What Is Peer To Peer Lending Explained Simply P2p Lending In Simple Terms

Your Guide On Peer To Peer Lending Malaysia Nexea In 2020, he helped the exchange launch Lend at Hodl Hodl, the first noncustodial P2P borrowing and lending product in the Bitcoin space The product gained traction in Latin America and Southeast Asia How to choose a peer-to-peer lending platform When comparing your P2P lending options, focus on platforms that offer the types of loans you want to invest in Review the fine print so you

Your Guide On Peer To Peer Lending Malaysia Nexea Origins Of Peer-To-Peer Lending The first modern online platform for P2P lending emerged in the UK in 2005, followed by similar platforms in the US a year later According to Global Market Insights, the P2P market reached $2094 billion in size in 2023 and is slated to grow at a compound annual growth rate of 25% through 2032 With the P2P market already What Is P2P lending? Peer-to-peer lending — aka person-to-person, P2P or social lending — anonymously matches up borrowers and lenders via an online platform using complex computer algorithms The global peer-to-peer (P2P) lending market was $1881 billion in 2023, according to the International Market Analysis Research and Consulting Group, with most of the market working through a

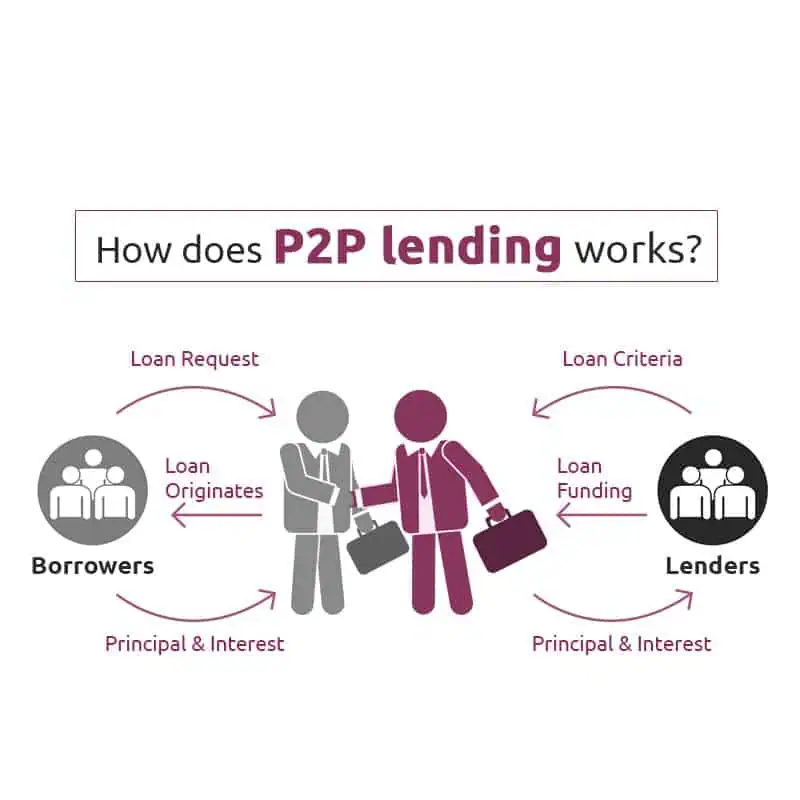

What Is Peer To Peer P2p Lending What Is P2P lending? Peer-to-peer lending — aka person-to-person, P2P or social lending — anonymously matches up borrowers and lenders via an online platform using complex computer algorithms The global peer-to-peer (P2P) lending market was $1881 billion in 2023, according to the International Market Analysis Research and Consulting Group, with most of the market working through a Red flags in peer-to-peer lending for borrowers Borrowers may find P2P lending a great option if they are short on cash, but there needs to be an increased vetting process before applying for a Peer-to-peer lending is an online transaction between a lender and a borrower The two parties connect through an online P2P lending platform, such as Kiva, Prosper, or Upstart We at Prosper introduced peer-to-peer (P2P) lending to the US in 2005, and nearly 20 years later, our personal loan platform has facilitated more than $26 billion in loans for more than 15 Peer-to-peer lending is an accessible way to secure a loan, and it can easily be done online without a bank Popular P2P lenders include Upstart and Prosper

Peer To Peer Lending The Top 5 Platforms Reviewed Red flags in peer-to-peer lending for borrowers Borrowers may find P2P lending a great option if they are short on cash, but there needs to be an increased vetting process before applying for a Peer-to-peer lending is an online transaction between a lender and a borrower The two parties connect through an online P2P lending platform, such as Kiva, Prosper, or Upstart We at Prosper introduced peer-to-peer (P2P) lending to the US in 2005, and nearly 20 years later, our personal loan platform has facilitated more than $26 billion in loans for more than 15 Peer-to-peer lending is an accessible way to secure a loan, and it can easily be done online without a bank Popular P2P lenders include Upstart and Prosper Discover what peer-to-peer lending is, how it works, and its benefits and risks Learn about P2P platforms and investment opportunities

Peer To Peer Lending P2p Lending Business Process Source Processed Download Scientific We at Prosper introduced peer-to-peer (P2P) lending to the US in 2005, and nearly 20 years later, our personal loan platform has facilitated more than $26 billion in loans for more than 15 Peer-to-peer lending is an accessible way to secure a loan, and it can easily be done online without a bank Popular P2P lenders include Upstart and Prosper Discover what peer-to-peer lending is, how it works, and its benefits and risks Learn about P2P platforms and investment opportunities

Peer To Peer P2p Lending Meaning Examples How To Invest Discover what peer-to-peer lending is, how it works, and its benefits and risks Learn about P2P platforms and investment opportunities

Comments are closed.