The 3 Types Of Retirement Plans Financial Advisor Explains

Video 1 Types Of Retirement Schemes And Their Features Lyst9078 Pdf Life Annuity Pension Financial advisor explains: the 3 types of retirement plansi am a fee only, fiduciary, independent financial planner based in united states. i've built 40 re. In this article, we'll go over some of the general rules of different retirement plans, along with pros and cons for each. as you consider your potential options, it’s a good idea to consult a financial advisor or tax professional to help you choose a plan (or plans) that’s right for you.

Retirement Financial Advisor Types Responsibilities There are all types of retirement plans you may consider to help you build your wealth, from 401(k)s to individual retirement accounts (iras) to annuities. understanding the nuances of these different retirement plans, like their tax benefits and various drawbacks, may help you choose the right mix of plans to achieve your financial goals. There are many retirement plans available to help you save for your golden years. 401 (k)s, iras and roth iras offer unique benefits and tax advantages tailored to different financial goals and employment situations. It can be difficult to choose which type of tax advantaged retirement account to use. learn about the different types of retirement savings plans. We’ll cover employer sponsored plans, individual retirement accounts, and plans for self employed individuals and small business owners. a 401 (k) is the most common type of employer sponsored.

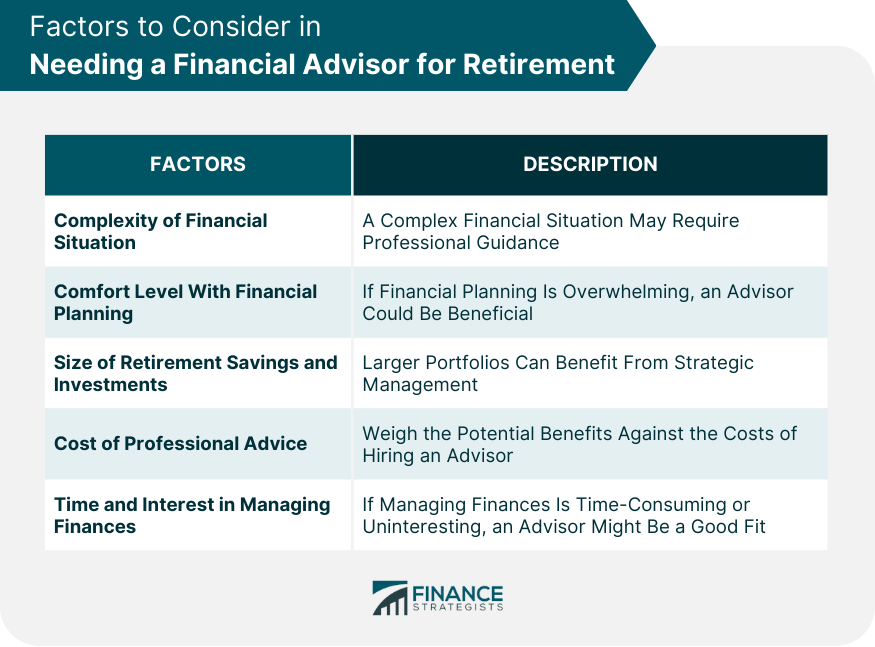

Do You Need A Financial Advisor For Retirement Factors It can be difficult to choose which type of tax advantaged retirement account to use. learn about the different types of retirement savings plans. We’ll cover employer sponsored plans, individual retirement accounts, and plans for self employed individuals and small business owners. a 401 (k) is the most common type of employer sponsored. It is crucial to have a financial advisor on your team to help navigate these options and determine which ones fit best in your situation. many of our clients use multiple options for their retirement savings, and our future articles will cover each of these plans in detail. Learn about common types of retirement plans and key features, eligibility requirements, and contribution limits for retirement plans like 401(k)s, iras, and more. Learning how to plan for retirement doesn't have to feel overwhelming. the various retirement plans available are easier to understand than you might think, although each is subject to its own limitations. Common forms of retirement saving fall into three buckets. accounts such as traditional 401 (k)s and iras are funded with money you have yet to pay taxes on. contributions you make to these accounts are typically deducted from your taxable income in the year you make the contributions.

Commission Financial Consultant And Retirement Planning Financial Advisor Source It is crucial to have a financial advisor on your team to help navigate these options and determine which ones fit best in your situation. many of our clients use multiple options for their retirement savings, and our future articles will cover each of these plans in detail. Learn about common types of retirement plans and key features, eligibility requirements, and contribution limits for retirement plans like 401(k)s, iras, and more. Learning how to plan for retirement doesn't have to feel overwhelming. the various retirement plans available are easier to understand than you might think, although each is subject to its own limitations. Common forms of retirement saving fall into three buckets. accounts such as traditional 401 (k)s and iras are funded with money you have yet to pay taxes on. contributions you make to these accounts are typically deducted from your taxable income in the year you make the contributions.

Where To Find A Financial Advisor For Retirement Planning Learning how to plan for retirement doesn't have to feel overwhelming. the various retirement plans available are easier to understand than you might think, although each is subject to its own limitations. Common forms of retirement saving fall into three buckets. accounts such as traditional 401 (k)s and iras are funded with money you have yet to pay taxes on. contributions you make to these accounts are typically deducted from your taxable income in the year you make the contributions.

Comments are closed.