Tds Payment Online Due Dates For Tds Return Fy 2024 25

Tds Payment Online Due Dates For Tds Return Fy 2024 25 Check tds return filing due dates & payment deadlines for fy 2024 25. avoid penalties, learn about late fees, interest, and online tds payment process. Learn about the due dates for tds and tcs payments, returns, and consequences for late filing, deduction, and payment under the income tax act.

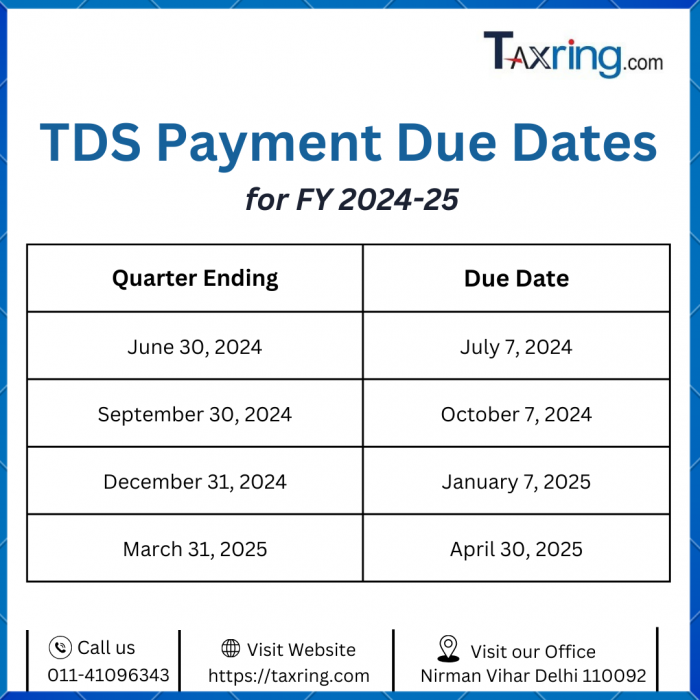

Tds Payment Due Dates Tds Return Due Dates Tds Due Dates Caknowledge The due date for tds payments with calendar for fy 2024 25 is here. avoid penalties & get 100% benefits of tds. stay compliant with our checklist. Discover tds return and payment due dates for fy 2024 25. learn about late filing penalties and interest charges to stay compliant. In this blog, we will provide an overview of the tds return due dates and payment deadlines for the financial year 2024 25, along with details on penalties for late payments. For fy 2024 25 | ay 2025 26, it’s crucial to mark your calendar with the specific deadlines for tds and tcs submissions to ensure timely compliance. an interest of 1% per month applies from the time the tax was supposed to be deducted until the deduction is made.

Stay On Top Of Tds Return Due Dates And Payment Deadlines For Fy 2024 25 In this blog, we will provide an overview of the tds return due dates and payment deadlines for the financial year 2024 25, along with details on penalties for late payments. For fy 2024 25 | ay 2025 26, it’s crucial to mark your calendar with the specific deadlines for tds and tcs submissions to ensure timely compliance. an interest of 1% per month applies from the time the tax was supposed to be deducted until the deduction is made. Here are the tds return due dates for fy 2024 25, based on each quarter: these are the official last dates of filing tds return for each quarter in the financial year 2024 25. delays beyond these deadlines result in late fees under section 234e and even penalties under section 271h. Through this post, we have mentioned all the information related to the tds payment due dates, late filing penalties, and more in relation to fy 2024 25. different forms are used for filing tds returns based on the type of transaction. following are the types of forms for filing tds returns: form 24q: quarterly statement of tds on salaries. Learn about the essential due dates for filing tds returns and making payments for the financial year 2024 25. stay compliant with tax regulations and avoid penalties by understanding the deadlines for tds return filing and payment obligations. Due date for belated and revised income tax filing for ay 2024 25 for non resident individuals (nri), huf and corporates. resident individuals due date extended to jan 15th 2025. professional tax due date varies from state to state.

Tds And Tcs Return Due Dates For The Fy 2022 2023 Check Late Filing Fees Penalty Interest Here are the tds return due dates for fy 2024 25, based on each quarter: these are the official last dates of filing tds return for each quarter in the financial year 2024 25. delays beyond these deadlines result in late fees under section 234e and even penalties under section 271h. Through this post, we have mentioned all the information related to the tds payment due dates, late filing penalties, and more in relation to fy 2024 25. different forms are used for filing tds returns based on the type of transaction. following are the types of forms for filing tds returns: form 24q: quarterly statement of tds on salaries. Learn about the essential due dates for filing tds returns and making payments for the financial year 2024 25. stay compliant with tax regulations and avoid penalties by understanding the deadlines for tds return filing and payment obligations. Due date for belated and revised income tax filing for ay 2024 25 for non resident individuals (nri), huf and corporates. resident individuals due date extended to jan 15th 2025. professional tax due date varies from state to state.

What Is The Tds Return Filing Due Date For Fy 2024 25 Pdf Learn about the essential due dates for filing tds returns and making payments for the financial year 2024 25. stay compliant with tax regulations and avoid penalties by understanding the deadlines for tds return filing and payment obligations. Due date for belated and revised income tax filing for ay 2024 25 for non resident individuals (nri), huf and corporates. resident individuals due date extended to jan 15th 2025. professional tax due date varies from state to state.

Tds Return Payments Due Date Fy 2024 25 Actax India

Comments are closed.