What Is Ach Deposit And How It Works Checkissuing

How Does An Ach Deposit Work A Behind The Scenes Look Plaid With an ach direct deposit, you can get paid by a state or federal agency or by your employer quickly. typically, you will receive an ach direct deposit in your bank account in one to two business days. Find out all you need to know about ach deposits, including how they work, how long they take, and how they measure up against other types of payments.

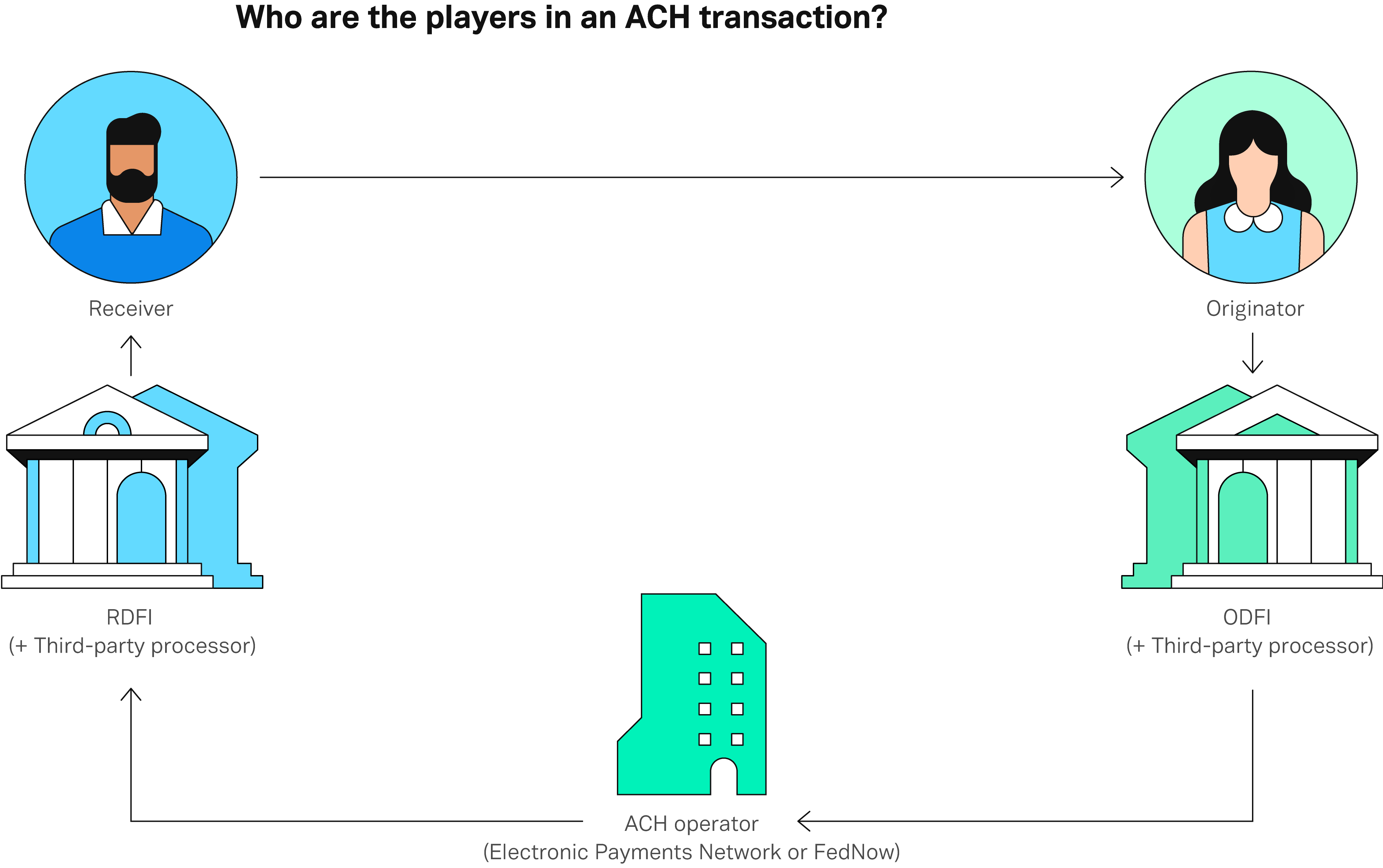

What Is Ach Deposit And How It Works Checkissuing To have money deposited into your account, you need to provide the sender with your bank details, including your bank name, routing number, and account number. sometimes, senders ask for a void. Ach payments work by moving money from one bank to another electronically, without a physical exchange of currency. two categories of transactions use ach payments: direct payment and. Discover what an ach deposit is, how it works, and its benefits in our comprehensive guide to automated clearing house transactions. Ach checks involve an originating depository financial institution (odfi) and a receiving depository financial institution (rdfi). a credit transaction involves “pushing” funds to an account, and an ach debit transaction involves “pulling” money from an account.

How Does An Ach Deposit Work A Behind The Scenes Look Plaid Discover what an ach deposit is, how it works, and its benefits in our comprehensive guide to automated clearing house transactions. Ach checks involve an originating depository financial institution (odfi) and a receiving depository financial institution (rdfi). a credit transaction involves “pushing” funds to an account, and an ach debit transaction involves “pulling” money from an account. Ach payments are a convenient way for business owners, individuals, and employers to use intuitive automated banking throughout their daily lives. most small business owners and employers are turning to ach payments instead paper check payments because of the ease and instant access the ach network provides. Ach payments are entirely electronic and work either as a direct deposit or a direct payment — a credit or a debit, respectively. the two sides of ach payments are the originator and the receiver. consumers and businesses can be on both sides, as can banks and credit unions. Ach payments apply to checking and savings accounts and include direct deposits and recurring payments. nacha, originally the national automated clearinghouse association, oversees and governs the ach network. ach payments work by “pushing” and “pulling” money between bank accounts. To fully understand the topic of ach payment, let’s review what it is, how it works, and when do we use it. what is ach? let’s start from the basics as you’re probably wondering what is ach payment, right? ach is an electronic network designed for processing and clearing transactions.

Comments are closed.