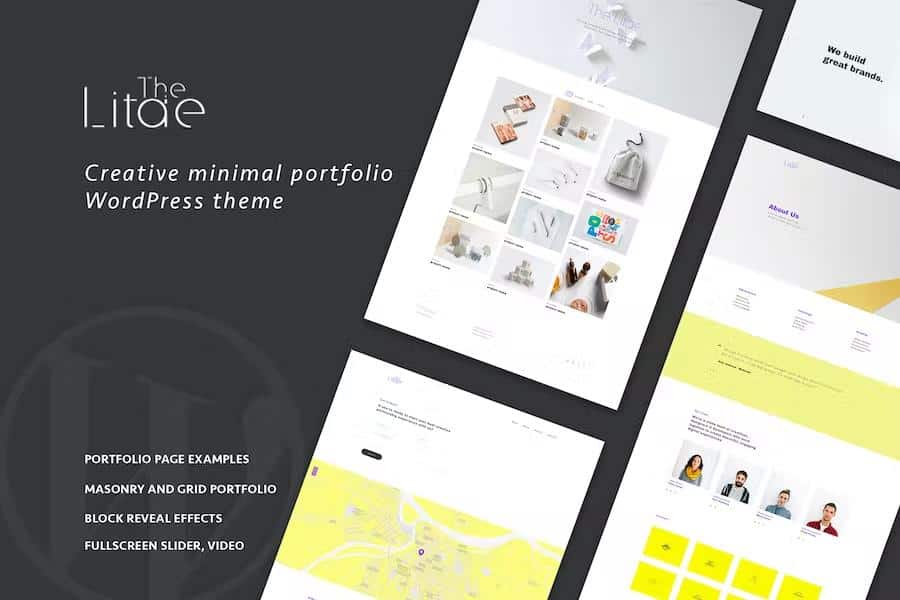

The Litae Minimal Portfolio WordPress Theme Download For WordPress

The Litae Creative Minimal Portfolio Wordpress Theme 1 4 0 Woocrack The assessment authority (assessor’s office) is responsible for establishing the fair market value of all property within st. charles county as of the tax date. Contact us city hall 200 n second street saint charles, mo 63301 phone: 636 949 3200 quick links site map accessibility.

The Litae Minimal Portfolio Wordpress Theme Toolszilla Assessor physical address: 201 n. second st. st. charles, mo 63301 phone: 636 949 7425 fax: 636 949 7435 email link: assessor page return to staff directory. Looking for st charles county assessor's office property tax assessments, tax rates & gis? quickly find assessor phone number, directions & records (st. charles, mo). Contact us city hall 200 n second street saint charles, mo 63301 phone: 636 949 3200 quick links site map accessibility. The st. charles county tax assessor's office oversees the appraisal and assessment of properties as well as the billing and collection of property taxes for all taxable real estate located in st. charles county.

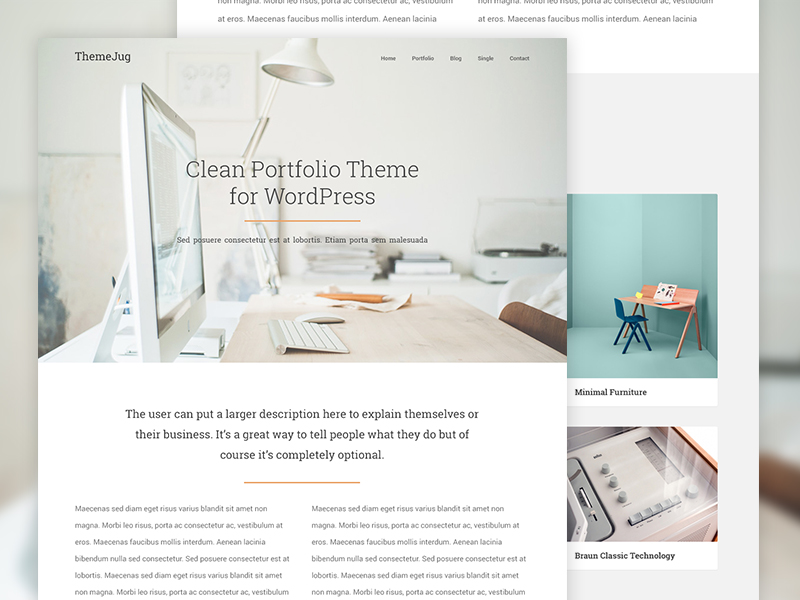

Alio Minimal Portfolio Wordpress Theme Az Theme Net Contact us city hall 200 n second street saint charles, mo 63301 phone: 636 949 3200 quick links site map accessibility. The st. charles county tax assessor's office oversees the appraisal and assessment of properties as well as the billing and collection of property taxes for all taxable real estate located in st. charles county. Not all sales are consummated at market value, but the intent of the assessor is to estimate the fair market value of each property in st. charles county as of tax day as required by law. the value assigned by the assessor’s office should represent fair market value as of january 1 of the tax year. Electronic filing, or e filing, allows you to file your st. charles county personal property assessment online—saving time and return postage. access your account using your account number and unique access code printed on your personal property assessment form. Discovering, listing, and valuing all property in st. charles parish, louisiana for ad valorem tax purposes. Charles county, mo.—st. charles county residents are receiving value assessment change notices about their personal property. the st. charles county assessor’s office is mailing notices ahead of the december tax deadline, looking to help residents plan ahead.

Minimal Wordpress Portfolio Theme By Oliur On Dribbble Not all sales are consummated at market value, but the intent of the assessor is to estimate the fair market value of each property in st. charles county as of tax day as required by law. the value assigned by the assessor’s office should represent fair market value as of january 1 of the tax year. Electronic filing, or e filing, allows you to file your st. charles county personal property assessment online—saving time and return postage. access your account using your account number and unique access code printed on your personal property assessment form. Discovering, listing, and valuing all property in st. charles parish, louisiana for ad valorem tax purposes. Charles county, mo.—st. charles county residents are receiving value assessment change notices about their personal property. the st. charles county assessor’s office is mailing notices ahead of the december tax deadline, looking to help residents plan ahead.

Very Clean And Minimal Portfolio Wordpress Theme Free Idevie Discovering, listing, and valuing all property in st. charles parish, louisiana for ad valorem tax purposes. Charles county, mo.—st. charles county residents are receiving value assessment change notices about their personal property. the st. charles county assessor’s office is mailing notices ahead of the december tax deadline, looking to help residents plan ahead.

Comments are closed.