Understanding Tracking Difference And Tracking Error Etf

Understanding Tracking Difference And Tracking Error Etf Tracking difference is the discrepancy between etf performance and index performance. tracking difference is rarely nil: the etf usually trails its index. that’s because a number of. Tracking difference shows the magnitude of deviations in fund and index performance. tracking error shows the consistency of tracking performance. before drawing conclusions, look for.

Understanding Tracking Error Etf Strategy Etf Strategy What is tracking difference? index or passive etfs aim to track an index—which means these etfs try to deliver the same returns as a particular index. tracking difference is the discrepancy between an etf's performance and its index performance. Tracking difference and tracking error are measures that can help you evaluate etfs and index mutual funds as you assess the best products for your portfolios. Effective from 1st july, all mutual fund companies have to disclose the tracking difference, tracking error, and inav (for etf) of etf and index funds in india. hence, it is important to understand the difference between tracking difference and tracking error. In this section, we will discuss the introduction to tracking difference and tracking error. 1. definition of tracking difference: tracking difference is a measure of how well an investment is tracking its benchmark. it is calculated as the difference between the returns of an investment and its benchmark.

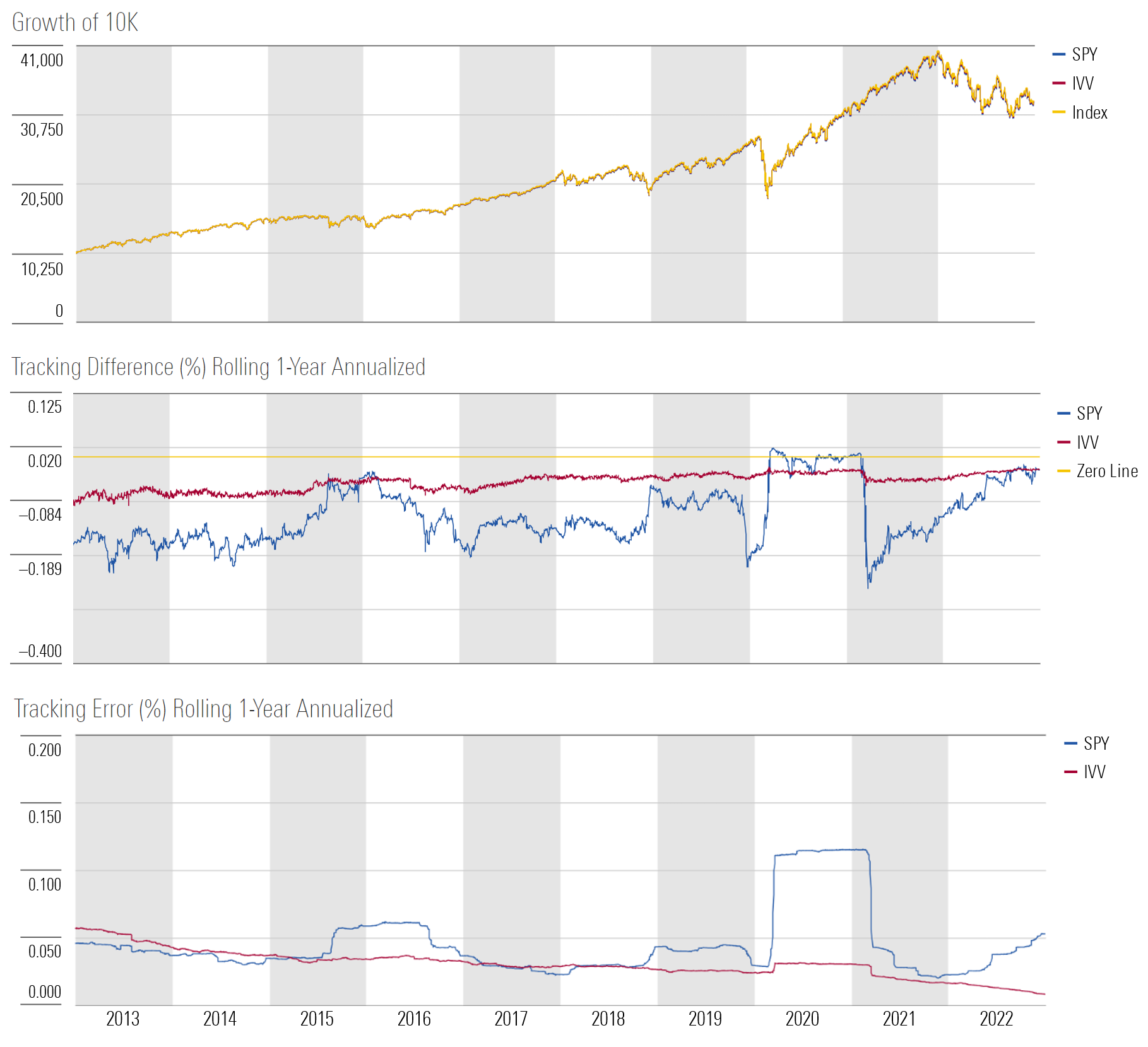

Etf Tracking Difference Fidelity Effective from 1st july, all mutual fund companies have to disclose the tracking difference, tracking error, and inav (for etf) of etf and index funds in india. hence, it is important to understand the difference between tracking difference and tracking error. In this section, we will discuss the introduction to tracking difference and tracking error. 1. definition of tracking difference: tracking difference is a measure of how well an investment is tracking its benchmark. it is calculated as the difference between the returns of an investment and its benchmark. Similar to tracking error, a lower tracking deviation means the etf’s returns closely align with the index, whereas a higher tracking deviation indicates a substantial difference in. If an etf has a high tracking difference, it means that it is not accurately mirroring the performance of its underlying index. this can result in lower returns for investors. on the other hand, if an etf has a low tracking difference, it means that it is closely tracking its underlying index. Tracking difference and tracking error are two key metrics used to evaluate the performance of bitcoin etfs relative to their underlying benchmarks. tracking difference measures. Etf guide: understanding tracking error vs tracking difference author: hsbc asset management subject: total return vs performance consistency keywords: etf, guide, tracking error, tracking difference, capital markets created date: 6 21 2021 9:08:41 am.

Tracking Difference Vs Tracking Error How To Analyze Etfs Morningstar Similar to tracking error, a lower tracking deviation means the etf’s returns closely align with the index, whereas a higher tracking deviation indicates a substantial difference in. If an etf has a high tracking difference, it means that it is not accurately mirroring the performance of its underlying index. this can result in lower returns for investors. on the other hand, if an etf has a low tracking difference, it means that it is closely tracking its underlying index. Tracking difference and tracking error are two key metrics used to evaluate the performance of bitcoin etfs relative to their underlying benchmarks. tracking difference measures. Etf guide: understanding tracking error vs tracking difference author: hsbc asset management subject: total return vs performance consistency keywords: etf, guide, tracking error, tracking difference, capital markets created date: 6 21 2021 9:08:41 am.

Comments are closed.