Tracking Error Of Various Index Fund Schemes R Indexfundindia

Tracking Error Of Various Index Fund Schemes R Indexfundindia In simplest terms, tracking difference refers to the difference in performance between an index fund and the benchmark index being tracked by the fund. to understand this better, let’s take an example. suppose the nifty 50 index gained 5% this month. Source cafemutual news passives 29591 index funds with lowest tracking error and tracking difference.

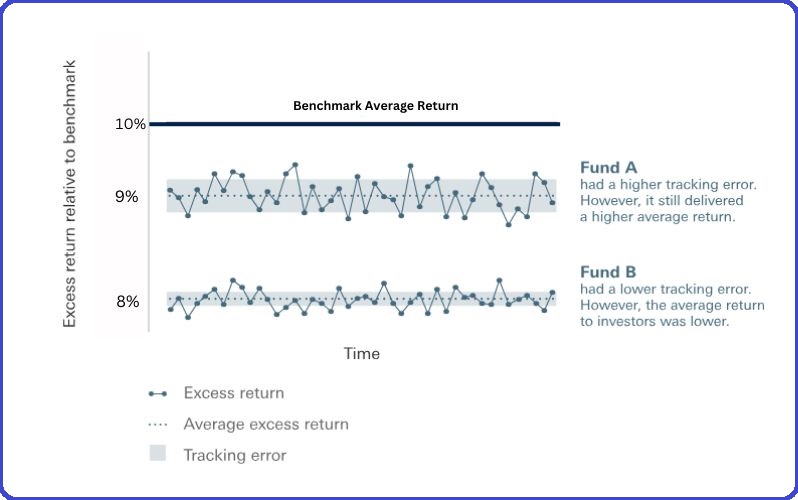

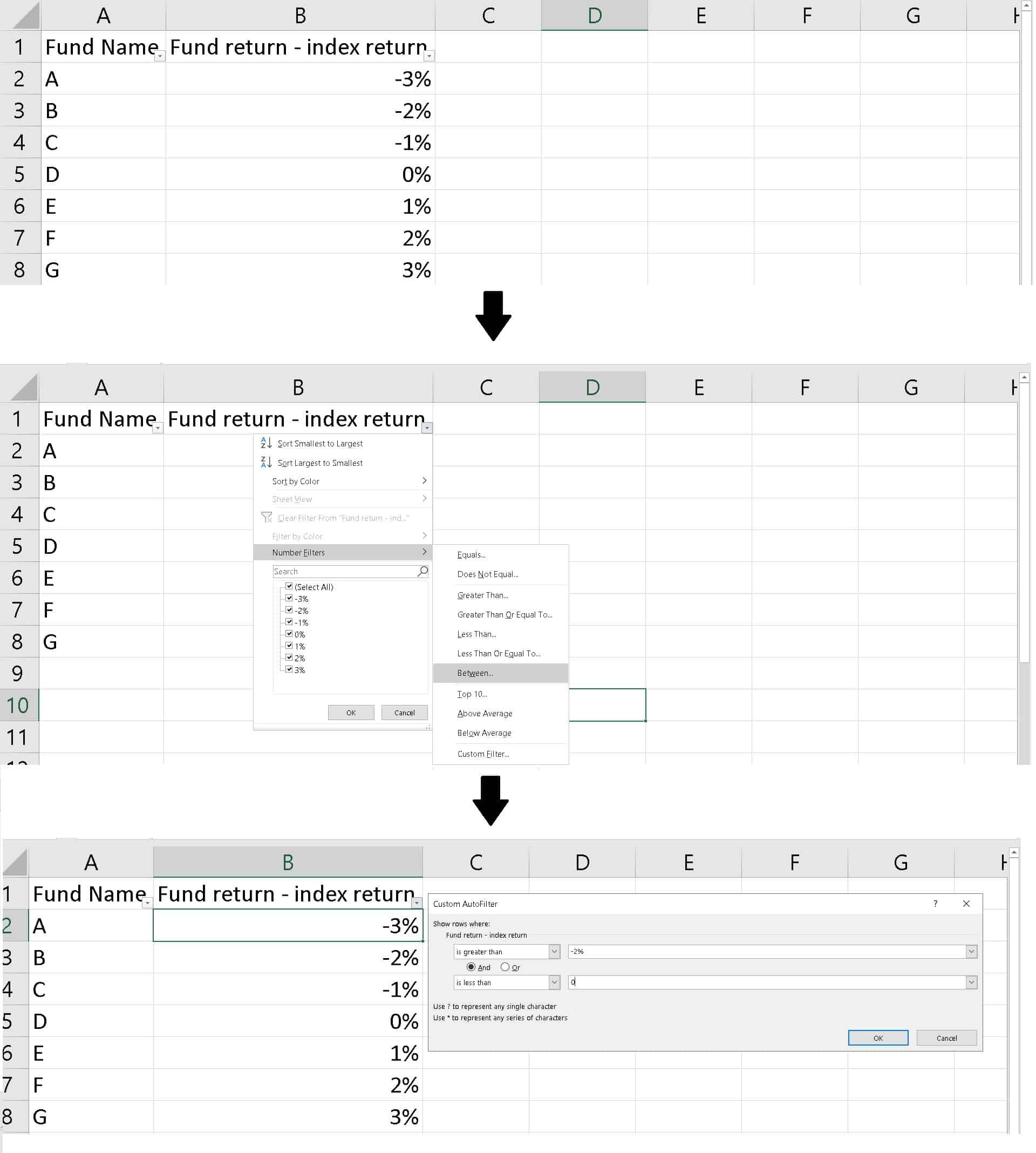

Tracking Error Vs Tracking Difference In Index Fund Quick Guide Actual return differences are more intuitive than tracking errors. (2) the tracking error of these 30 index funds over the last 1,2,3,4,5,6,7 and 8 years is also provided. the tracking error is the standard deviation of the index fund minus index monthly return differences. There are 3 main reasons why a tracking error may occur in index funds. here’s a look at each of these in detail: mutual funds expenses could include the cost of buying and selling stocks, fund management fees, administration charges, etc which makes up the expense ratio of a mutual fund. Analyze the historical tracking error of the index fund to understand its performance consistency. a fund with a consistently low tracking error indicates a more reliable performance in mirroring the index. Since the first index fund launched in 1999, the index fund market in india has been growing steadily. in this paper, we seek to measure and understand the tracking error of index funds in india.

Fund Tracking Error Envelope Indicator By Mum Mum Tradingview Analyze the historical tracking error of the index fund to understand its performance consistency. a fund with a consistently low tracking error indicates a more reliable performance in mirroring the index. Since the first index fund launched in 1999, the index fund market in india has been growing steadily. in this paper, we seek