Tutorial Defined Benefit Pension Accounting 7 Intermediate Financial Accounting Ii Tutorial 66

Intermediate Financial Accounting Ii Pdf Intangible Asset Expense This tutorial walks through the accounting for a defined benefit pension plan. chapter 19 part 1 tutorial #66 (overall). Acc 302 chapter 13 learning notes 3 to be completed prior to class on thursday, january 19, 2017 prior to class: read page 668 through page 672 (point 9 through point 13 of the chapter 13 focus) 1. companies must accrue a liability for the compensation.

Accounting For Pensions Pdf Pension Investing Prepare the accounting entries for a defined contribution pension plan. describe the various estimations required and elements included in the accounting for defined benefit pension plans, and evaluate the effects of these estimations on the accounting for these plans. Study with quizlet and memorize flashcards containing terms like defined contribution pension plan, defined benefit pension plan, contributory plan and more. Accounting 352: intermediate financial accounting ii is the second course in the two course intermediate accounting sequence. it provides in depth coverage of the following: accounting issues associated with the equity side of the balance sheet (liabilities and shareholders’ equity). Studying acc 927 intermediate financial accounting 2 at mcmaster university? on studocu you will find 32 practice materials, mandatory assignments, summaries,.

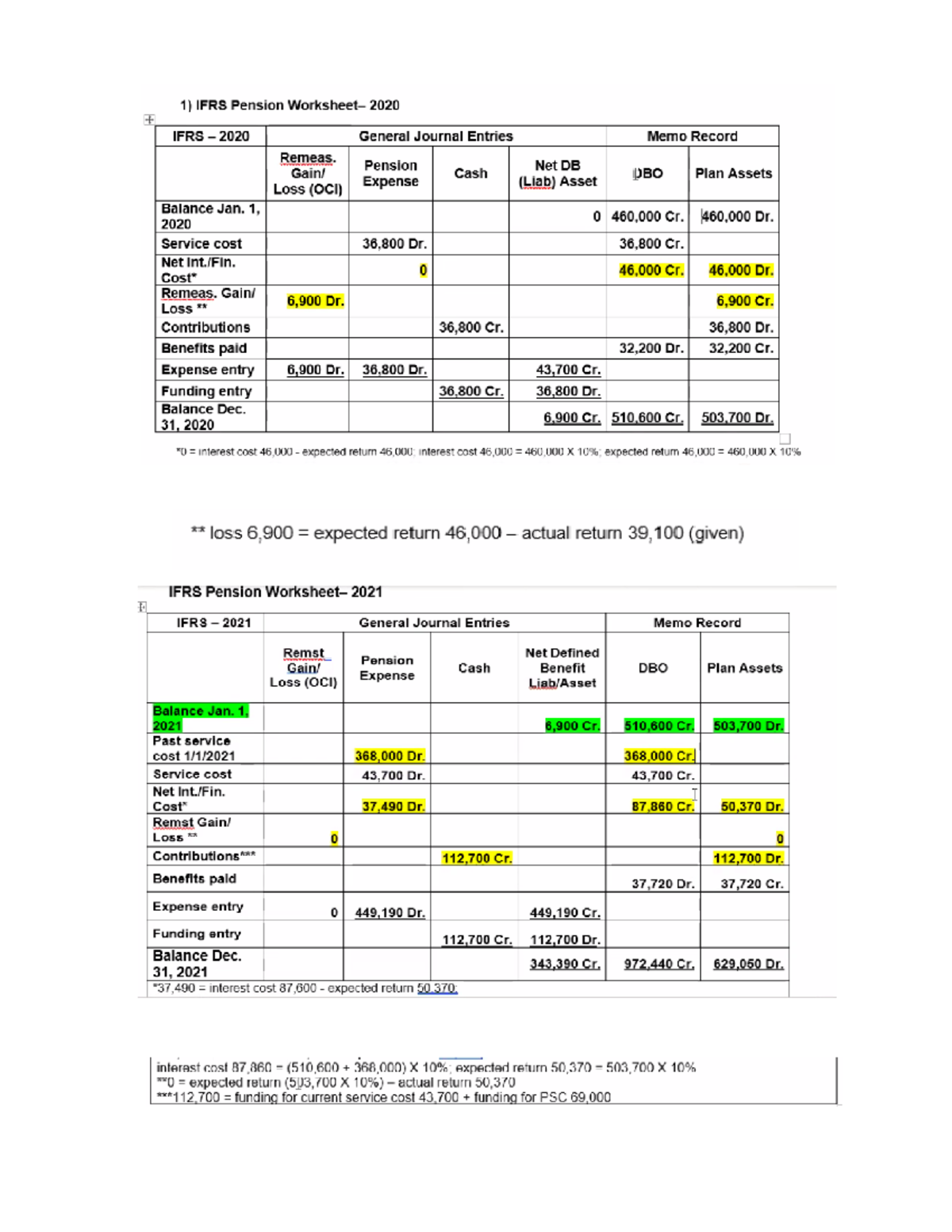

Pension Worksheet Intermediate Accounting Calculation Acct 306 Studocu Accounting 352: intermediate financial accounting ii is the second course in the two course intermediate accounting sequence. it provides in depth coverage of the following: accounting issues associated with the equity side of the balance sheet (liabilities and shareholders’ equity). Studying acc 927 intermediate financial accounting 2 at mcmaster university? on studocu you will find 32 practice materials, mandatory assignments, summaries,. With a defined benefit plan, the amount of pension income the employee will receive upon retirement is defined either as a pre determined amount or by calculation using a prescribed formula. because the ultimate payment from the plan is defined, the risks of the plan now fall upon the employer. Study with quizlet and memorize flashcards containing terms like pension retirement benefit, actuaries, pension plan trustee and more. The document provides examples of accounting problems related to defined benefit pension plans. it includes information about projected benefit obligations, service costs, returns on plan assets, and remeasurement gains and losses. This tutorial walks through the accounting for a defined benefit pension plan from the perspective of the employer.chapter 19 part 1 tutorial #61 (overall).

Defined Benefit Plan Data Pdf Intermediate Fa 2 Example To Accompany Tutorial 10 A B Serenity With a defined benefit plan, the amount of pension income the employee will receive upon retirement is defined either as a pre determined amount or by calculation using a prescribed formula. because the ultimate payment from the plan is defined, the risks of the plan now fall upon the employer. Study with quizlet and memorize flashcards containing terms like pension retirement benefit, actuaries, pension plan trustee and more. The document provides examples of accounting problems related to defined benefit pension plans. it includes information about projected benefit obligations, service costs, returns on plan assets, and remeasurement gains and losses. This tutorial walks through the accounting for a defined benefit pension plan from the perspective of the employer.chapter 19 part 1 tutorial #61 (overall).

Comments are closed.