What Are Defined Contribution And Defined Benefit Pension Plans

Defined Benefit Vs Defined Contribution Pension Money We Have What is the difference between defined benefit plans and defined contribution plans? a.) defined benefit plans guarantee payments to retirees, whereas defined contribution plans make contributions to retiree accounts without making guarantees. As the names imply, a defined benefit plan—also commonly known as a traditional pension plan—provides a specified payment amount in retirement. a defined contribution plan allows.

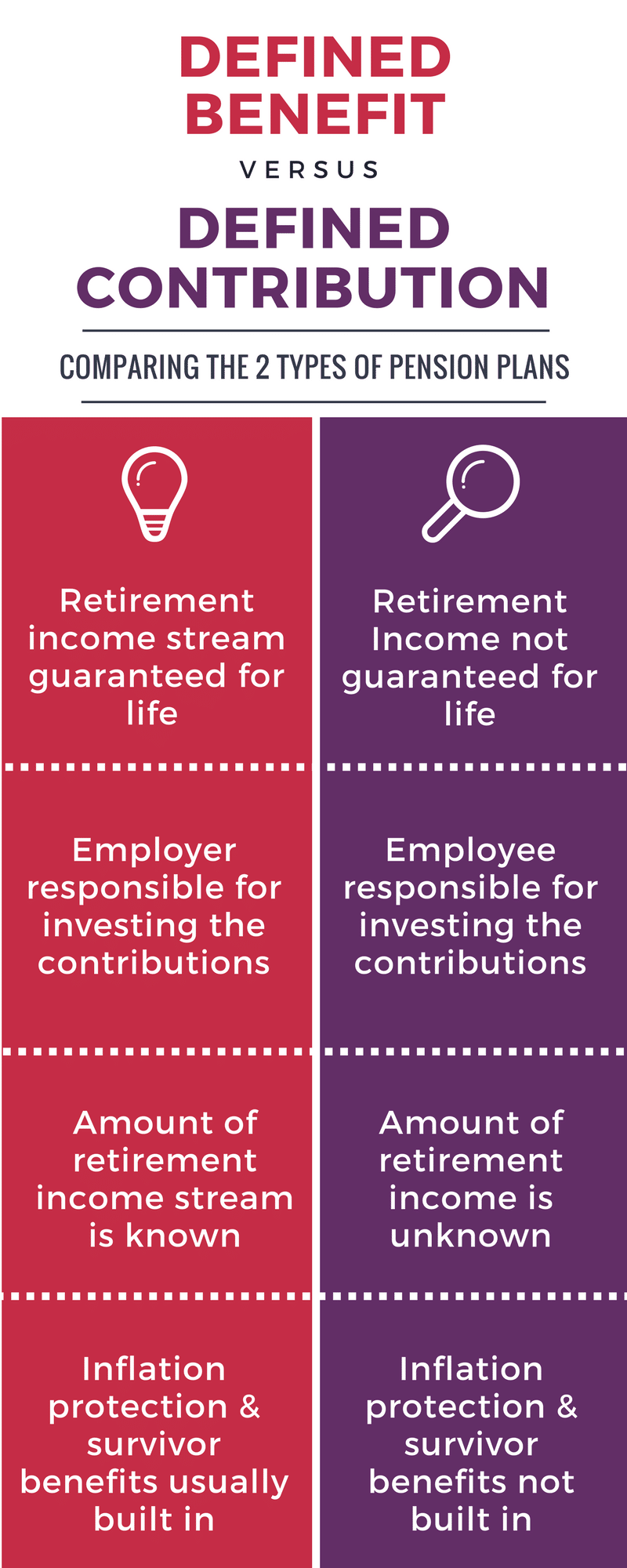

Defined Benefit Vs Defined Contribution Retirement Plan Pd Dean barber and bud kasper discuss pension plans while breaking down the differences between defined benefit and defined contribution plans. Defined benefit plans offer guaranteed income based on salary and years of service, while defined contribution plans rely on individual contributions and investment performance. In simpler terms, a defined benefit plan ensures retirees receive a steady and guaranteed income throughout their retirement years, while a defined contribution plan allows individuals to regularly contribute a portion of their earnings to a retirement savings account. Delving into the world of employer sponsored retirement, we discover two main actors: defined benefit and defined contribution pensions plans. these pension plans are not just financial jargon; they are crucial in shaping how comfortably we can live in our retirement years.

Defined Benefit Vs Defined Contribution Plans Gosline Retirement Planning In simpler terms, a defined benefit plan ensures retirees receive a steady and guaranteed income throughout their retirement years, while a defined contribution plan allows individuals to regularly contribute a portion of their earnings to a retirement savings account. Delving into the world of employer sponsored retirement, we discover two main actors: defined benefit and defined contribution pensions plans. these pension plans are not just financial jargon; they are crucial in shaping how comfortably we can live in our retirement years. Q: what are the main differences between defined benefit and defined contribution plans? a: defined benefit plans provide a predetermined monthly payout upon retirement, while defined contribution plans involve individual contributions invested for potential growth. Keep reading to learn the difference between defined benefit and defined contribution pension plans. what is a defined benefit pension plan? a defined benefit pension plan is a traditional pension. it is one that provides a specific and predictable benefit (or amount of income) at retirement. Defined benefit plans provide guaranteed retirement payouts and put investment risks on employers. these plans are funded by employers, who also manage investments and contributions. in. Defined benefit plans provide a predetermined retirement benefit based on factors like salary and years of service, while defined contribution plans involve employees making contributions to their retirement accounts, with the ultimate benefit depending on investment performance.

Pension Plans Part 2 Defined Benefit Vs Defined Contribution Pharma Tax Q: what are the main differences between defined benefit and defined contribution plans? a: defined benefit plans provide a predetermined monthly payout upon retirement, while defined contribution plans involve individual contributions invested for potential growth. Keep reading to learn the difference between defined benefit and defined contribution pension plans. what is a defined benefit pension plan? a defined benefit pension plan is a traditional pension. it is one that provides a specific and predictable benefit (or amount of income) at retirement. Defined benefit plans provide guaranteed retirement payouts and put investment risks on employers. these plans are funded by employers, who also manage investments and contributions. in. Defined benefit plans provide a predetermined retirement benefit based on factors like salary and years of service, while defined contribution plans involve employees making contributions to their retirement accounts, with the ultimate benefit depending on investment performance.

Pension Plans Part 2 Defined Benefit Vs Defined Contribution Pharma Tax Defined benefit plans provide guaranteed retirement payouts and put investment risks on employers. these plans are funded by employers, who also manage investments and contributions. in. Defined benefit plans provide a predetermined retirement benefit based on factors like salary and years of service, while defined contribution plans involve employees making contributions to their retirement accounts, with the ultimate benefit depending on investment performance.

Defined Benefit Plan Vs Defined Contribution Plan

Comments are closed.