What Is The Difference Between Wire Transfer And Ach

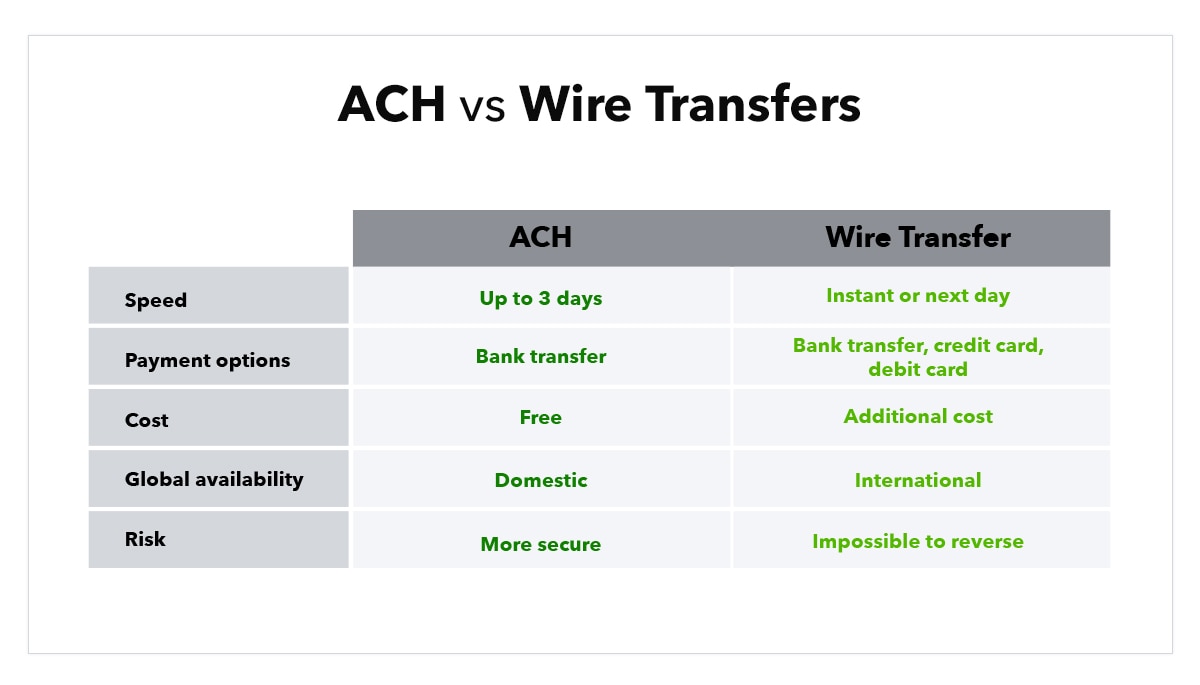

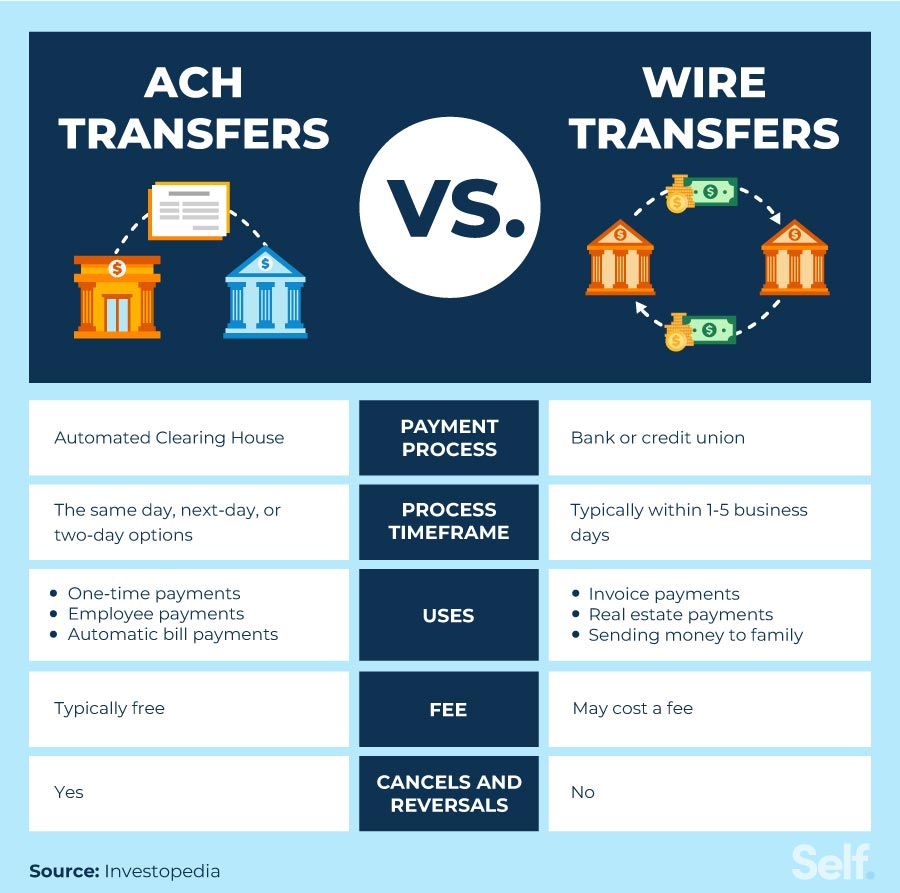

Difference Between Ach And Wire Transfer Ach and wire transfers are both ways to send money to other people or institutions. wire transfers are usually faster but cost more than ach transfers. There are seven major differences between ach transfers and wire transfers, which we explore in detail below. this chart outlines these differences briefly:.

:max_bytes(150000):strip_icc()/ach-vs-wire-transfer-5208168_final-6803fde548d34872958bf66f403801b2.png)

Difference Between Ach And Wire Transfer A wire transfer goes directly and electronically from one bank account to another without an intermediary system. ach transfers typically have lower fees than wire transfers have. money sent with wire transfers is typically received faster than money sent with ach transfers. An ach transfer and a wire transfer are ways to get money from one place to another, with the main differences being speed and fees. ach transfers tend to be a little slower but low or no cost; wire transfers are much faster but sometimes come with a hefty fee. The difference between ach and wire transfers often comes down to factors like cost, transaction time, and security considerations. ach transfers are cheaper, more secure, and best for everyday transactions, but can be slower to complete and limited to domestic fund transfers. Since ach and wire transfers are electronic payments, they’re considered efts but have a number of key differences:.

Ach Vs Wire Transfer Comparison Faqs Avidxchange 52 Off The difference between ach and wire transfers often comes down to factors like cost, transaction time, and security considerations. ach transfers are cheaper, more secure, and best for everyday transactions, but can be slower to complete and limited to domestic fund transfers. Since ach and wire transfers are electronic payments, they’re considered efts but have a number of key differences:. With an ach transfer, money is sent from one bank to another by way of an intermediary (the automated clearing house). with a wire transfer, money is sent directly between two different banks. wire transfers are generally faster than ach transfers but come with a higher cost. Choosing between utilising ach or a wire transfer will largely depend on the purpose behind the delivery or receipt of money as well as the degree of urgency for the transaction to be completed. in the majority of cases, wire transfers usually process at a much faster speed compared to ach transfers. This article explains the differences between electronic ach bank transfer and wire transfer payment methods. an ach transfer is completed through a clearing house — a network of financial institutions — and is used most often for processing direct deposits or payments. Ach is the best choice if low cost is a priority, while a wire transfer will likely be better if you need to move money fast. ach transfers are often free — if there’s a fee, it’s generally minimal.

Comments are closed.