What Is Peer To Peer Lending How It Works Uplarn

What You Need To Know About Peer To Peer Lending Peer to peer lending is where one can contribute money without using a conventional monetary institution. this sort of loan is done online, and the interest rates are often cheaper than those found through a bank. keep reading to learn more about peer to peer lending and how it can benefit you. Peer to peer (p2p) lending allows individuals to lend money to or borrow money from other individuals without going through a bank. p2p lenders are individual investors who typically.

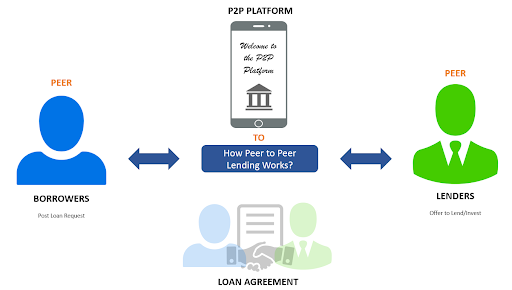

What Is Peer To Peer Lending How It Works Uplarn Peer to peer lending is an online transaction between a lender and a borrower. the two parties connect through an online p2p lending platform, such as kiva, prosper, or upstart. the. Peer to peer (p2p) lending works as private credit by connecting borrowers who need money with lenders who want to make a return on their investments. borrowers submit loan requests to the peer to peer lender and investors then compete to finance the loans in exchange for an interest rate. Peer to peer (p2p) lending is a financial practice in which individuals and businesses lend money directly to one another through online platforms, bypassing traditional financial. Peer to peer lending is a form of direct lending of money to individuals or businesses without an official financial institution participating as an intermediary in the deal. p2p lending is generally done through online platforms that match lenders with the potential borrowers.

What Is Peer To Peer Lending How It Works Uplarn Peer to peer (p2p) lending is a financial practice in which individuals and businesses lend money directly to one another through online platforms, bypassing traditional financial. Peer to peer lending is a form of direct lending of money to individuals or businesses without an official financial institution participating as an intermediary in the deal. p2p lending is generally done through online platforms that match lenders with the potential borrowers. How does peer to peer lending work? this lending method occurs via online p2p lending platforms like upstart, lendingclub, and prosper. on these sites, borrowers create loan listings, specifying the amount they want to borrow and the purpose of the loan. Peer to peer loans offer easy online access to money without involving a bank or credit union. p2p loans can be useful for borrowers who don’t meet traditional lenders’ requirements,. Here's everything about peer to peer lending you should know, from how p2p lending works to loan benefits. find out if peer to peer loans are right for you. Peer to peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms. make sure you know about the potential risks of p2p lending before you decide to become a p2p borrower or lender.

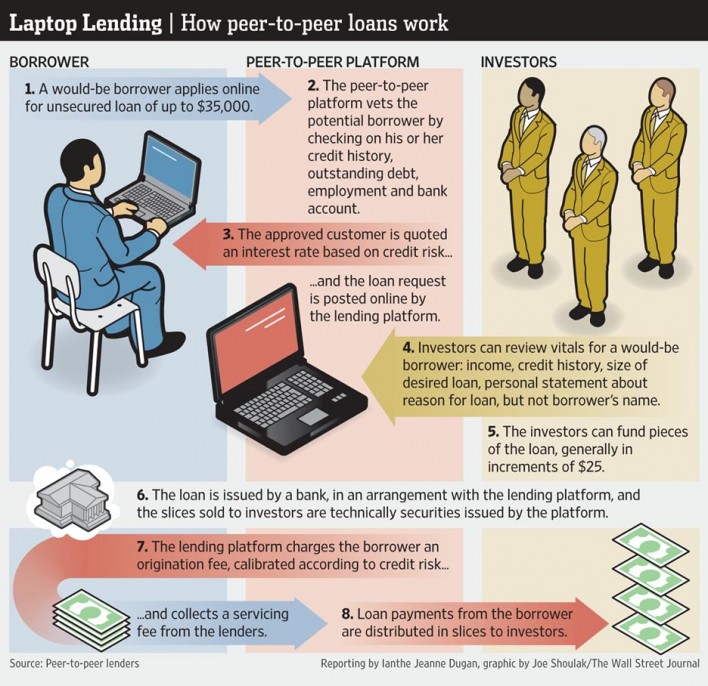

92 How Peer To Peer Lending Works Joe Shoulak Graphics How does peer to peer lending work? this lending method occurs via online p2p lending platforms like upstart, lendingclub, and prosper. on these sites, borrowers create loan listings, specifying the amount they want to borrow and the purpose of the loan. Peer to peer loans offer easy online access to money without involving a bank or credit union. p2p loans can be useful for borrowers who don’t meet traditional lenders’ requirements,. Here's everything about peer to peer lending you should know, from how p2p lending works to loan benefits. find out if peer to peer loans are right for you. Peer to peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms. make sure you know about the potential risks of p2p lending before you decide to become a p2p borrower or lender.

Comments are closed.