Understanding Candlestick Patterns

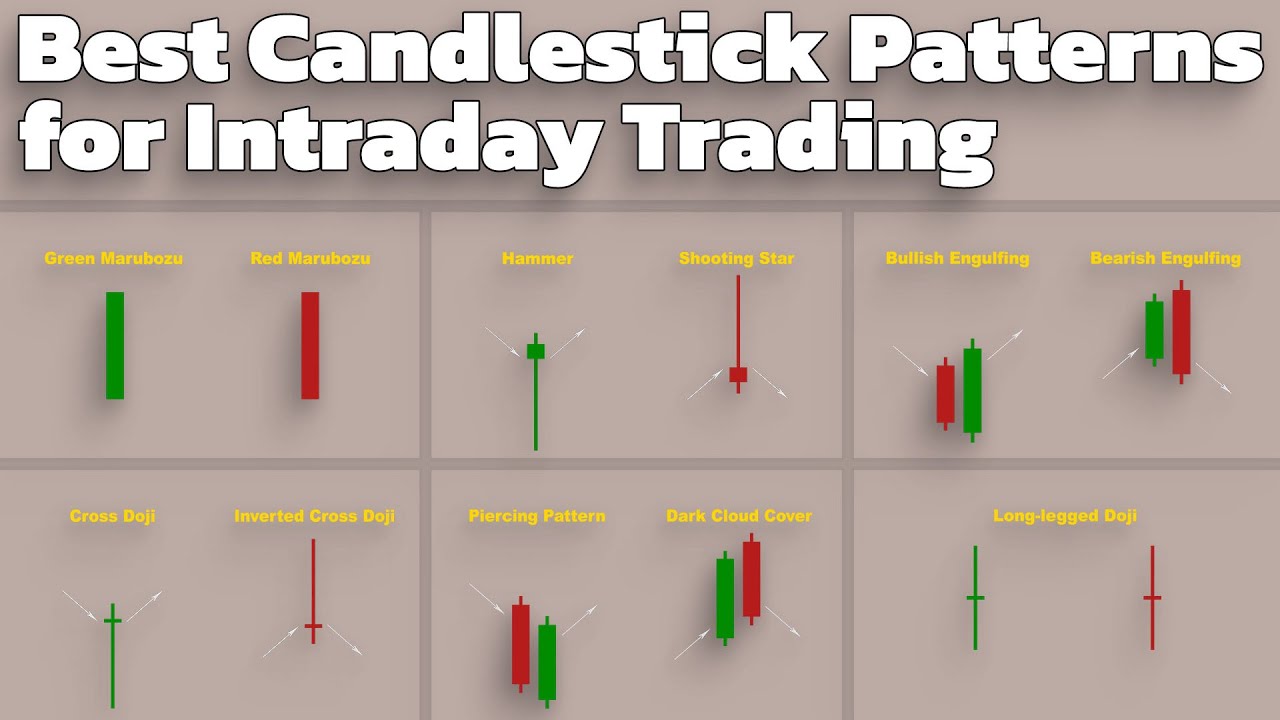

Understanding Candlestick Patterns Learn about all the trading candlestick patterns that exist: bullish, bearish, reversal, continuation and indecision with examples and explanation. Learn the basics of candlestick charting, a method of price analysis that reveals the emotions and psychology of buyers and sellers. discover the history, formation, and examples of reliable candlestick patterns, and download a free cheat sheet.

Understanding Candlestick Chart Patterns A Comprehensive 46 Off These patterns work for all kinds of trading – whether you’re looking at prices every day or once in a while. in short, candlestick patterns are important because they help traders understand the market better and make smarter decisions. Understanding candlestick patterns can help you get a sense of whether the bulls or the bears are dominant in the market at a given time. candlestick charts give traders an easy to read. Learn how to read candlestick charts and understand candlestick patterns with this beginner friendly video guide. instantly identify over 30 candlestick patterns across any chart with built in pattern recognition indicators. set up custom alerts that notify you when specific candlestick patterns form on your favorite assets. A candlestick chart is a type of financial chart that shows the price movement of derivatives, securities, and currencies, presenting them as patterns. candlestick patterns typically represent one whole day of price movement, so there will be approximately 20 trading days with 20 candlestick patterns within a month.

Understanding Candlestick Patterns Learn how to read candlestick charts and understand candlestick patterns with this beginner friendly video guide. instantly identify over 30 candlestick patterns across any chart with built in pattern recognition indicators. set up custom alerts that notify you when specific candlestick patterns form on your favorite assets. A candlestick chart is a type of financial chart that shows the price movement of derivatives, securities, and currencies, presenting them as patterns. candlestick patterns typically represent one whole day of price movement, so there will be approximately 20 trading days with 20 candlestick patterns within a month. Understanding how candlesticks form and what information they hold is essential in mastering candlestick patterns. now that we covered this part, let’s continue exploring the most common bullish and bearish patterns. It’s important to make sure you know what the candlestick colors represent before you check the open and close prices to ensure you aren’t getting them confused. always double check the settings or the color key for the app or platform you are looking at the charts in. Understanding candlestick patterns is important in financial trading. bullish and bearish candles are key indicators of market sentiment. a bullish candle happens when the closing price is.

Comments are closed.