Ultimate Guide To Moving Averages Formula For Simple Moving Average Enlightened Stock Trading

Ultimate Guide To Moving Averages Comparison Of Simple Moving Average Exponential Moving To get the most recent 10 day moving average, you take the closing price on each of the last 10 days, you add them up and then divide it by 10; then you plot the result. to get the previous bar’s moving average, which was one day ago, same sort of thing. you take the last 10 bars, which is 1 up 10. Ultimate guide to moving averages – formula for simple moving average. by adrian reid | 0 comments.

Ultimate Guide To Moving Averages Formula For Simple Moving Average Enlightened Stock Trading Ultimate guide to moving averages – simple moving average. by adrian reid | 0 comments. Ultimate guide to moving averages calculation of the 10 day and 200 day simple moving average. From simple support and resistance strategies to advanced indicators like the hma and alma, there's a moving average approach for every trading style and market condition. the key is to understand not just how these indicators work, but when and why to use them. remember: use moving averages as part of a complete trading system. There are 2 types of moving averages simple and exponential. they are calculated in slightly different ways. a simple moving average is a straight average of the stock price.

Ultimate Guide To Moving Averages Simple Moving Average Enlightened Stock Trading From simple support and resistance strategies to advanced indicators like the hma and alma, there's a moving average approach for every trading style and market condition. the key is to understand not just how these indicators work, but when and why to use them. remember: use moving averages as part of a complete trading system. There are 2 types of moving averages simple and exponential. they are calculated in slightly different ways. a simple moving average is a straight average of the stock price. In this trading guide, you will learn how to unleash the power of this simple indicator to analyze the market and boost your profits. don’t worry. we will not go through boring formulas and spreadsheets of moving average calculations. For example: a 5 day simple moving average is calculated by adding the closing prices for the last 5 days and dividing the total by 5. the calculation is repeated for each price bar on the chart. the averages are then joined to form a smooth curving line the moving average line. While it’d be nice to give you a clear cut rule set as to which moving averages you should use, it isn’t that simple (nothing is in the market!). but, we’ve come up with a 2 step guide to help you narrow down your choices here. The two basic and commonly used mas are the simple moving average (sma), which is the simple average of a security over a defined number of time periods, and the exponential moving average (ema), which gives bigger weight to more recent prices.

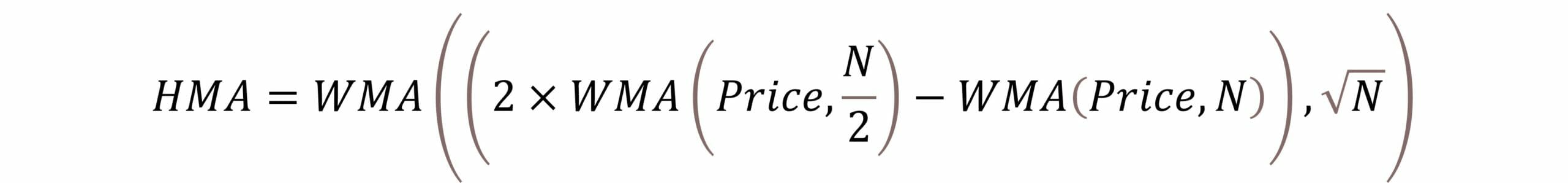

Ultimate Guide To Moving Averages Formula For Hull Moving Average Enlightened Stock Trading In this trading guide, you will learn how to unleash the power of this simple indicator to analyze the market and boost your profits. don’t worry. we will not go through boring formulas and spreadsheets of moving average calculations. For example: a 5 day simple moving average is calculated by adding the closing prices for the last 5 days and dividing the total by 5. the calculation is repeated for each price bar on the chart. the averages are then joined to form a smooth curving line the moving average line. While it’d be nice to give you a clear cut rule set as to which moving averages you should use, it isn’t that simple (nothing is in the market!). but, we’ve come up with a 2 step guide to help you narrow down your choices here. The two basic and commonly used mas are the simple moving average (sma), which is the simple average of a security over a defined number of time periods, and the exponential moving average (ema), which gives bigger weight to more recent prices.

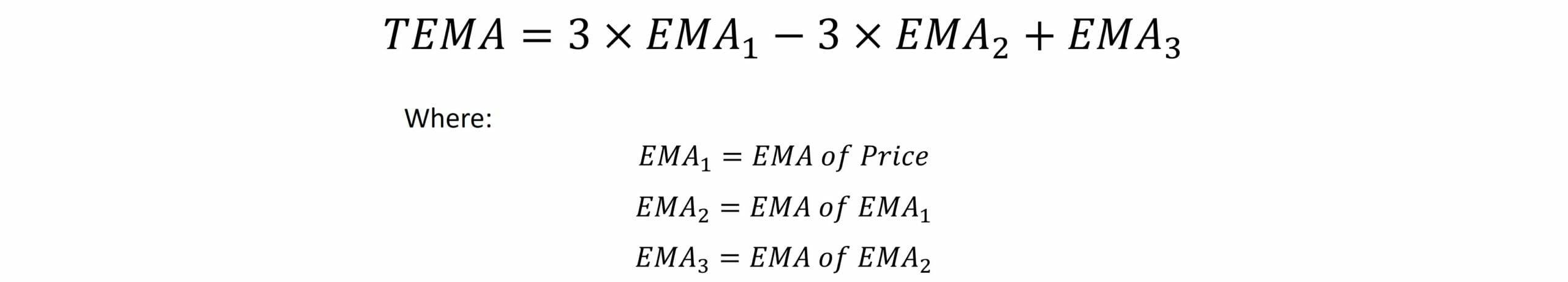

Ultimate Guide To Moving Averages Formula For Tema Moving Average Enlightened Stock Trading While it’d be nice to give you a clear cut rule set as to which moving averages you should use, it isn’t that simple (nothing is in the market!). but, we’ve come up with a 2 step guide to help you narrow down your choices here. The two basic and commonly used mas are the simple moving average (sma), which is the simple average of a security over a defined number of time periods, and the exponential moving average (ema), which gives bigger weight to more recent prices.

Ultimate Guide To Moving Averages Formula For Weighted Moving Average Enlightened Stock Trading

Comments are closed.