Unlock The Power Of Microsoft Defender For Office 365 Everything You Should Know Peter Rising Mvp

Microsoft Defender For Office 365 Pdf Phishing Computer Security Unlock technologies offers home equity agreements that allow you to receive cash for a portion of the future value of your property. Wondering how unlock works? discover how a home equity agreement lets you access cash from your equity—no monthly payments. see if you qualify today.

Microsoft 365 Security Defender Endpoint O365 Worldwide Pdf Microsoft Windows Security An unlock agreement has no age requirements. depending on your circumstances an unlock agreement can yield more or less cash to you up front versus a reverse mortgage. with a typical reverse mortgage, you are required to pay off your existing mortgage at closing in order to qualify. Not registered with unlock? start an application privacy 2025 © unlock technologies, inc. In most cases, unlock must be in no greater than 2nd lien position and the property must be clear of any liens deemed unacceptable by unlock in its discretion. a minimum hea amount of $15,000 is required on all transactions. What is unlock? a fintech company that helps you access funds without monthly payments or added debt. learn more about who we are and what we offer.

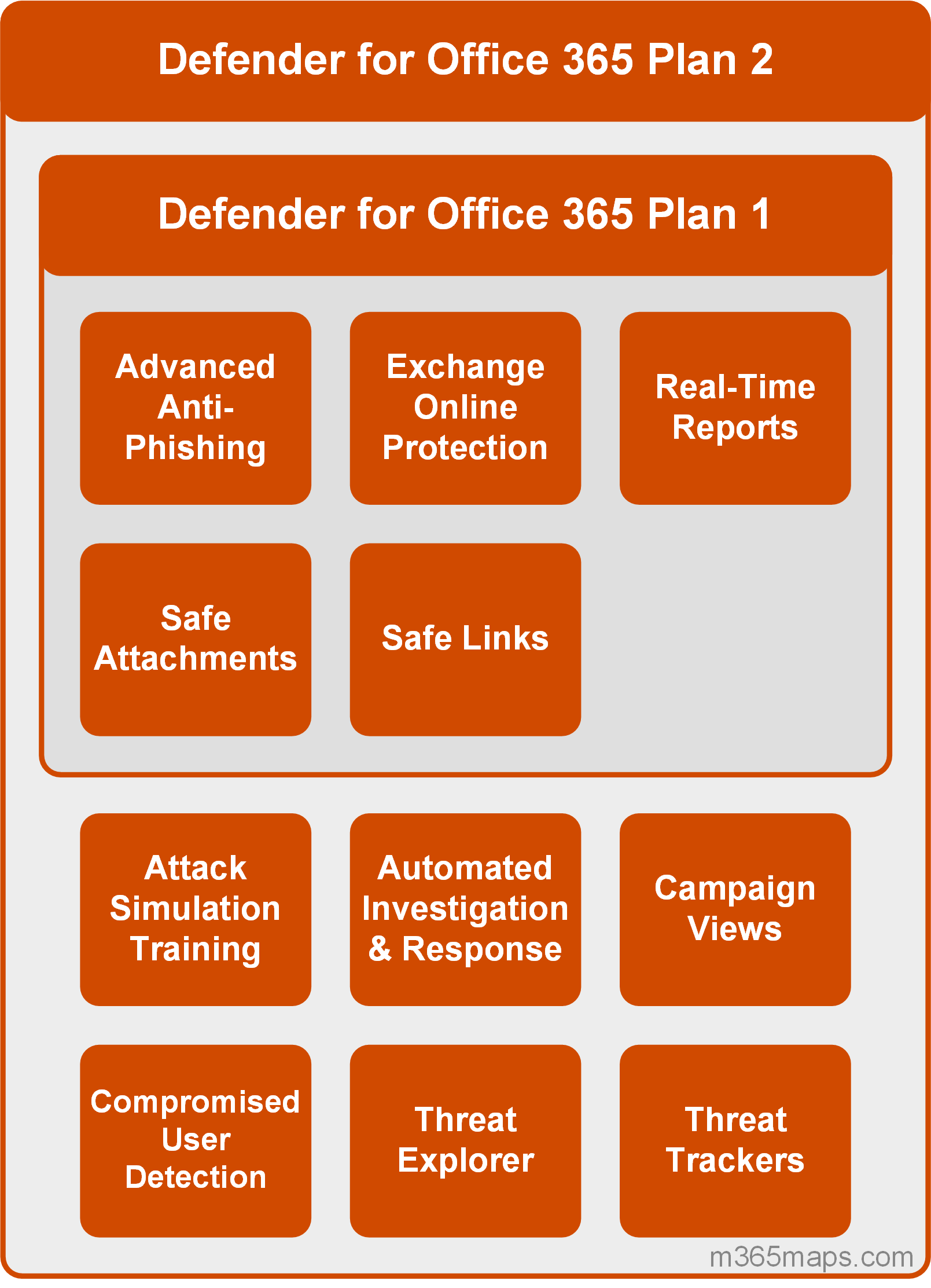

Microsoft Defender For Office 365 M365 Maps In most cases, unlock must be in no greater than 2nd lien position and the property must be clear of any liens deemed unacceptable by unlock in its discretion. a minimum hea amount of $15,000 is required on all transactions. What is unlock? a fintech company that helps you access funds without monthly payments or added debt. learn more about who we are and what we offer. With an unlock home equity agreement (hea), you receive a lump sum of cash today in exchange for a share of your home’s future value. the cost of your hea is based on how much or how little your home appreciates during the length your hea term, which can last up to 10 years. In most cases, unlock must be in no greater than 2nd lien position and the property must be clear of any liens deemed unacceptable by unlock in its discretion. a