What Is Tds And Tcs Tds And Tcs In Income Tax Difference Between Tds And Tcs

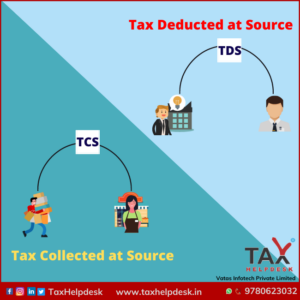

Pin On Mdp Referance Tds represents the tax deducted by the payer from payments made when the amount exceeds a set limit. conversely, tcs refers to the tax collected by the sellers during transactions with buyers. however, taxpayers often mix up these terms and use them interchangeably. While tds is an expense, tcs is an income. tds stands for tax deduction at source, tcs expands to tax collection at source. these are not taxes but are an obligation, which is deducted at the time of payment or received more and deposited to the income tax department.

Difference Between Tds And Tcs Tds is deducted by the person making the payment, while tcs is collected by the seller. tds applies to income like transactions, and tcs is tied to the sale of specified items. Tds (tax deducted at source) and tcs (tax collected at source) are two instances of indirect taxes imposed by the government. it is a common misconception that tds and tcs are the same for taxation purposes, but that is not the case. there is a significant difference between tds and tcs. Both tds and tcs are imposed at the source of income in india. tds refers to the tax deducted by a company on payments to an individual that exceed a specified limit. on the other hand, tcs represents the tax collected by sellers during transactions with buyers. In india, indirect taxes include tds (tax deducted at source) and tcs (tax collected at source). it is a tax collection system where the person responsible for paying specific amounts, such as salaries, commissions, professional fees, interest, rent, etc., is required to deduct a certain percentage of tax before making the payment.

Difference Between Tds And Tcs Both tds and tcs are imposed at the source of income in india. tds refers to the tax deducted by a company on payments to an individual that exceed a specified limit. on the other hand, tcs represents the tax collected by sellers during transactions with buyers. In india, indirect taxes include tds (tax deducted at source) and tcs (tax collected at source). it is a tax collection system where the person responsible for paying specific amounts, such as salaries, commissions, professional fees, interest, rent, etc., is required to deduct a certain percentage of tax before making the payment. Tds applies to income related payments, whereas tcs targets specific high value sales. although both collect tax upfront, tds focuses on income sources, and tcs focuses on particular purchases, each with its own set of tax rates. Confused between tds and tcs? learn their differences, how they work, penalties for non compliance, and their significance in tax planning. simplify taxes with expert insights. Two of the most common terms used to define certain factors in the tax system are tds and tcs. however, there are times when people use both terms interchangeably, confusing other taxpayers about the applicability of both terms while paying taxes. Although both taxes are levied at the point of origin of income payment, there are quite a few significant differences between tds and tcs. read on to get a clear understanding of the difference between tds and tcs.

Difference Between Tds And Tcs Easily Explained Tds applies to income related payments, whereas tcs targets specific high value sales. although both collect tax upfront, tds focuses on income sources, and tcs focuses on particular purchases, each with its own set of tax rates. Confused between tds and tcs? learn their differences, how they work, penalties for non compliance, and their significance in tax planning. simplify taxes with expert insights. Two of the most common terms used to define certain factors in the tax system are tds and tcs. however, there are times when people use both terms interchangeably, confusing other taxpayers about the applicability of both terms while paying taxes. Although both taxes are levied at the point of origin of income payment, there are quite a few significant differences between tds and tcs. read on to get a clear understanding of the difference between tds and tcs.

Difference Between Tds And Tcs Easily Explained Two of the most common terms used to define certain factors in the tax system are tds and tcs. however, there are times when people use both terms interchangeably, confusing other taxpayers about the applicability of both terms while paying taxes. Although both taxes are levied at the point of origin of income payment, there are quite a few significant differences between tds and tcs. read on to get a clear understanding of the difference between tds and tcs.

Difference Between Tds And Tcs A Brief Analysis

Comments are closed.