What Is A Trading Indicators And How To Use Them Wisely

What Is A Trading Indicators And How To Use Them Wisely What are trading indicators? trading indicators are algorithms developed to spot trends, zones, mathematical ratios, etc., in the market. indicators analyze the price data and plot respective lines on the candlestick charts. Whether you trade forex, crypto, or stocks, indicators give you clues about price direction, momentum, volume, and more. in this beginner guide, you’ll learn what trading indicators are, how they work, and how to use them wisely.

What Is A Trading Indicators And How To Use Them Wisely Trading indicators are tools that help traders understand market movements. they use mathematical calculations based on price, trading volume, and other market activity. traders use them to predict future price movements, identify trends, and make informed decisions. Simply put, indicators analyze historical data to predict how the price of a financial instrument will behave in the future. the moment certain market conditions are met, indicators send specific signals to the trader. this is why indicators are particularly valued by some traders. By applying indicators, traders can identify trends, momentum, and other market characteristics that inform their trading strategies. the key is to select indicators that align well with the trader’s trading strategy and to use them as part of a comprehensive trading system. Trading indicators are often misunderstood. in this video, i explain how to use indicators effectively, not as buy sell signals, but as tools to gauge market.

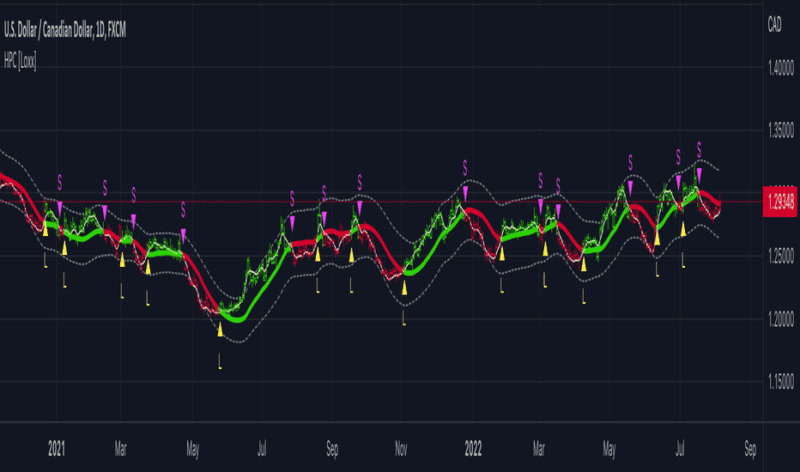

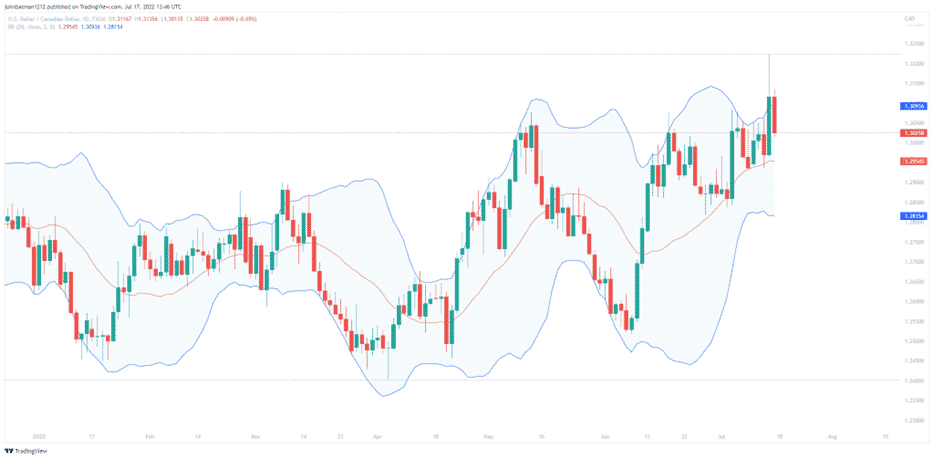

Our Indicators For Tradingview Smart Trading Indicators By applying indicators, traders can identify trends, momentum, and other market characteristics that inform their trading strategies. the key is to select indicators that align well with the trader’s trading strategy and to use them as part of a comprehensive trading system. Trading indicators are often misunderstood. in this video, i explain how to use indicators effectively, not as buy sell signals, but as tools to gauge market. Trading indicators are mathematical formulas that give you a way to plot information on a price chart. this information can be used to identify possible signals, trends, and shifts in momentum. in simple terms, trading indicators can highlight when something might be happening. Trading indicators are tools used by traders to help make informed decisions about the direction of a security’s price based on historical data. they provide insights into the market’s past movements and help traders predict future price direction. there are many types of indicators, each with its own characteristics and uses. Trading indicators are an important area in technical analysis and are used in conjunction with the actual price action. technical trading indicators are mathematical calculations or algorithms broadly based on three inputs; price, volume and time. Technical indicators are mathematical calculations that transform price data into trading signals, helping traders identify trends, momentum, and potential entry exit points.

Trading Indicators What Are The Different Types Trading indicators are mathematical formulas that give you a way to plot information on a price chart. this information can be used to identify possible signals, trends, and shifts in momentum. in simple terms, trading indicators can highlight when something might be happening. Trading indicators are tools used by traders to help make informed decisions about the direction of a security’s price based on historical data. they provide insights into the market’s past movements and help traders predict future price direction. there are many types of indicators, each with its own characteristics and uses. Trading indicators are an important area in technical analysis and are used in conjunction with the actual price action. technical trading indicators are mathematical calculations or algorithms broadly based on three inputs; price, volume and time. Technical indicators are mathematical calculations that transform price data into trading signals, helping traders identify trends, momentum, and potential entry exit points.

Trading Indicators Explained Your Comprehensive Guide Trading indicators are an important area in technical analysis and are used in conjunction with the actual price action. technical trading indicators are mathematical calculations or algorithms broadly based on three inputs; price, volume and time. Technical indicators are mathematical calculations that transform price data into trading signals, helping traders identify trends, momentum, and potential entry exit points.

Comments are closed.