Tds Tcs Return Filing Dates Tds Tcs Payment Last Dates How To File Tds Return

Tds Payment Due Dates Tds Return Due Dates Tds Due Dates Caknowledge Learn about the due dates for tds and tcs payments, returns, and consequences for late filing, deduction, and payment under the income tax act. Check tds return filing and payment due dates for fy 2025 26 (ay 2026 27). know about time limit to deposit tds and file tds return. also know interest and penalty charges for late deposit or filing of tds return.

What Is Tds Due Date Of Tds Payment And Filing Tds Return Mcp Hot Sex Picture Due dates for e filing of tds return fy 2025 26. check late filing fees, penalty, interest rate for payment of tds and tds return forms. We cover the tds return filing last date and tcs return filing due dates in a proper format (quarterly basis) for ay 2026 27 (fy 2025 26). also, the taxpayer gets the details of the tds tcs payment deposits every month for government and non government employees. Tax collected at source (tcs) returns follow a quarterly filing schedule, with deadlines typically falling 15 days before the corresponding tds return due dates for each quarter. ensure timely compliance to avoid penalties. form 24q, 26q, 27q & 27eq must be filed quarterly. Since the tds return due date is july 31st, the delay in tds return filing will be 109 days. the penalty amount is greater than the total tds deducted, i.e., rs.10,000. therefore, you will only have to pay rs.10,000 as a penalty.

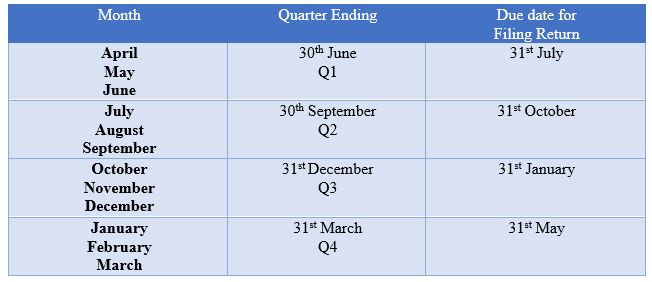

Tds Return File Know How To File Tds Tcs Return The Due Dates Of E Filling Tds Tcs In The Fy Tax collected at source (tcs) returns follow a quarterly filing schedule, with deadlines typically falling 15 days before the corresponding tds return due dates for each quarter. ensure timely compliance to avoid penalties. form 24q, 26q, 27q & 27eq must be filed quarterly. Since the tds return due date is july 31st, the delay in tds return filing will be 109 days. the penalty amount is greater than the total tds deducted, i.e., rs.10,000. therefore, you will only have to pay rs.10,000 as a penalty. Only for the month of march, the tds can be deposited up to 30th april. the due date to file tds return for quarter 1 (april to june), quarter 2 (july to september), quarter 3 (october to december) and quarter 4 (january to march) is 31st july, 31st october, 31st december and 31st may, respectively. Find tds tcs return due dates with the time period and last date for filing for ay 2025 26 (fy 2024 25). tds stands for tax deduction at source while tcs stands for tax collected at source. E filing returns of tax deducted at source (tds) and tax collected at source (tcs) are filed every quarter, and the quarterly statements are accepted regarding provisions of the income tax department. be sure to check the eligibility requirements, penalty details, and filing process for this tax return. The due dates for q1 returns fall in july 2025 —with 15th july as the deadline for tcs returns and 31st july for tds returns. to ensure accurate and successful filing, protean (nsdl) has released the latest rpu v5.7 and fvu v9.2 utilities, which are mandatory for preparing and validating your returns. in this article, we cover:.

Comments are closed.