minimum hea amount of $15,000 is required on all transactions. Unlock offers an innovative financial product that – not surprisingly – unlocks a portion of your home equity. the cash you receive from unlock is not a loan, so you pay no interest and make no monthly payments to unlock. in fact, there are no payments to us at all until you decide to sell your home or buy us out – up to 10 years later. To qualify for an unlock hea, you’ll need to meet several property and personal finance requirements. here’s a look at the conditions.

Introduction To Microsoft Defender For Office 365 Training Microsoft Learn With an unlock home equity agreement (hea), you receive a lump sum of cash today in exchange for a share of your home’s future value. the cost of your hea is based on how much or how little your home appreciates during the length your hea term, which can last up to 10 years. In most cases, unlock must be in no greater than 2nd lien position and the property must be clear of any liens deemed unacceptable by unlock in its discretion. a minimum hea amount of $15,000 is required on all transactions. Unlock offers an innovative financial product that – not surprisingly – unlocks a portion of your home equity. the cash you receive from unlock is not a loan, so you pay no interest and make no monthly payments to unlock. in fact, there are no payments to us at all until you decide to sell your home or buy us out – up to 10 years later. To qualify for an unlock hea, you’ll need to meet several property and personal finance requirements. here’s a look at the conditions.

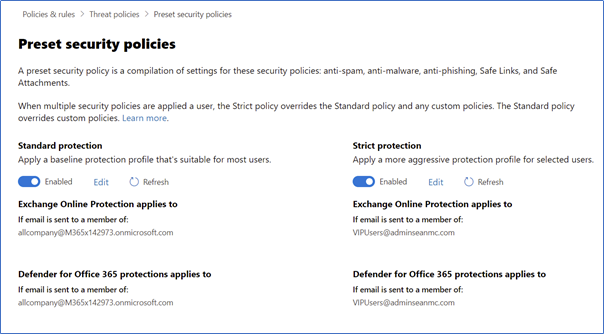

Configuring Microsoft Defender For Office 365 Practical365 Unlock offers an innovative financial product that – not surprisingly – unlocks a portion of your home equity. the cash you receive from unlock is not a loan, so you pay no interest and make no monthly payments to unlock. in fact, there are no payments to us at all until you decide to sell your home or buy us out – up to 10 years later. To qualify for an unlock hea, you’ll need to meet several property and personal finance requirements. here’s a look at the conditions.

Comments are closed.