What Is The Difference Between Tds Vs Tcs Turbocomplyturbocomply

Pin On Mdp Referance Although both taxes are levied at the point of origin of income payment, there are quite a few significant differences between tds and tcs. read on to get a clear understanding of the difference between tds and tcs. Tds represents the tax deducted by the payer from payments made when the amount exceeds a set limit. conversely, tcs refers to the tax collected by the sellers during transactions with buyers. however, taxpayers often mix up these terms and use them interchangeably.

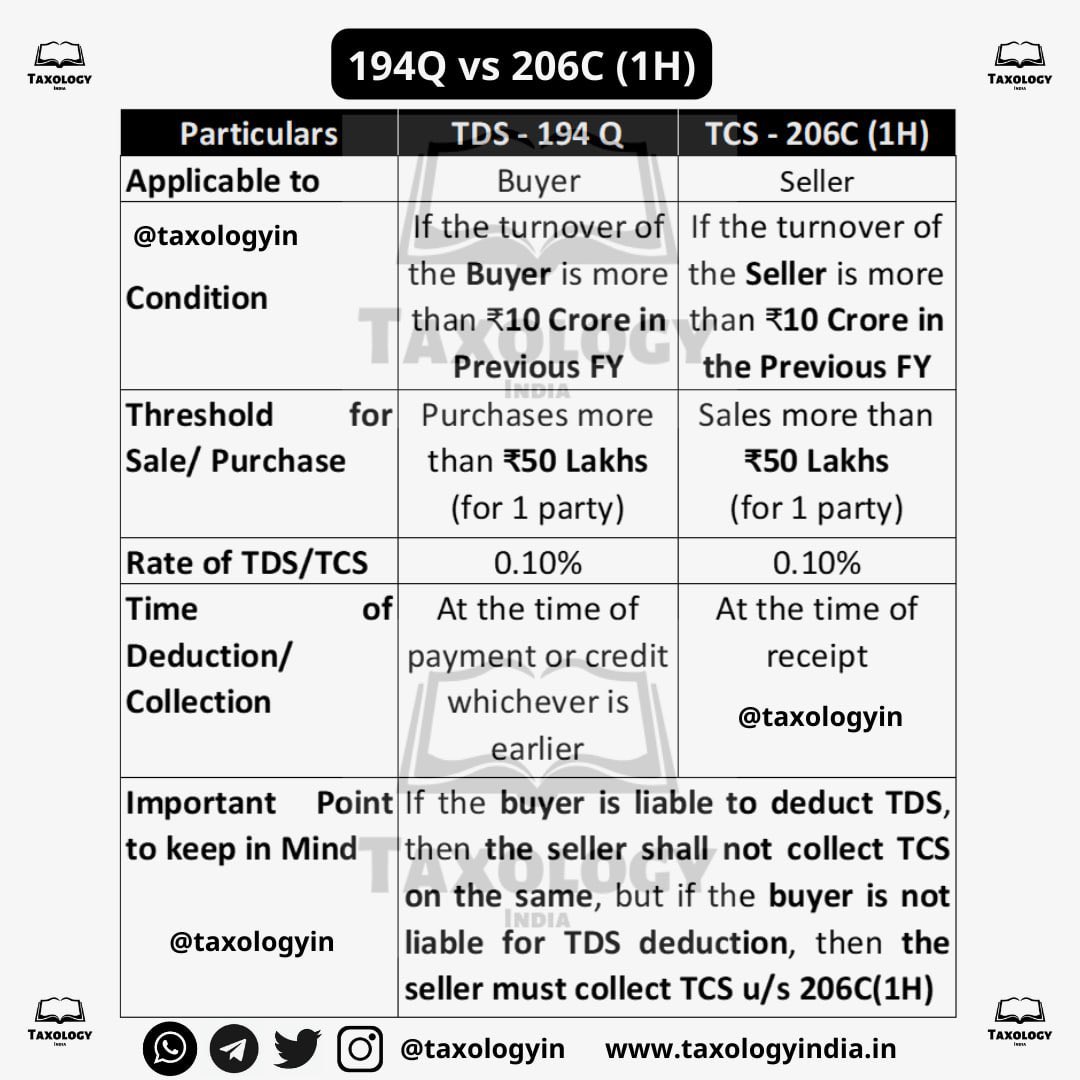

Tds Vs Tcs Difference Between Tds And Tcs What Is Tds And Tcs Tds And Hot Sex Picture Confused between tds and tcs? learn their differences, how they work, penalties for non compliance, and their significance in tax planning. simplify taxes with expert insights. The most important difference between tds and tcs is that tax deduction at source (tds) occurs at the time of making payment, i.e. it is a deduction from the income of the recipient. on the other hand, tax collection at source is absolutely opposite of tds. Understand the key difference between tds and tcs, including how they apply under gst, their examples, and expert insights. The distinction between tds vs tcs deviates at the tax deduction and collection level, as well as who is responsible and who is applicable. in this blog, we will evaluate tds and tcs and discover the key differences between them.

What Is The Difference Between Tds Vs Tcs Turbocomplyturbocomply Understand the key difference between tds and tcs, including how they apply under gst, their examples, and expert insights. The distinction between tds vs tcs deviates at the tax deduction and collection level, as well as who is responsible and who is applicable. in this blog, we will evaluate tds and tcs and discover the key differences between them. Tds and tcs are two different tax collection mechanisms that serve different purposes but ensure better tax compliance. tds is deducted on payments made, while tcs is collected on specific transactions. The primary difference between tds and tcs, as stated earlier, lies in who collects the tax (payer vs seller), the nature of the transaction made (income payments vs sales of goods), and when the tax is deducted or collected (at the time of payment vs at the time of sale). Tds and tcs are two of the most significant sources of income for the government. and, it’s crucial for businesses to make such on time tax payments to avoid penalties and stay compliant. read as we take a deep dive into the difference between tds and tcs and their importance for businesses. In conclusion, while both tcs and tds are related to tax collection, they have distinct attributes that make them unique. tcs is applicable on specific goods and is collected by the seller, while tds is applicable on various payments and is deducted by the payer.

Difference Between Tds And Tcs A Brief Analysis Tds and tcs are two different tax collection mechanisms that serve different purposes but ensure better tax compliance. tds is deducted on payments made, while tcs is collected on specific transactions. The primary difference between tds and tcs, as stated earlier, lies in who collects the tax (payer vs seller), the nature of the transaction made (income payments vs sales of goods), and when the tax is deducted or collected (at the time of payment vs at the time of sale). Tds and tcs are two of the most significant sources of income for the government. and, it’s crucial for businesses to make such on time tax payments to avoid penalties and stay compliant. read as we take a deep dive into the difference between tds and tcs and their importance for businesses. In conclusion, while both tcs and tds are related to tax collection, they have distinct attributes that make them unique. tcs is applicable on specific goods and is collected by the seller, while tds is applicable on various payments and is deducted by the payer.

Comments are closed.