Understanding The Short Straddle Strategy A Comprehensive Guide

Mastering The Short Straddle Strategy A Comprehensive Guide Tradethischart The short straddle strategy is your ticket to profiting from minimal price movement. in this guide, we’ll unravel the secrets of selling calls and puts together for maximum effect when stocks snooze. What is the straddle trading strategy? the straddle trading strategy is a unique approach designed for situations where you expect a significant price movement in an asset but are unsure of the direction. have you ever considered a market event and thought, “something big is going to happen, but i don’t know if prices will rise or fall”?.

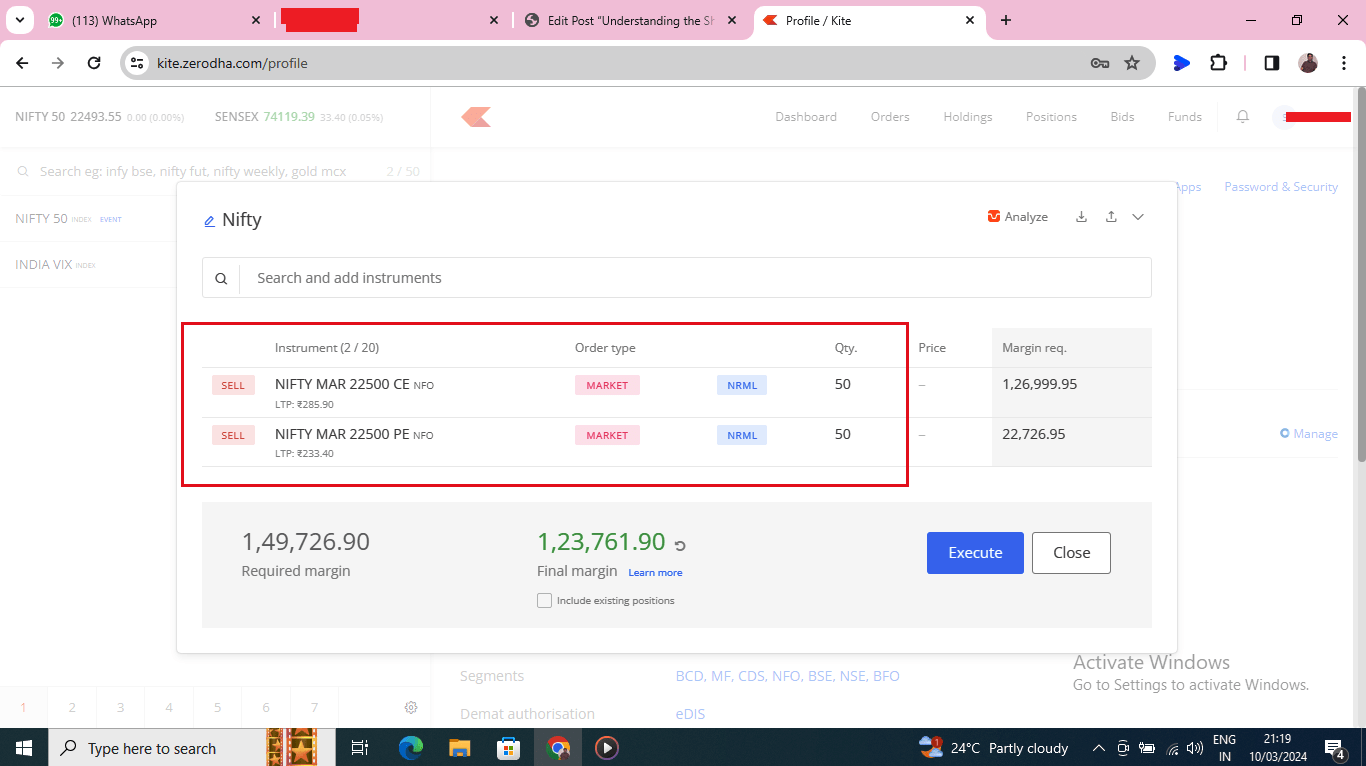

Short Straddle Option Strategy Example Options Trading Iq In this comprehensive guide, we will explore the ins and outs of the short straddle strategy, highlighting its profit potential, risk management techniques, and the role it plays within the realm of options strategies. This guide has aimed to demystify the short straddle, shedding light on its fundamental principles and mechanisms, and providing insights into its strategic deployment in various market conditions. Short straddles consist of selling a short call and a short put at the same strike price for the same expiration date. the strategy capitalizes on minimal stock movement, time decay, and decreasing volatility. short straddles are market neutral and have no directional bias. Complete straddle trading guide. master long and short straddle strategies with live examples, profit loss calculations, risk management techniques, and advanced variations for volatility trading.

Understanding The Short Straddle Strategy A Comprehensive Guide Shashwat Asati Short straddles consist of selling a short call and a short put at the same strike price for the same expiration date. the strategy capitalizes on minimal stock movement, time decay, and decreasing volatility. short straddles are market neutral and have no directional bias. Complete straddle trading guide. master long and short straddle strategies with live examples, profit loss calculations, risk management techniques, and advanced variations for volatility trading. Learn about the short straddle options strategy, a neutral approach that profits from low volatility. maximize premiums but beware of unlimited risk in volatile markets. Short straddle: this strategy involves selling both a call and a put option with the same strike price and expiration date. a short straddle profits when the underlying asset’s price. In this comprehensive guide, we’ll delve deeper into short straddles, discussing their mechanics, advantages, disadvantages, and how they compare to similar strategies.

Understanding The Short Straddle Strategy A Comprehensive Guide Shashwat Asati Learn about the short straddle options strategy, a neutral approach that profits from low volatility. maximize premiums but beware of unlimited risk in volatile markets. Short straddle: this strategy involves selling both a call and a put option with the same strike price and expiration date. a short straddle profits when the underlying asset’s price. In this comprehensive guide, we’ll delve deeper into short straddles, discussing their mechanics, advantages, disadvantages, and how they compare to similar strategies.

Short Straddle Strategy Explained News Mab In this comprehensive guide, we’ll delve deeper into short straddles, discussing their mechanics, advantages, disadvantages, and how they compare to similar strategies.

Short Straddle Options Trading Strategy Guide Xtreme Trading Free Options Trading Course

Comments are closed.