Types Of Pension Plans

Types Of Pension Plans And Their Pros And Cons 1600x1000 W Words Planeasy Review retirement plans, including 401 (k) plans, the savings incentive match plans for employees (simple ira plans) and simple employee pension plans (sep). Choosing the right home for your retirement savings is as important as saving for retirement in the first place. your retirement plan dictates how much you can contribute annually, how it's.

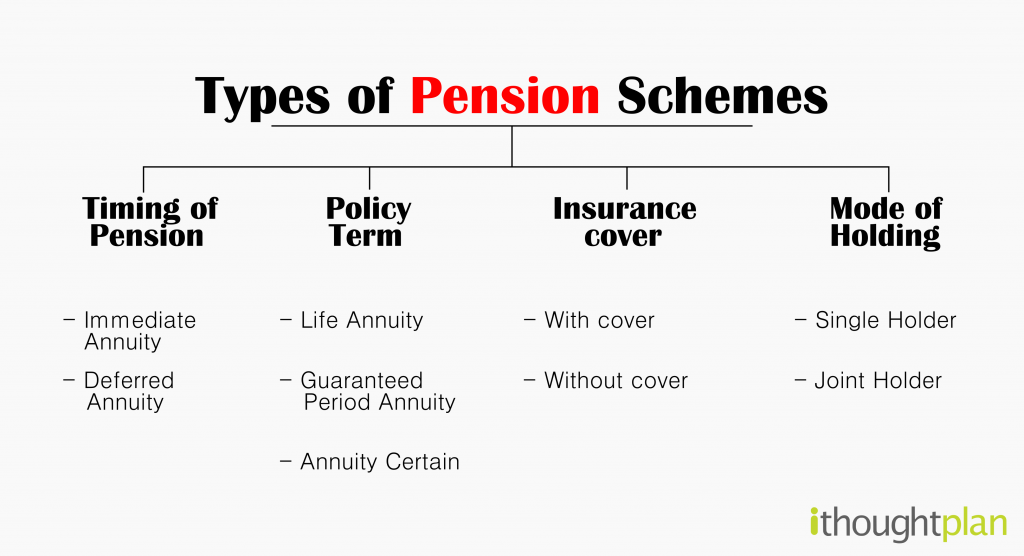

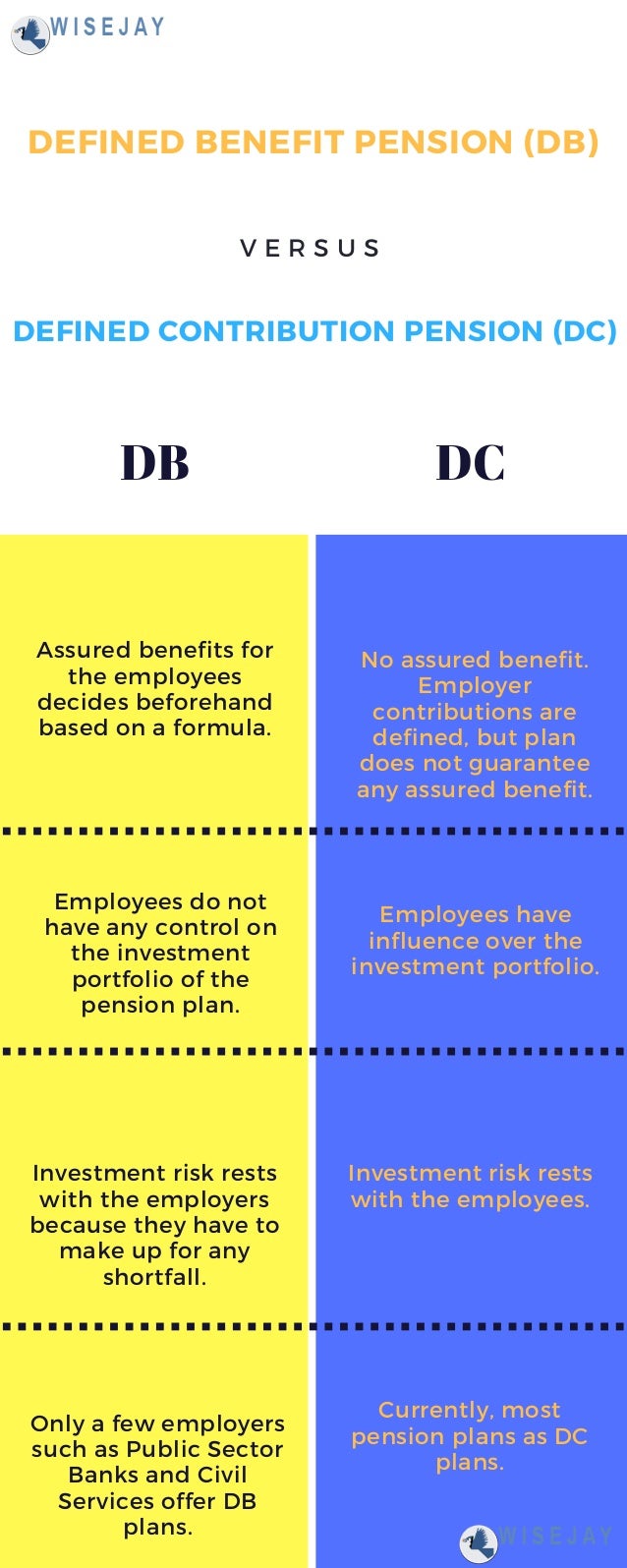

Types Of Pension Plans Ithought Plan S Blog On Pension Schemes The main types of pension plans include defined benefit plans, defined contribution plans, and hybrid plans, each offering unique features and benefits. understanding these types can help individuals make informed decisions about their retirement savings. The two most widely known types of pension plans are defined benefit and defined contribution plans. however, government pensions also have distinct features that are worth discussing. Learn about common types of retirement plans and key features, eligibility requirements, and contribution limits for retirement plans like 401 (k)s, iras, and more. with so many different types of retirement plans out there, how do you know which one is right for you?. Defined benefit plans offer stability with fixed benefits, while defined contribution plans provide flexibility and the potential for higher returns based on investment performance. hybrid plans blend these elements, offering a mix of security and growth potential.

Types Of Pension Plans Ithought Plan S Blog On Pension Schemes Learn about common types of retirement plans and key features, eligibility requirements, and contribution limits for retirement plans like 401 (k)s, iras, and more. with so many different types of retirement plans out there, how do you know which one is right for you?. Defined