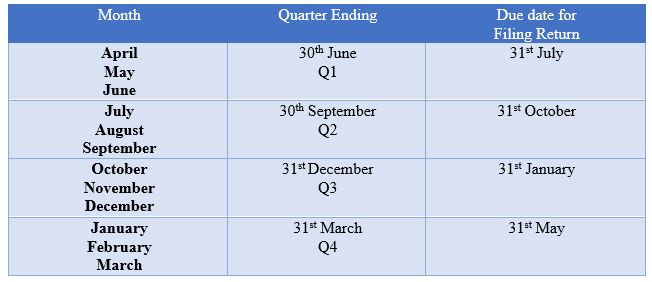

Tds Payment Due Dates Introduction Eligibility Forms The due date for tds payment is usually the 7th of the next month. however, for march, the due date for tds payment to the government is extended to 30 april 2025. the following are the tds return forms and the purpose for which they are used: this form is used for reporting tds on salary payments. In this blog, we will provide an overview of the tds return due dates and payment deadlines for the financial year 2024 25, along with details on penalties for late payments. whether you are a taxpayer or a tax professional, staying informed with taxspanner can help you manage your tds obligations efficiently. What is the difference between tds payment and tds return due dates? this is a common query for startups and small businesses. the tds payment due date is the last date to deposit deducted tax into the government account. the tds return due date refers to filing quarterly statements (form 24q, 26q, etc.) containing all tds transactions. often, businesses confuse both, leading to late penalties. Get the latest tds due dates for fy 2024 25, including payment deadlines, return filing, and form 16 issuance. Here’s a comprehensive overview of the due dates for tds payments and return filings for the financial year 2025 26: for most deductors, tds must be deposited by the 7th of the following month. however, for deductions made in march, the due date is extended to april 30th. After depositing the tds, the deductor must file a tds return. this is a statement providing details of the tax deducted and deposited with the government. the tds deposit due date for filing returns is the last day of the month following the end of the quarter.

Tds Return Due Dates Due Date June 31 Return What is the difference between tds payment and tds return due dates? this is a common query for startups and small businesses. the tds payment due date is the last date to deposit deducted tax into the government account. the tds return due date refers to filing quarterly statements (form 24q, 26q, etc.) containing all tds transactions. often, businesses confuse both, leading to late penalties. Get the latest tds due dates for fy 2024 25, including payment deadlines, return filing, and form 16 issuance. Here’s a comprehensive overview of the due dates for tds payments and return filings for the financial year 2025 26: for most deductors, tds must be deposited by the 7th of the following month. however, for deductions made in march, the due date is extended to april 30th. After depositing the tds, the deductor must file a tds return. this is a statement providing details of the tax deducted and deposited with the government. the tds deposit due date for filing returns is the last day of the month following the end of the quarter.

What Is Tds Due Date Of Tds Payment And Filing Tds Return Mcp Hot Sex Picture Here’s a comprehensive overview of the due dates for tds payments and return filings for the financial year 2025 26: for most deductors, tds must be deposited by the 7th of the following month. however, for deductions made in march, the due date is extended to april 30th. After depositing the tds, the deductor must file a tds return. this is a statement providing details of the tax deducted and deposited with the government. the tds deposit due date for filing returns is the last day of the month following the end of the quarter.

Comments are closed.