What Is Dollar Cost Averaging Dca Explained How Does Dollar Cost

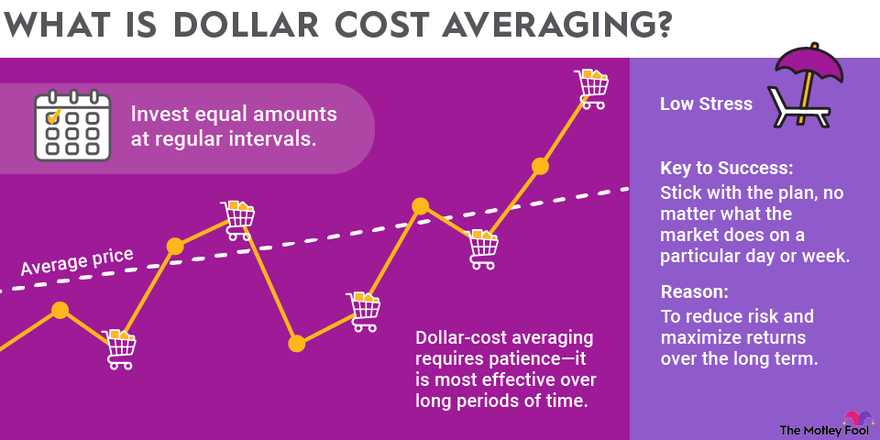

Dollar Cost Averaging Dca Explained With Examples And 44 Off Dollar cost averaging involves investing the same amount of money in a target security at regular intervals over a certain period, regardless of price. by using dollar cost averaging,. Dollar cost averaging reduces investment risk, and capital is preserved to avoid a market crash. it preserves money, which provides liquidity and flexibility in managing an investment portfolio.

Dollar Cost Averaging Dca Explained With Examples And 44 Off While dollar cost averaging doesn't ensure a profit or protect against loss in declining markets, it's a strategy that some investors use to make regular contributions without trying to "time the market.". Dollar cost averaging (dca) is a strategy where rather than investing the available capital all at once, incremental investments are made. Dollar cost averaging is a strategy that can help you lower the amount you pay for investments and minimize risk. over the long term, dollar cost averaging can help lower your investment costs and. Dollar cost averaging (dca) is one of those terms that's thrown around a lot by investors. if you're not entirely sure what it means, or how it could work for you, we're here to help. dollar cost averaging is the strategy of spreading out your investment purchases, buying at regular intervals and in roughly equal amounts.

Dca Or Dollar Cost Averaging Explained For Beginners Dollar cost averaging is a strategy that can help you lower the amount you pay for investments and minimize risk. over the long term, dollar cost averaging can help lower your investment costs and. Dollar cost averaging (dca) is one of those terms that's thrown around a lot by investors. if you're not entirely sure what it means, or how it could work for you, we're here to help. dollar cost averaging is the strategy of spreading out your investment purchases, buying at regular intervals and in roughly equal amounts. It’s called dollar cost averaging (dca), and it might be one of the smartest ways to start investing for the long term. in this guide, we’ll break down what dollar cost averaging is, how it works, its benefits, and why it’s a go to strategy for so many investors, including a simple mathematical example to demonstrate its impact. What is dollar cost averaging and how does it work? learn how dollar cost averaging works, its benefits, common mistakes to avoid, and whether it's the right strategy for your long term investment goals. In this article, we’ll explore what dollar cost averaging is, how it works, its potential advantages and disadvantages, and provide real world examples to illustrate why this strategy can be a powerful tool in your investment arsenal. Dollar cost averaging (dca) is an investment strategy where an investor divides the total amount to be invested across periodic purchases of a target asset to reduce the impact of volatility on the overall purchase. the purchases occur regardless of the asset's price and at regular intervals.

Dca Dollar Cost Averaging Investment Strategy Explained D Petkovski It’s called dollar cost averaging (dca), and it might be one of the smartest ways to start investing for the long term. in this guide, we’ll break down what dollar cost averaging is, how it works, its benefits, and why it’s a go to strategy for so many investors, including a simple mathematical example to demonstrate its impact. What is dollar cost averaging and how does it work? learn how dollar cost averaging works, its benefits, common mistakes to avoid, and whether it's the right strategy for your long term investment goals. In this article, we’ll explore what dollar cost averaging is, how it works, its potential advantages and disadvantages, and provide real world examples to illustrate why this strategy can be a powerful tool in your investment arsenal. Dollar cost averaging (dca) is an investment strategy where an investor divides the total amount to be invested across periodic purchases of a target asset to reduce the impact of volatility on the overall purchase. the purchases occur regardless of the asset's price and at regular intervals.

Dollar Cost Averaging Dca Explained Tap Global In this article, we’ll explore what dollar cost averaging is, how it works, its potential advantages and disadvantages, and provide real world examples to illustrate why this strategy can be a powerful tool in your investment arsenal. Dollar cost averaging (dca) is an investment strategy where an investor divides the total amount to be invested across periodic purchases of a target asset to reduce the impact of volatility on the overall purchase. the purchases occur regardless of the asset's price and at regular intervals.

Comments are closed.