to measure and understand the tracking error of index funds in india. After scouring through many posts here, i have concluded that index funds are best for large cap. also found out that tracking error is a very important number upon which we can select an index fund. however, could not find this data anywhere. To minimise the tracking error in index funds, the fund manager uses various strategies such as rebalancing the portfolio, managing dividend payments, lending securities, using index futures or investing in fixed income instruments. Criteria for selecting index funds is: low tracking error (consistently accurate tracking) low expense ratio; high aum; time in the market (otherwise data on tracking error and faith in the expense ratio would not be available). Tracking error measures the difference between the returns of a portfolio (like a mutual fund or etf) and its benchmark index. it quantifies how closely a portfolio replicates or "tracks" the benchmark it aims to follow.

Index Fund Tracking Error Screener April 2024 After scouring through many posts here, i have concluded that index funds are best for large cap. also found out that tracking error is a very important number upon which we can select an index fund. however, could not find this data anywhere. To minimise the tracking error in index funds, the fund manager uses various strategies such as rebalancing the portfolio, managing dividend payments, lending securities, using index futures or investing in fixed income instruments. Criteria for selecting index funds is: low tracking error (consistently accurate tracking) low expense ratio; high aum; time in the market (otherwise data on tracking error and faith in the expense ratio would not be available). Tracking error measures the difference between the returns of a portfolio (like a mutual fund or etf) and its benchmark index. it quantifies how closely a portfolio replicates or "tracks" the benchmark it aims to follow.

Comments are closed.