What Are The Income Tax Brackets For 2025 Uk James Rawson

What Are The Income Tax Brackets For 2025 Uk James Rawson This tax free allowance is added to your personal allowance. income tax rates and bands. the table shows the tax rates you pay in each band if you have a standard personal allowance of £12,570. Discover the united kingdom tax tables for 2025, including tax rates and income thresholds. stay informed about tax regulations and calculations in united kingdom in 2025.

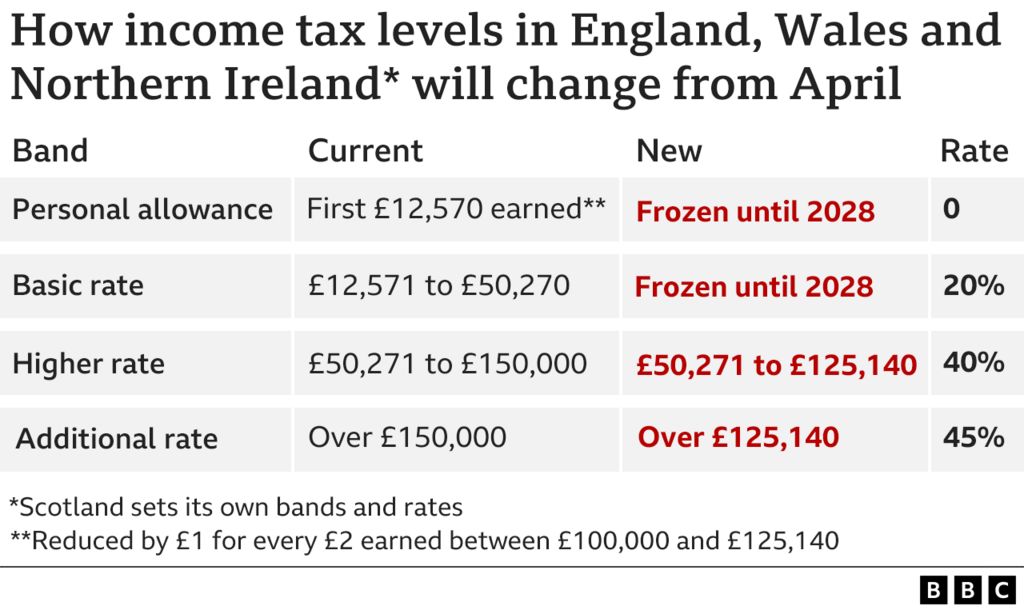

What Are The Income Tax Brackets For 2025 Uk James Rawson (3) the individual income tax rates and bands for scotland and wales for 2025 26 were announced in the scottish budget and the draft welsh budget on 4 december 2024 and 10 december 2024, respectively, but the legislation to give them effect has not been enacted as at january 2025. Below are the latest tax bands and rates applicable in england, wales, and northern ireland: key points to note: if you earn £100,000 or more, your personal allowance is reduced by £1 for every £2 earned over this amount. those earning above £125,140 will lose their personal allowance entirely. For the 2025 26 tax year, if you live in england, wales or northern ireland, there are three marginal income tax bands which set the rate of tax you pay – the 20% basic rate, the 40% higher rate and the 45% additional rate (also remember your personal allowance starts to shrink once earnings hit £100,000). Income tax bands and percentages *0% starting rate is for savings income only if your non savings income is above the starting band level, the 0% rate will not apply and the basic rate percentage will be used instead.

Income Tax Brackets Uk 2025 Paul Russell For the 2025 26 tax year, if you live in england, wales or northern ireland, there are three marginal income tax bands which set the rate of tax you pay – the 20% basic rate, the 40% higher rate and the 45% additional rate (also remember your personal allowance starts to shrink once earnings hit £100,000). Income tax bands and percentages *0% starting rate is for savings income only if your non savings income is above the starting band level, the 0% rate will not apply and the basic rate percentage will be used instead. Tax bands 2025 2026 tax year tax free allowance 0% tax, £1048 per month, £12,576 per year basic tax rate 20% on annual earnings above the tax free allowance threshold and up to £37,700 higher tax rate 40% on annual earnings from £37,701 to £87,440 additional tax rate 45% on annual earnings above £87,441 emergency tax code 1257l m1 the. The uk tax system has a range of allowances and rates that apply to individuals and businesses. understanding these can help you accurately calculate tax liabilities including your net take home pay. below is an overview of the most important tax allowances and rates for the 2025 26 tax year. Tax changes effective in the 2025 26 tax year (from april 6, 2025) income tax: the personal allowance remains frozen at £12,570 until april 2028. income tax thresholds and rates for england, wales, and northern ireland are unchanged: basic rate: 20% (up to £37,700) higher rate: 40% (£37,701 – £125,140) additional rate: 45% (over £125,140). Annual allowance charge on excess is at applicable tax rate(s) on earnings *reduced by £1 for every £2 of adjusted income over £260,000 to a minimum of £10,000, subject to threshold income being over £200,000.

Income Tax Brackets 2025 Australia Uk Gavin Rivera Tax bands 2025 2026 tax year tax free allowance 0% tax, £1048 per month, £12,576 per year basic tax rate 20% on annual earnings above the tax free allowance threshold and up to £37,700 higher tax rate 40% on annual earnings from £37,701 to £87,440 additional tax rate 45% on annual earnings above £87,441 emergency tax code 1257l m1 the. The uk tax system has a range of allowances and rates that apply to individuals and businesses. understanding these can help you accurately calculate tax liabilities including your net take home pay. below is an overview of the most important tax allowances and rates for the 2025 26 tax year. Tax changes effective in the 2025 26 tax year (from april 6, 2025) income tax: the personal allowance remains frozen at £12,570 until april 2028. income tax thresholds and rates for england, wales, and northern ireland are unchanged: basic rate: 20% (up to £37,700) higher rate: 40% (£37,701 – £125,140) additional rate: 45% (over £125,140). Annual allowance charge on excess is at applicable tax rate(s) on earnings *reduced by £1 for every £2 of adjusted income over £260,000 to a minimum of £10,000, subject to threshold income being over £200,000.

Comments are closed.