benefit plans offer stability with fixed benefits, while defined contribution plans provide flexibility and the potential for higher returns based on investment performance. hybrid plans blend these elements, offering a mix of security and growth potential. Vesting schedules come in two forms: cliff and graded. with cliff vesting, you have no claim to any company contributions until a certain period has passed. with graded vesting, a certain percentage of your benefits vest each year, until you reach 100% vesting. In this post, we examine six primary types of pension plans that global employers should consider when compensating international talent competitively and compliantly. 1. statutory (mandatory) pension plans. statutory pension plans form the foundation of retirement benefits in most countries. Explore 4 essential types of retirement plans. learn about pension plans and how they can help you secure your financial future after retirement.

Types Of Pension Plans Vesting schedules come in two forms: cliff and graded. with cliff vesting, you have no claim to any company contributions until a certain period has passed. with graded vesting, a certain percentage of your benefits vest each year, until you reach 100% vesting. In this post, we examine six primary types of pension plans that global employers should consider when compensating international talent competitively and compliantly. 1. statutory (mandatory) pension plans. statutory pension plans form the foundation of retirement benefits in most countries. Explore 4 essential types of retirement plans. learn about pension plans and how they can help you secure your financial future after retirement.

Different Types Of Pension Plans Read Book Money Explore 4 essential types of retirement plans. learn about pension plans and how they can help you secure your financial future after retirement.

Comments are closed.