Tokenization Of Assets Real World Assets On The Blockchain

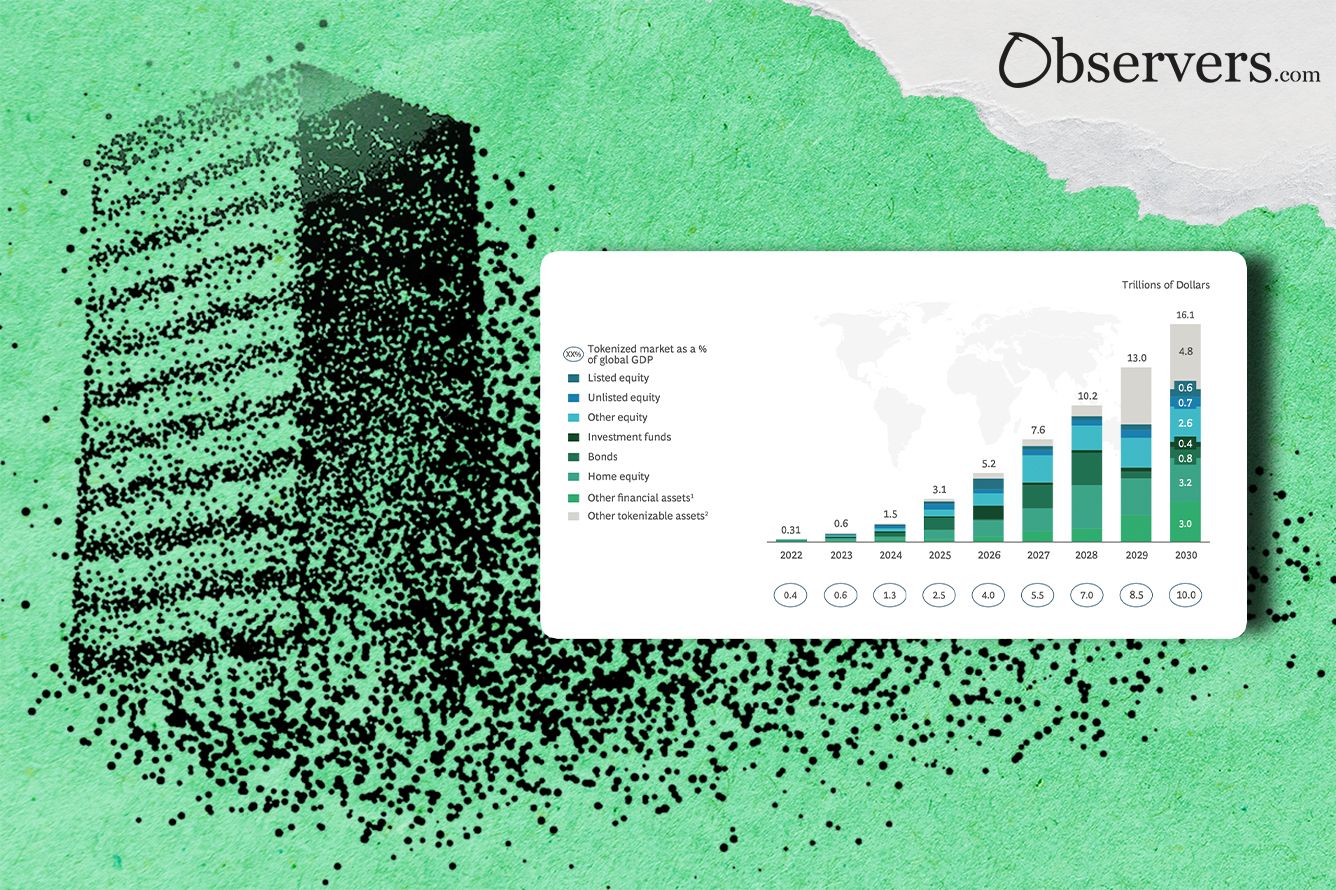

Tokenization Of Real World Assets Tokenization of real world assets converts physical or financial assets into blockchain based digital tokens. while real estate tokenization dominated early rwa projects, 2025 sees growth in treasuries, commodities, art, carbon credits, and private equity. Asset tokenization is the process of converting rights to a physical or digital asset, such as real estate or luxury goods, into a digital token on a blockchain.

Tokenization Of Assets Real World Assets On The Blockchain Tokenization is the process of creating a digital representation of a real thing on the blockchain. this transformation is more than just digitization – it is a complete reinvention of how we record, transfer, and manage ownership of assets. Real world assets are tokenized by embodying their ownership rights as onchain tokens. this technique generates a digital copy of the underlying asset, allowing for on chain administration of the asset’s ownership rights and bridging the gap between physical and digital assets. Converting physical assets like real estate, gold, art, and company shares into blockchain based digital tokens is known as real world asset tokenization. this process makes it easier to trade and manage these assets digitally. By converting physical or traditional financial assets into digital tokens on a blockchain, tokenization enables fractional ownership and simplifies asset management.

Real World Assets Tokenization Is Inevitable Converting physical assets like real estate, gold, art, and company shares into blockchain based digital tokens is known as real world asset tokenization. this process makes it easier to trade and manage these assets digitally. By converting physical or traditional financial assets into digital tokens on a blockchain, tokenization enables fractional ownership and simplifies asset management. Asset tokenization transforms real world assets like property or art into digital tokens on a blockchain, enhancing security and transparency. tokenized assets offer benefits like improved. Tokenized real world assets (rwas) are blockchain based digital tokens that represent physical and traditional financial assets, such as cash, commodities, equities, bonds, credit, artwork, and intellectual property. In particular, the developments related to the tokenization of real world assets using blockchain technology implicate major financial market functions and processes like issuance, trading, transfer, settlement, and record of ownership. Tokenization is the process of converting ownership rights to an rwa (real world asset) into a digital token on a blockchain.

Comments are closed.